Major indices had their worst week since the financial crisis 12 years ago. U.S. markets officially slipped into “correction” territory – a drop of at least 10% from a recent peak – and posted their biggest one-day point drop ever. The one positive last week came late Friday afternoon as the stock market reduced its losses from earlier in the day.

As investors continue to deal with the economic effects of the coronavirus, the Fed’s chairman, Jerome Powell has stated the Fed will “Act as appropriate” to stabilize the U.S. economy. The futures market has priced in a 96% chance that the Fed will lower interest rates before years’ end.

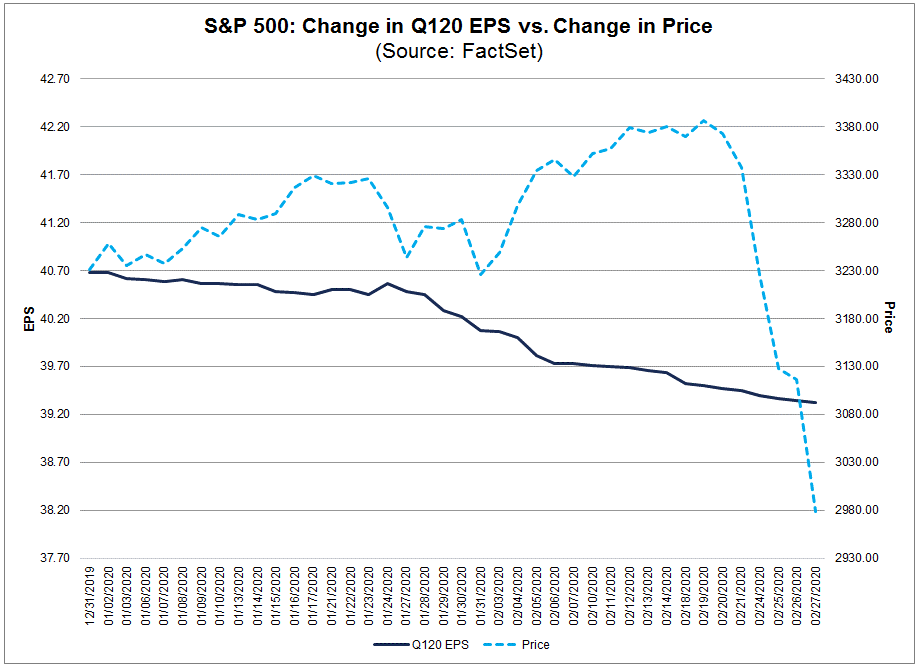

The chart below from FactSet shows how earnings for the S&P 500 has been slowly declining since the beginning of 2019 (solid dark line). The light-blue broken line is the price line of the S&P 500. You can see the sharp correction over the last week as the market reacted to concerns over the economic impact of the coronavirus. Markets rarely drop so much so fast without some sort of bounce upward. It would seem likely for that to happen over the next few trading days. Of course, that depends on whether more negative news is reported.

Analysts are beginning to announce reductions in first quarter 2020 revenue and earnings. While no one knows where the final tally will end up, we believe this is a great buying opportunity for investors that we may not see again for years.

As tough as the last week has been on our clients and friends, we are here for you. Patience during times like these is extremely difficult, but as history has shown us, crucial to our financial well-being.

If anyone would like to discuss this more, please call me at 888-411-2590.

This blog was prepared by David M. Kover, CFP® C(k)P®

Sources: Bloomberg, Dorsey Wright & Associates, Inc. and The Wall Street Journal, FactSet. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly.

Securities offered through Triad Advisors, member FINRA/SIPC. Investment advice offered through Resources Investment Advisors, LLC, an SEC-registered investment adviser. Resources Investment Advisors. LLC and Vertical Financial Group are not affiliated with Triad Advisors.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance. Consult your financial professional before making any investment decision. You cannot invest directly in an index. Past performance does not guarantee future results.