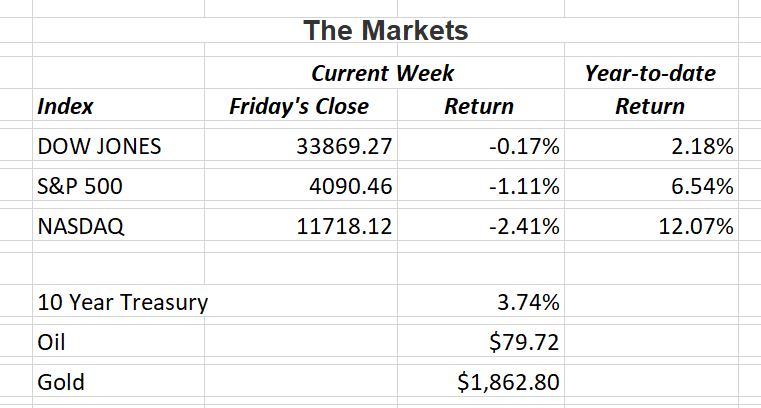

With the rally the stock market experienced in January, it only makes sense for it to take a pause. Especially since a concern over inflation and whether the U.S. will slip into a recession remains high on investors’ minds. All the major indices slipped a bit last week with the Nasdaq dropping almost 2.5%. Tech stocks make up a significant amount of the Nasdaq index. Those companies are especially sensitive to interest rate changes and the threat of a recession since their borrowing needs are higher.

This leads me to the adage; “As goes January, so goes the year.” While this saying is not foolproof, it does have an attractive success rate. Here are the statistics from Nasdaq Dorsey Wright regarding this barometer;

- When the S&P 500 posts a gain in the month of January, it has recorded a gain for the entire year 88% of the time.

- Going back to 1950, the barometer has been right 73% of the time.

- The barometer has been more accurate predicting up years than down years.

- The average return for years that the S&P 500 posts a positive January is 16.64%.

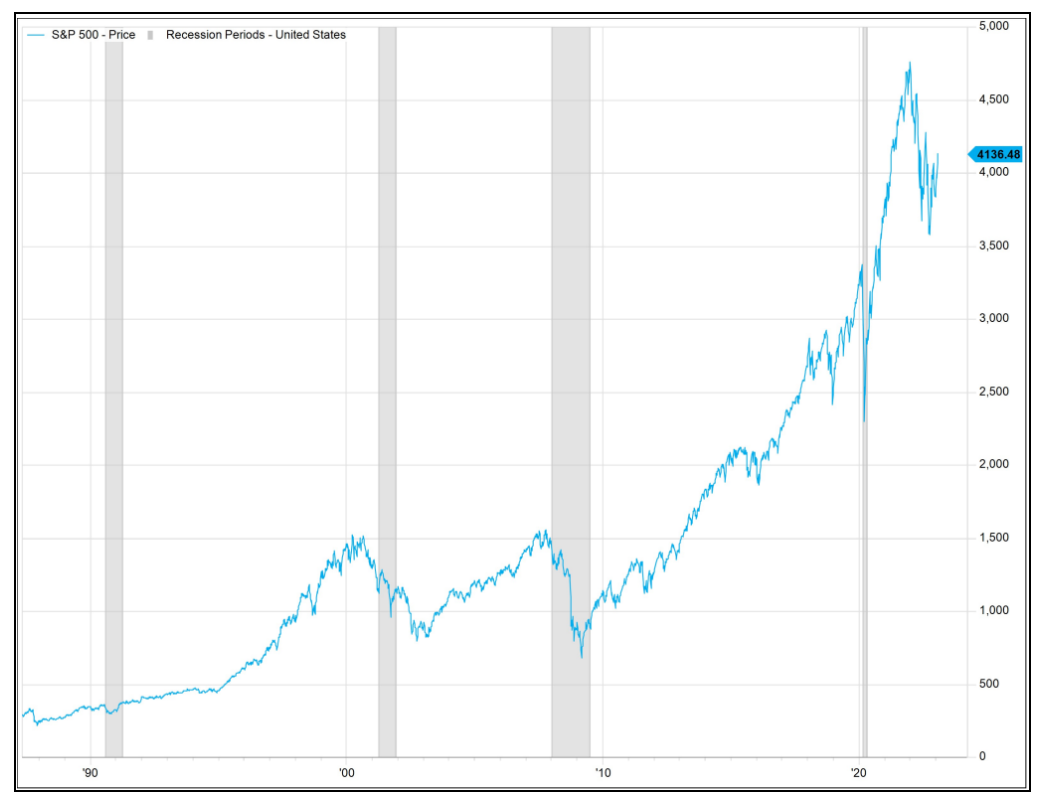

To add even more perspective to this concept, look at the chart below. The shaded bars are recessions and the solid blue line is the S&P 500. You can see that the market typically sells off through a recession. It then recovers moving upward again. Since recessions are only validated well after they occur, it is not unreasonable to think the worst may be over.

Only time will tell how the U.S. economy and stock market will do in 2023. But as I have been saying for months, I believe the underlying foundation is strong.

If you have any questions, please contact me.

The Markets and Economy

- In recent weeks, restaurants have reported sales have been holding up in light of inflationary concerns. However, costs have been sharply higher due to increased supply and wage expenses.

- The week ending January 25 saw more workers in major S. cities go to their offices than at any other time since the pandemic began according to Kastle Systems.

- The U.S. housing market is gradually picking up steam. Mortgage rates have fallen to about 6% in recent weeks. Last November saw mortgage rates top 7% due to inflation concerns.

- A recent article in the Wall Street Journal said, the good news is many Americans will live a lot longer than they expect. The bad news is, this often leads to the realization they didn’t plan properly for longevity risk, or outliving your money. This often leads to many retirees regretting taking Social Security too soon, not taking advantage of annuities that can offer lifetime income options and not planning for long-term care expenses. If you are concerned about longevity risk, contact me for an evaluation.

- The U.S. posted its largest trade deficit on record last year. Even as economies around the world have experienced decreasing growth due to inflation, post-pandemic conditions and rising inflation. However, the U.S. economy is strong showing that consumer demand for goods is holding up.

- U.S. companies announced 102,943 job cuts in January. 41% of those reductions came from the tech industry according to Challenger, Gray & Christmas.

Offices in Chicago, Naples & Valparaiso.

The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is an unmanaged, market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Consult your financial professional before making any investment decision. You cannot invest directly in an index. Past performance does not guarantee future results.

This newsletter was prepared by David M. Kover®. To unsubscribe from the Weekly Market Update please write us at 555 Eastport Centre Dr., Suite B, Valparaiso, IN 46383 or click this link: Unsubscribe .

Note: All figures exclude reinvested dividends (if any). Sources: Bloomberg, Dorsey Wright & Associates, Inc. and The Wall Street Journal. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly.

Securities offered through Triad Advisors LLC, member FINRA/SIPC. Triad is separately owned and other entities and/or marketing names, products or services referenced here are independent of Triad Advisors LLC.

Investment advice offered through One Digital Investment Advisors, LLC, an SEC-registered investment adviser. One Digital Investment Advisors. LLC and Vertical Financial Group are not affiliated with Triad Advisors LLC.