It was announced on Friday that the Consumer Price Index hit its highest level in more than four decades. The Labor Department said the 8.6% increase year-over was the fastest pace since December 1981. It was also up slightly from April’s reading but down slightly from March’s number. Energy and food costs were the main reasons for the increase as the war in Ukraine continues without a resolution in sight.

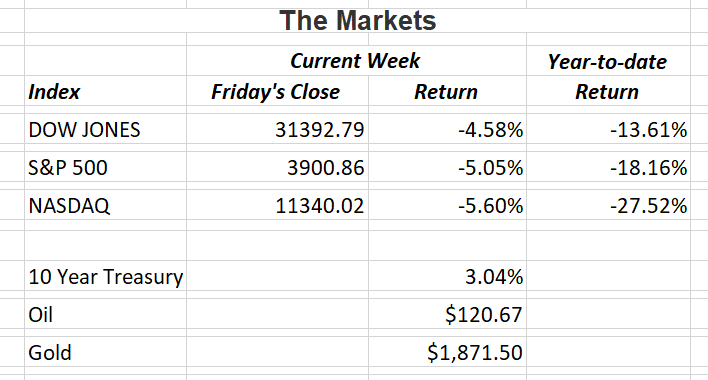

Declines were broad-based as major U.S. indexes were down between 4.5% – 5.5% for the week. Investor concerns centered around the possibility the Fed may need to take more drastic action to deal with persistent inflation and throw the U.S. into a recession. Analysts I follow believe that while inflation may last longer than we would like, the worst of it should be over. As the summer winds down, gasoline prices are expected to begin decreasing.

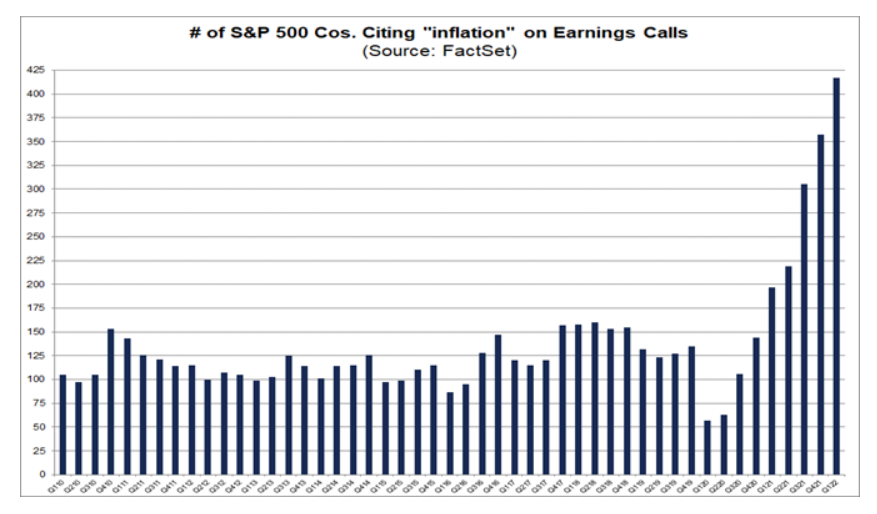

Consumers aren’t the only ones concerned, the chart below from FactSet shows that 417 S&P 500 companies cited inflation concerns on their recent earnings calls. That’s the highest figure since FactSet started tracking the information in 2010.

Whether the Fed can engineer a soft landing or we bounce a little harder than we would like, the U.S. economy still has many positives going for it. No one likes to see the losses the market is posting. We all need to be patient and wait for things to settle down. The sky is not falling. if you have any questions, please contact me.

The Markets and Economy

- Bookings for foreign travel is rapidly approaching pre-pandemic levels. Americans are eager to resume their long-delayed oversea travel as Covid-19 restrictions continue to ease.

- The World Bank cut it’s forecast for the global economy for 2022. After posting a strong growth rate of 5.7% in 2021, the bank cut its 2022 outlook to a decline of 2.9%. It had previously projected a growth rate of 4.1% for this year. The World Bank also raised concern about the prospect of stagflation is considerable. Stagflation is rising inflation in a declining economic conditions. The S. last experienced stagflation in the 1970’s.

- While Social Security trustees announced the fund would run into trouble starting in 2034, Medicare is running a surplus. The national healthcare program for people 65 and over covers about 19% of the S. population. It took in $888 billion in income for 2021 and paid out $839 billion in benefits.

- Just as S. retailers stocked up on inventory to meet the expected demand of stay-at-home workers, they started going back to the office. Too many casual clothes, activewear and home goods are not moving fast enough for stores who count on merchandise turnover. Many retailers had a banner year in 2021 but must adapt as consumers tire of being stuck at home.

- Individual tax collections are estimated to hit a record $2.6 trillion this year according to the Congressional Budget Office. That equals 10.6% in the economy and is up from the 9.1% posted in 2021. It is also the highest collection in 109 years that the tax existed.

- Mortgage applications fell 6.5% for the week ending June That’s the lowest level in 22 years according to the Mortgage Bankers Association.

- The number of job openings nationwide was 11.4 million, nearly twice the 5.94 million jobless Americans.

As consumer demand weakens during inflationary times, it can have a dramatic effect on imports. The U.S. reported a sharp drop in April due to moderating domestic demand. That resulted in a 19.1% reduction in the trade gap.

Offices in Chicago, Naples & Valparaiso.

The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is an unmanaged, market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Consult your financial professional before making any investment decision. You cannot invest directly in an index. Past performance does not guarantee future results.

This newsletter was prepared by David M. Kover®. To unsubscribe from the Weekly Market Update please write us at 555 Eastport Centre Dr., Suite B, Valparaiso, IN 46383 or click this link: Unsubscribe .

Note: All figures exclude reinvested dividends (if any). Sources: Bloomberg, Dorsey Wright & Associates, Inc. and The Wall Street Journal. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly.

Securities offered through Triad Advisors, LLC, member FINRA/SIPC. Investment advice offered through Resources Investment Advisors, LLC, an SEC-registered investment adviser. Resources Investment Advisors. LLC and Vertical Financial Group are not affiliated with Triad Advisors, LLC.