With last week’s announcement declaring the coronavirus an official pandemic, the 11-year old bull market came to an official end. Volatility continued to be the rule of the day as the Dow Jones Industrial Average fell over 2.000 points (7.8%) on Monday,. Recovered 1,200 points on Tuesday and lost another 1,400 on Wednesday (which technically ended the longest running bull market in history as it is now down at least 20% from its February high). On Thursday, the Dow had it’s worst single day since the market crash of 1987 as it fell 2,352 points (10%). By Friday’s close though, it rallied 1,985 points (9.4%) to end the week down over 10%.

Much of the selling over the last couple of weeks has been driven by high-frequency traders and algorithmic strategies which compounded market swings. Basically, they’re computer programs that trigger buy or sell orders for large baskets of securities when certain thresholds are hit. The end result is a compounding of the volatility experienced by U.S. equity markets.

With all that bad news out of the way, I’d like to focus on the positives.

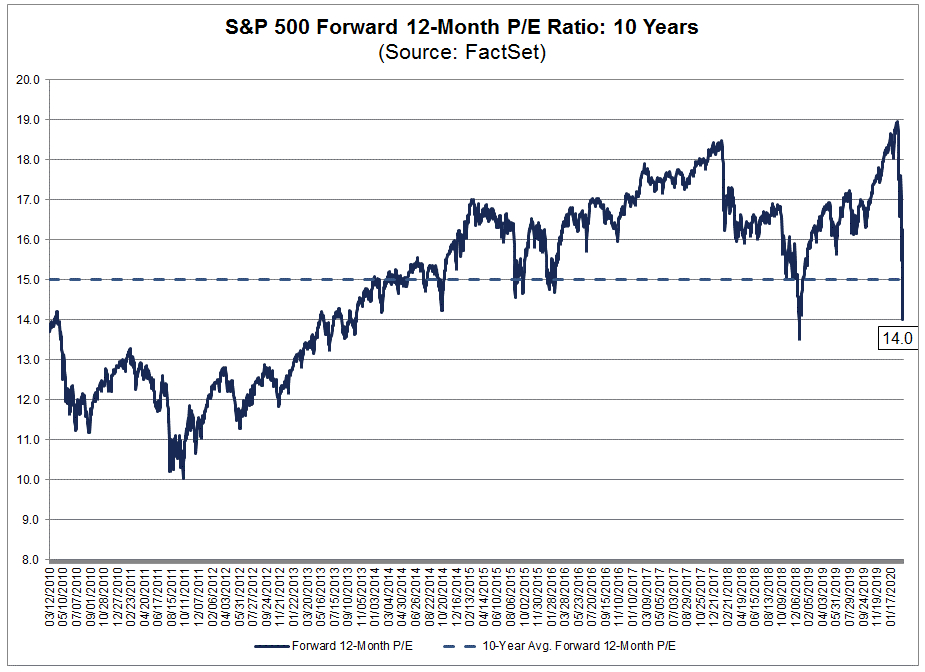

Many analysts have complained over the last couple of years that market valuations are much too high. That has now changed. The chart below from FactSet shows just how much the forward price-to-earnings (PE) ratio has dropped over the last few weeks. Earlier this year, the 12-month forward PE was around 19. It now stands at 14 which is below the five, ten, 15 and 20 year average.

On Sunday, the Fed cut interest rates to a range of 0.0% – 0.25%. They also increased their bond buying to help add liquidity to the markets. As of Sunday night, the market futures are down about 5%.

It is important to understand that this pandemic will pass and the U.S. along with the rest of the world will get back to business. In no way am I minimizing the terrible effects this pandemic is having on families in these uncertain times. And as much as we hate that uncertainty, the stock market hates it even more. We could see more downside in the market until the reporting of new cases in the U.S. begins to decline. That, has already happened in China and is expected to start in Europe in a few weeks. The U.S. will follow after that as the outbreak started here much later.

Now is not the time to panic with regard to your investments. As we have learned from numerous other market declines, patience will win out in the end. We will all get through this. Everyone at Vertical Financial is here if you need anything. Be safe.

Of course, past performance is not a guarantee of future results.

Sources: Bloomberg, Dorsey Wright & Associates, Inc. and The Wall Street Journal, FactSet. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly.

Securities offered through Triad Advisors, member FINRA/SIPC. Investment advice offered through Resources Investment Advisors, LLC, an SEC-registered investment adviser. Resources Investment Advisors. LLC and Vertical Financial Group are not affiliated with Triad Advisors, LLC