Bullish investors continue to hold up U.S. equity markets. Both the Dow Jones Industrial Average and the S&P 500 posted gains of over 1% last week. The tech-heavy Nasdaq posted a very strong gain of 2.2% as the tech and health care sectors advanced strongly.

While investor sentiment remains bullish, one subject that is on most minds is the coronavirus and the potential impact it may have on the global economy. China, where the outbreak occurred, is the world’s second-largest economy. They are still suffering from the effects of the trade dispute with the U.S. over the last couple of years. And, because of President Trump’s implementation of trade tariffs, U.S. companies have had to look for other suppliers outside of China. Remember, tariffs are paid by the U.S. companies who are importing goods from China. Asian nations such as Taiwan, the Philippines, Vietnam and South Korea have helped keep prices down for American businesses and consumers by filing the need of cheaper suppliers. Even with the recently signed “phase one” agreement with the U.S., China has rough road ahead.

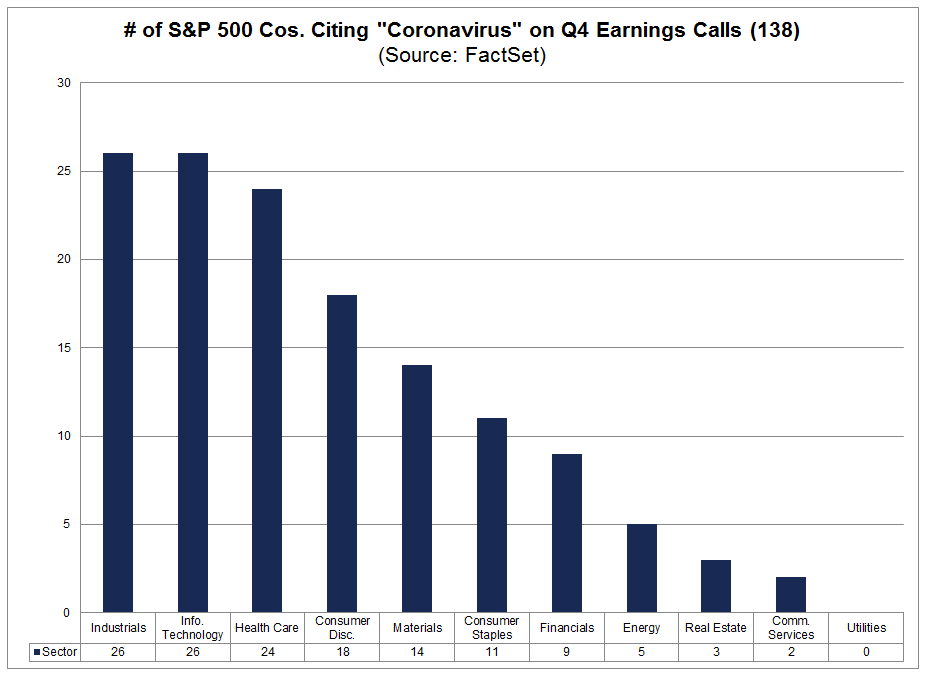

The chart below is from FactSet. They recently reviewed the transcripts of 364 S&P 500 companies that discussed fourth-quarter 2019 earnings on their recent call with investors. 38% cited the coronavirus on their calls and raised concern over the potential impact on first quarter 2020 earnings. While many are uncertain about the possible effects, I would expect to see more negative guidance announced over the next couple of months.

We are still bullish on the U.S. economy and markets. While the effects of the coronavirus may have an impact here at home on corporate earnings for the next few quarters, our economy should be able to withstand any pressure.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Consult your financial professional before making any investment decision. You cannot invest directly in an index. Past performance does not guarantee future results.

This blog was prepared by David M. Kover, CFP® C(k)P®

Sources: Bloomberg, Dorsey Wright & Associates, Inc. and The Wall Street Journal, FactSet. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly.

Securities offered through Triad Advisors, member FINRA/SIPC. Investment advice offered through Resources Investment Advisors, LLC, an SEC-registered investment adviser. Resources Investment Advisors. LLC and Vertical Financial Group are not affiliated with Triad Advisors.