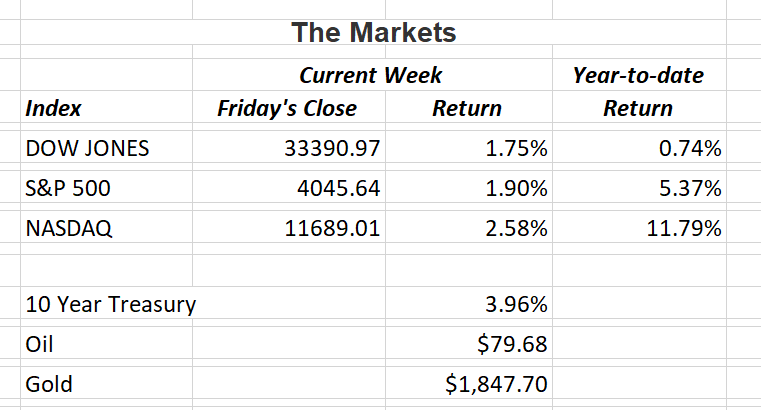

After a lackluster start to the week, the S&P 500 rallied on the last two trading days to post another gain of almost 2%. Strong economic data was met with concerns over the Fed’s next interest rate move. Investors are finding themselves between a rock and a hard place as the continued threat of inflation may make the central bank’s case for higher interest rates this year. On the positive side, Federal Reserve Bank of Atlanta President Raphael Bostic said that he “still very firmly” supports raising interest rates in quarter-point increments. He believes that past interest rate increases would slow the economy more notably later this year. The Fed seems divided over its next step.

The U.S. service sector posted its strongest month since last summer. Stocks rallied on the report even though the strong numbers may mean higher interest rates. In some ways, consumers seem to be comfortable with higher rates.

China’s elimination of Covid restrictions are resulting in stronger manufacturing reports and increased exports over the last two months. Many analysts believe China’s economy will have strong rebound for the rest of 2023.

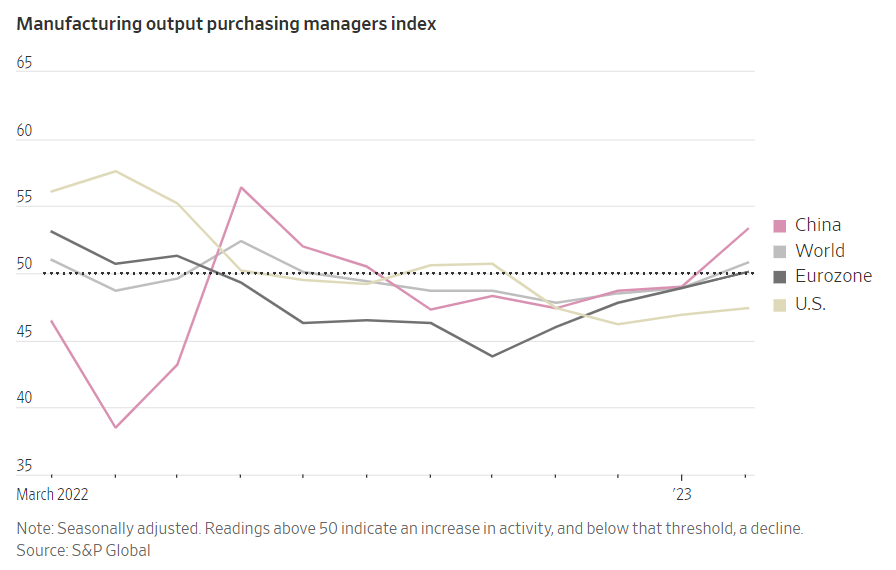

One reason global stocks are rebounding is due to increased economic activity around the world. The chart below from S&P Global shows that after declining over the summer months, the manufacturing output purchasing managers index began to rebound through the end of 2022. The trend continues in 2023. It is interesting to note that the U.S. is rebounding the least.

If you have any questions, please contact me.

Important 2022 Tax Information

It’s that time of year again when preparations are being made for annual tax returns. For your Charles Schwab account, you can easily access your tax forms online just as you do to view your account. We encourage everyone to sign up for online access. It is much safer and more secure than sending mail through the U.S. Postal Service. For providers other than Schwab, you will receive your tax forms directly from them.

One word of caution. I know everyone wants to file their tax return as soon as possible. However, it is not uncommon for Schwab to send amended 1099’s after the first one goes out. This is because Schwab only passes on the taxable information from the companies held in your account. If those companies make a mistake in their first reporting to Schwab, then they will send Schwab a corrected report. Schwab in turn sends you a new corrected 1099. It may be best to wait a while before submitting your tax information to your tax preparer.

The Markets and Economy

- Since 1845, February has been the second-worst performing month for the S&P 500. September holds the title for first place. March tends to see things turn around posting gains almost two-thirds of the time.

- Home sales in China are rising again. Monthly sales at 100 of the country’s largest real estate developers rose 14.9% from February 2022.

- Global shipping took a dive in 2022. A major slowdown in China exports fell 10% just in December due to Covid lockdown restrictions. The results create lower shipping costs for manufacturers and retailers.

- U.S. employees have embraced remote working and have turned their back more on returning to the office than their international counterparts. U.S. office occupancy stands at 40% to 60% of prepandemic levels. That compares poorly to the 70% to 90% rate in Europe and the Middle East.

- Fear is creeping back into the stock market. A sharp increase in the purchase of options on the Chicago Board of Options Exchange has been taking place recently. The options on the Volatility Index (VIX) are bets that volatility will continue to rise. This is due to wide fluctuations in stock prices as investors try to figure out the Fed’s next interest rate move.

- The Mortgage Bankers Association reports the volume of purchase applications is currently down over 40% year-over-year. That is the sharpest decrease since 1995.

- Stock buybacks for companies in the S&P 500 are projected to top $1 trillion in 2023. The record-setting figure shows U.S. companies faith in their own business and the economy.

Offices in Chicago, Naples & Valparaiso.

The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is an unmanaged, market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Consult your financial professional before making any investment decision. You cannot invest directly in an index. Past performance does not guarantee future results.

This newsletter was prepared by David M. Kover®. To unsubscribe from the Weekly Market Update please write us at 555 Eastport Centre Dr., Suite B, Valparaiso, IN 46383 or click this link: Unsubscribe .

Note: All figures exclude reinvested dividends (if any). Sources: Bloomberg, Dorsey Wright & Associates, Inc. and The Wall Street Journal. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly.

Securities offered through Triad Advisors LLC, member FINRA/SIPC. Triad is separately owned and other entities and/or marketing names, products or services referenced here are independent of Triad Advisors LLC.

Investment advice offered through One Digital Investment Advisors, LLC, an SEC-registered investment adviser. One Digital Investment Advisors. LLC and Vertical Financial Group are not affiliated with Triad Advisors LLC.