After a double-digit decline two weeks ago, the S&P 500 settled down ending last week with a slight gain. This came with significant volatility where it was common for the market to swing by 1,000 points or more on many trading days. What can we expect going forward?

Much of what happens in global stock markets and economies for the rest of 2020 will be driven by the impact of the coronavirus. Some believe the virus may have peaked in China as the number of new cases appears to be on the decline. Unfortunately, it will still be a few months before that declining trend is seen in other countries. The effects of the coronavirus will hit global economies hard. However, according to the Center for Disease Control, during this flu season, an estimated 34-49 million people will catch the regular flu (not the coronavirus) with 20,000-52,000 dying from it in the U.S. Globally, officials estimate 3,500 deaths from the coronavirus to date.

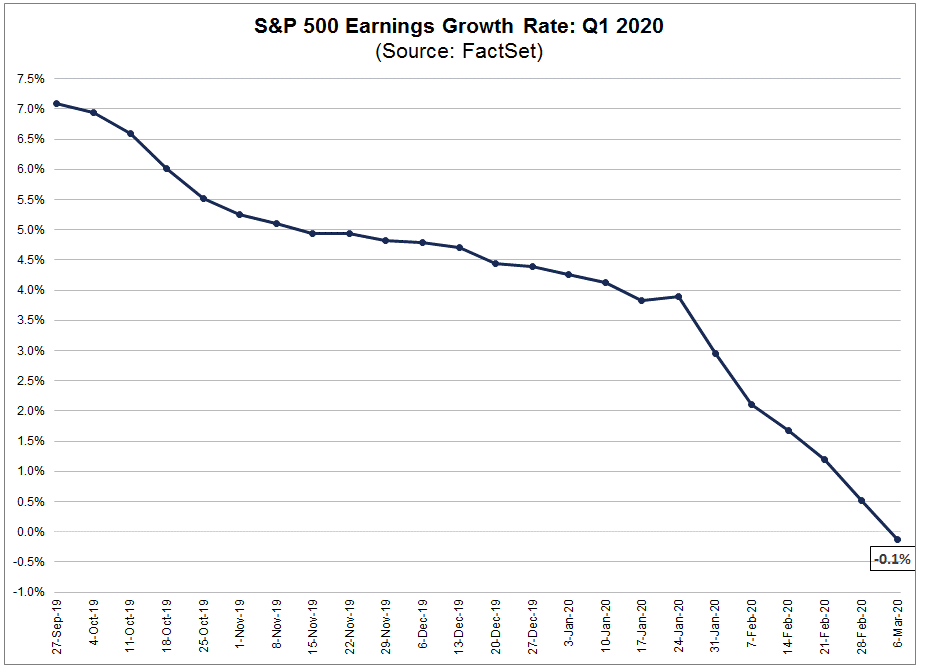

Here in the U.S., first quarter 2020 earnings estimates for the S&P 500 have continued to be revised downward. The chart below from FactSet shows the decline in earnings estimates since last September when earnings were originally expected to grow at 7%. Currently, a decline of 0.1% is estimated.

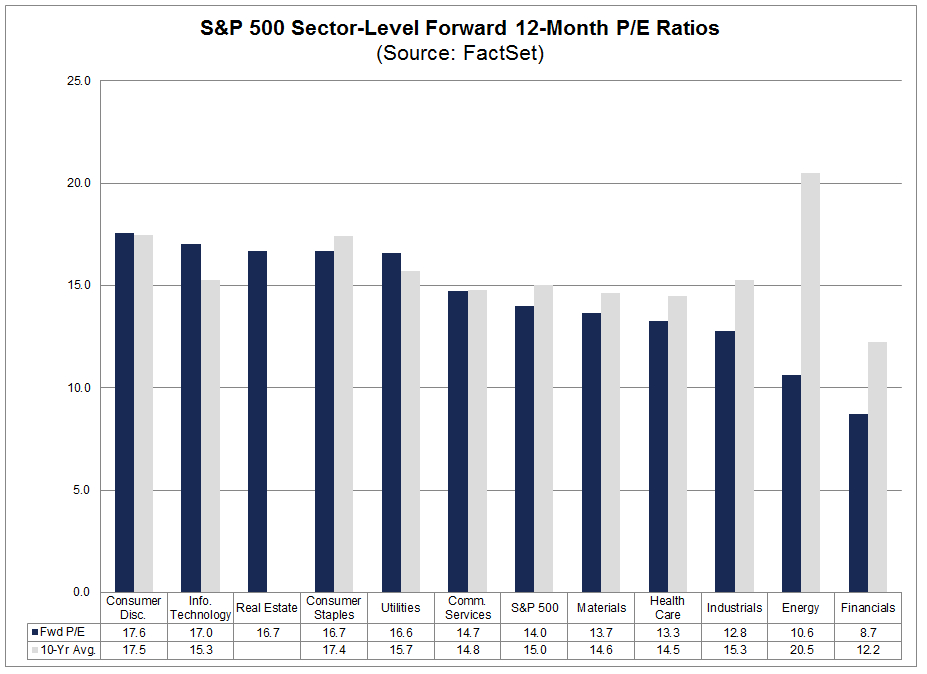

The second chart shows which sectors are expected to see the biggest decline.

As I have mentioned in previous market commentaries, It’s important to understand this is the seventh outbreak in the last 20 years. Each time, the market experienced a decline only to rebound higher than before. The U.S. is in the strongest position to weather this situation. Patience for investors is imperative.

If you have any questions or want to discuss this further, please call me at 888-411-2590.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Consult your financial professional before making any investment decision. You cannot invest directly in an index. Past performance does not guarantee future results.

This blog was prepared by David M. Kover, CFP® C(k)P®

Sources: Bloomberg, Dorsey Wright & Associates, Inc. and The Wall Street Journal, FactSet. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly.

Securities offered through Triad Advisors, member FINRA/SIPC. Investment advice offered through Resources Investment Advisors, LLC, an SEC-registered investment adviser. Resources Investment Advisors. LLC and Vertical Financial Group are not affiliated with Triad Advisors.