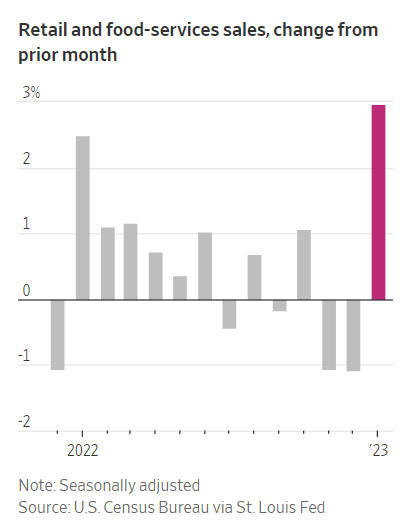

Inflation reared its ugly head last week on several fronts. First, the Bureau of Labor Statistics announced consumer prices rose 6.4% in January. While that is lower than December’s reading of 6.5%, it is still far away from the Fed’s stated target of 2% for inflation. Second, the Labor Department said prices at the wholesale level rose 0.7% in January. Economists polled by the Wall Street Journal had expected an increase of 0.4%. And third but not least, retail sales rebounded strongly in January rising a seasonally adjusted 3%. This strong number comes after two back-to-back monthly declines in November and December. The chart below from the U.S. Census Bureau illustrates the dramatic rise in January.

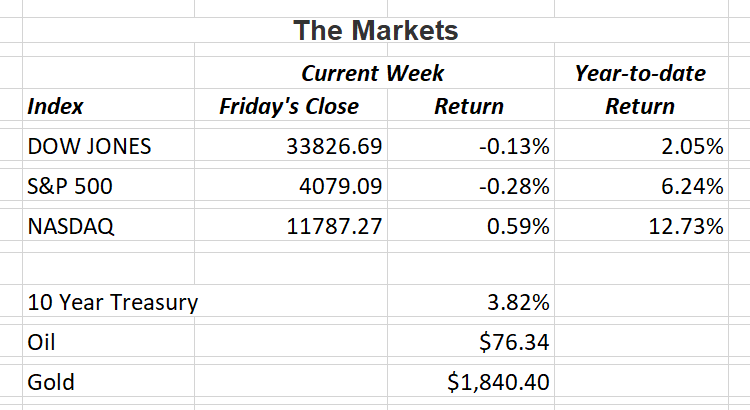

What all of this adds up to was a mostly flat week for the U.S. equites market. With the strong gains posted in January, stocks are watching closely for any indication what the Fed will do next. Analysts believe the stock market has priced in a couple more 0.25% rate increases in 2023. However, two Fed officials have recently said they favor a 0.5% increase when the central bank meets on March 21-22. Investors are concerned the Fed’s continued interest rate increases will result in the U.S. economy sliding into a recession. The higher interest rates go, the more expensive the cost of doing business becomes for all of us.

If you have any questions, please contact me.

The Markets and Economy

- 3% of U.S. auto loans extended to people with low credit scores were 30 days or more behind on payments at the end of 2022. That’s the highest share since 2010.

- Nearly one million French workers marched in protest last Saturday. Labor unions organized the demonstration in response to President Macron’s plan to raise the retirement age from 62 to 64. With more workers reaching the age of 64, the financial strain on France’s pension fund is becoming unsustainable.

- S. investors appear to be cooling to domestic equities. In the past six weeks, investors have pulled $31 billion from funds that track U.S. equities. $12 billion of that money has been invested in funds with international exposure while $27 billion has been funneled to bond funds.

- In one of the most aggressive moves yet to deal with climate change, European Lawmakers approved a law that will effectively ban the sale of new gasoline and diesel-powered vehicles starting in 2035. In adjusting to the shift in production to electric vehicles, Ford Motor Co. is planning to slash 3,800 jobs in Europe over the next three years at traditional gas-powered auto production facilities.

- Inflation in Britain fell for the third consecutive month, boosting optimism that prices may have peaked and are inching their way lower. The Bank of England forecasts prices will fall rapidly in the second half of 2023.

Offices in Chicago, Naples & Valparaiso.

The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is an unmanaged, market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Consult your financial professional before making any investment decision. You cannot invest directly in an index. Past performance does not guarantee future results.

This newsletter was prepared by David M. Kover®. To unsubscribe from the Weekly Market Update please write us at 555 Eastport Centre Dr., Suite B, Valparaiso, IN 46383 or click this link: Unsubscribe .

Note: All figures exclude reinvested dividends (if any). Sources: Bloomberg, Dorsey Wright & Associates, Inc. and The Wall Street Journal. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly.

Securities offered through Triad Advisors LLC, member FINRA/SIPC. Triad is separately owned and other entities and/or marketing names, products or services referenced here are independent of Triad Advisors LLC.

Investment advice offered through One Digital Investment Advisors, LLC, an SEC-registered investment adviser. One Digital Investment Advisors. LLC and Vertical Financial Group are not affiliated with Triad Advisors LLC.