I mentioned in last week’s market commentary that I believed the pullback we saw would be short-lived, I just didn’t think it would end that quickly! U.S. equity markets staged a strong rebound last week posting 3% gains for the Dow Jones Industrial Average and the S&P 500. But even with the strong recovery last week, some analysts are noting that companies that are reporting the strongest earnings are only seeing modest gains in their share prices.

64% of S&P 500 companies have reported fourth quarter 2019 earnings results so far. Of those reporting, 71% are reporting numbers above estimates. However, in the days surrounding their earnings announcement, the companies that are beating estimates are only seeing a price gain of 0.7%. According to FactSet, that is well below the five-year average of 1.0%.

Analysts believe the reason for the muted response by investors is due to concern over the spread of the coronavirus as well as the market needing to digest its significant gains in 2019. It’s logical to assume a combination of the two is likely. It’s not uncommon for the market to take a pause when the previous year was so strong. Likewise, the one thing the market hates is uncertainty. How bad the effects of the coronavirus will be for the global economy remains to be seen as it may not have reached its peak yet.

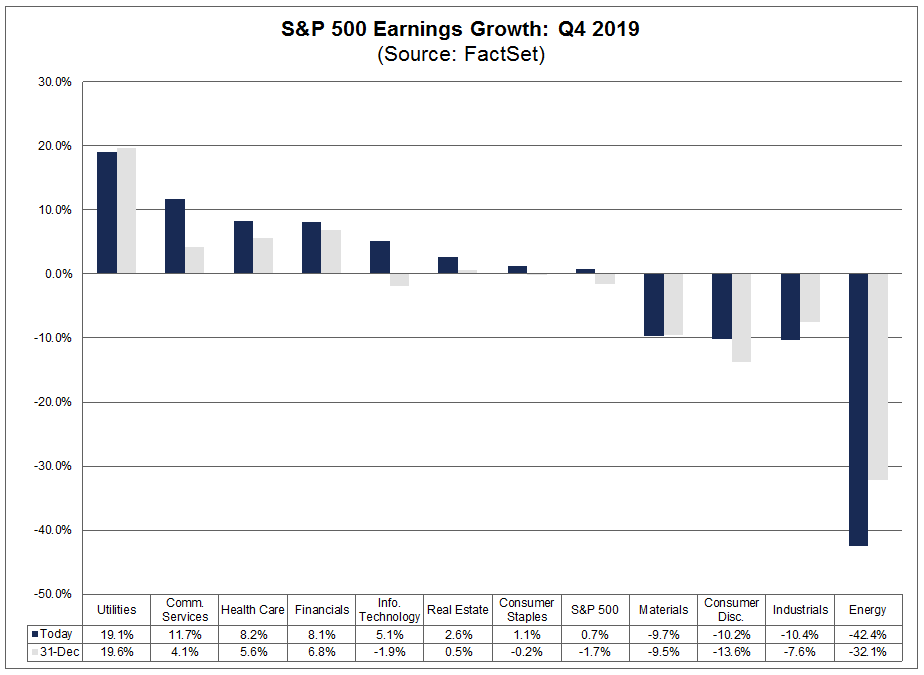

The chart below comes to us courtesy of FactSet. It shows which sectors are exhibiting the strongest earnings gains for the last quarter of 2019. Utilities, which benefit the most from decreasing interest rates, is showing the most gain in earnings. They are followed by Communication Services, Health Care and Financials. Not surprisingly, the Energy sector fared the worst. The price of crude continues to drop in anticipation of reduced demand due to a slower global economy suffering from the spread of the coronavirus.

While the market may struggle to find more gains for 2020, we believe strong earnings will remain a key component for future price increases.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Consult your financial professional before making any investment decision. You cannot invest directly in an index. Past performance does not guarantee future results.

This blog was prepared by David M. Kover, CFP® C(k)P®

Sources: Bloomberg, Dorsey Wright & Associates, Inc. and The Wall Street Journal, FactSet. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly.

Securities offered through Triad Advisors, member FINRA/SIPC. Investment advice offered through Resources Investment Advisors, LLC, an SEC-registered investment adviser. Resources Investment Advisors. LLC and Vertical Financial Group are not affiliated with Triad Advisors.