U.S. markets suffered their worst week since the financial crisis in 2008. The double-digit sell-off left investors wondering just how far the major indices could drop. As I have said many times, if there is one thing the stock market hates most of all, it’s uncertainty…and there’s plenty of that going around. However, I recommend ALL investors heed the words of Warren Buffett, who said, “The most important quality for an investor is temperament not intellect…You need a temperament that neither derives great pleasure from being with the crowd or against the crowd.”

In last week’s market commentary, I mentioned that U.S. equity markets had officially entered a bear market. That happens when an index like the S&P 500 drops at least 20% from a previous high. The major U.S. indices closed last week down 27% from the February 16 high. Historically, it takes an average of eight months to enter a bear market. This time, it took less than one month – the fastest ever.

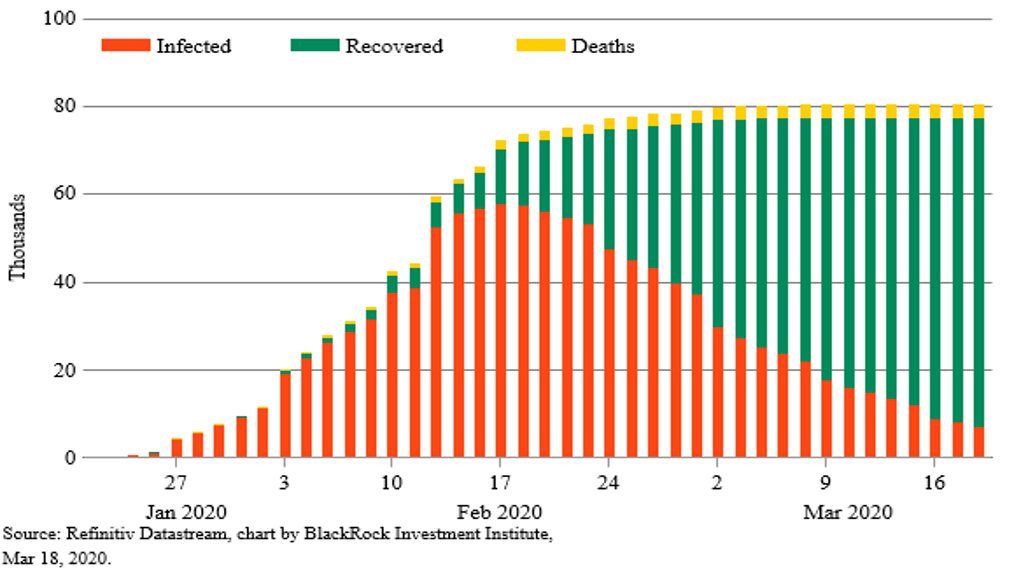

On a positive note, the chart below from Blackrock shows what can happen when a government and the people act to contain the spread of the coronavirus. The large orange area shows the rapid decline of newly reported cases as the number of those infected with the virus who are recovering grows.

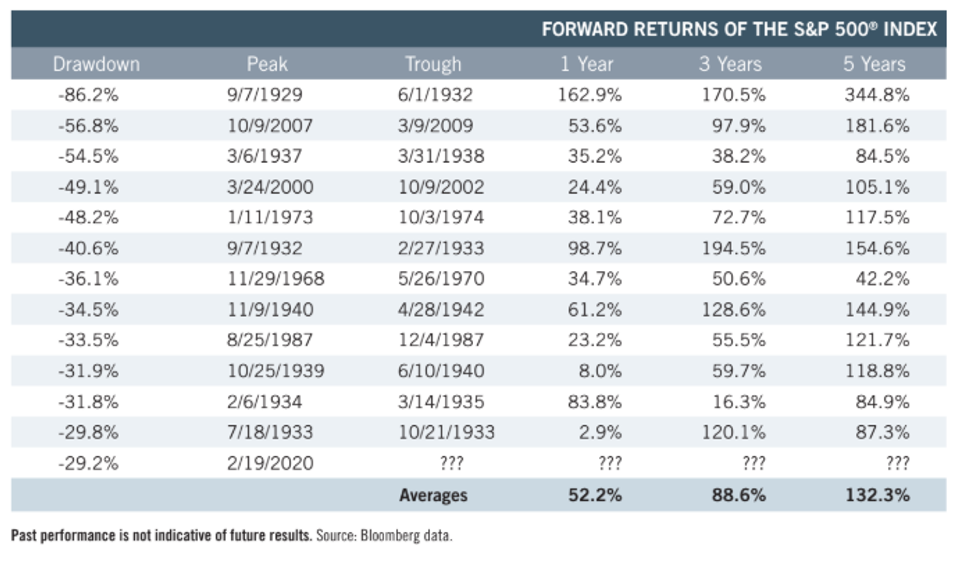

What next? We know we’re in a bear market and it can be gut-wrenching. Understanding that, let’s focus on what things might look like in a year or two when we recover. The chart below courtesy of Bloomberg shows the last 13 bear markets and how they looked one, three and five years later. In each instance, markets were higher and in many instances they posted double and triple digit returns.

Our thoughts and prayers are with the families that are suffering from this horrible virus. Everyone needs to heed the federal, state and local governments requests. That may vary in different geographic regions and is the key to beating this pandemic. The sooner we begin to see the number of new cases reported decline, the sooner the U.S. economy can get back to business. Be safe!

Sources: Bloomberg, Dorsey Wright & Associates, Inc. and The Wall Street Journal, FactSet. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly.

Securities offered through Triad Advisors, member FINRA/SIPC. Investment advice offered through Resources Investment Advisors, LLC, an SEC-registered investment adviser. Resources Investment Advisors. LLC and Vertical Financial Group are not affiliated with Triad Advisors, LLC