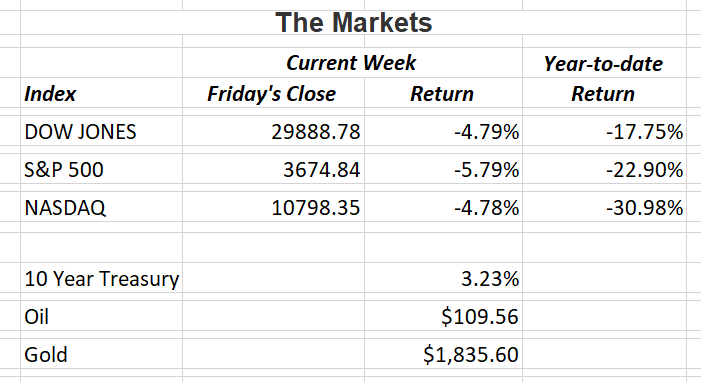

In one of the worst weeks since 2020, the S&P 500 officially entered a “Bear” market as it is now down over 22% from its January 3rd all-time high. A bear market is defined by an index being down at least 20% from its previous high. There was a brief rally on the news of the Fed increasing short-term interest rates 0.75% on Wednesday. However, major U.S. indices soon resumed their decline.

Whether the Fed can engineer a soft landing or we do enter a recession is up for debate. But I have repeatedly said that the U.S. is in better financial shape now than most pre-recession periods. Yes, the rest of 2022 will be tough on investors, but many analysts are still optimistic on U.S. companies.

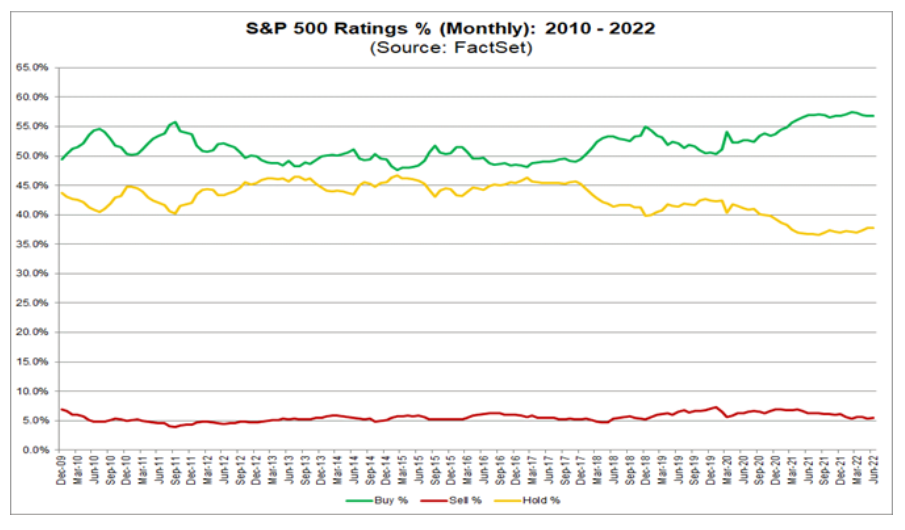

The chart below from FactSet shows the number of analyst’s “buy” recommendations (top green line), the number of “hold” recommendations (middle yellow line) and the number of “sell” recommendations (bottom red line). Almost 57% of S&P 500 stocks are currently on a buy rating while less than 38% are on a hold rating. This shows analysts are more bullish on their outlook than market conditions would have you believe. And even though some companies are beginning to reduce their workforce, there are still two jobs available for every unemployed person in the U.S.

I will continue to monitor and report on the latest economic conditions affecting all of us. if you have any questions, please contact me.

The Markets and Economy

- The Producer Price Index rose a seasonally adjusted 0.8% in May from the prior month. Economists are closely watching both the producer and consumer price indexes for signs inflation may soon be peaking. Signs are already being seen as home construction across the S. fell sharply in May.

- Industrial production in the S. grew at a slower pace in May according to the Federal Reserve. The 0.2% increase in output at mining, factory and utilities was a significant drop from the 1.4% increase posted in April.

- According to the Federal Trade Commission, 46,000 Americans reported being scammed out of an estimated $1 billion from cryptocurrency cons from January 2021 through March

- Inflation isn’t a problem confined to the S. The Bank of England raised a key interest rate for the fifth time and warned more increases may be likely. The same spikes in fuel, and food prices that are plaguing Americans are also affecting the British.

- China is the number 1 importer of crude oil and the number 2 consumer of oil among all countries in the world.

- Inflation may be hurting small business owners in the S. more than larger corporations. In the last four out of five months, companies with fewer than 50 employees reported their number of employees decreased. Continued labor shortages and concerns over the possibility of a recession were cited as the main reasons.

The Social Security Trust Fund paid out $59.1 billion more than it received in 2021. That was only the second time in the last 25 years that costs exceeded income.

Offices in Chicago, Naples & Valparaiso.

The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is an unmanaged, market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Consult your financial professional before making any investment decision. You cannot invest directly in an index. Past performance does not guarantee future results.

This newsletter was prepared by David M. Kover®. To unsubscribe from the Weekly Market Update please write us at 555 Eastport Centre Dr., Suite B, Valparaiso, IN 46383 or click this link: Unsubscribe .

Note: All figures exclude reinvested dividends (if any). Sources: Bloomberg, Dorsey Wright & Associates, Inc. and The Wall Street Journal. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly.

Securities offered through Triad Advisors, LLC, member FINRA/SIPC. Investment advice offered through Resources Investment Advisors, LLC, an SEC-registered investment adviser. Resources Investment Advisors. LLC and Vertical Financial Group are not affiliated with Triad Advisors, LLC.