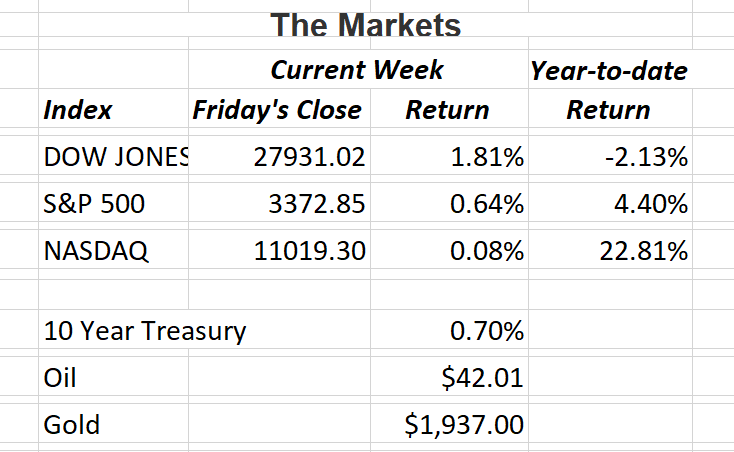

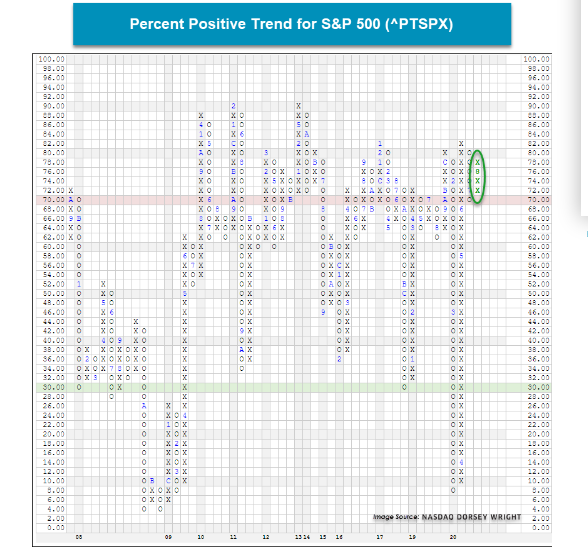

The biggest news I read last week comes from our main source for technical analysis advice; the Nasdaq Dorsey Wright daily equity report. Recently, we’ve seen significant improvement on a couple of the charts we follow. The Percent Positive Trend chart for the S&P 500 (PTSPX) reversed back into a column of X’s at 78%. This comes after falling to a low of 8% on the chart back in March. The current reading simply means that 78% of all S&P 500 stocks are in positive trends today, which is an overall positive sign for the market. This also comes as the Percent Positive Trend chart for the New York Stock Exchange (PTNYSE) reversed back to X’s at 56%, indicating a majority of NYSE stocks are also in positive trends.

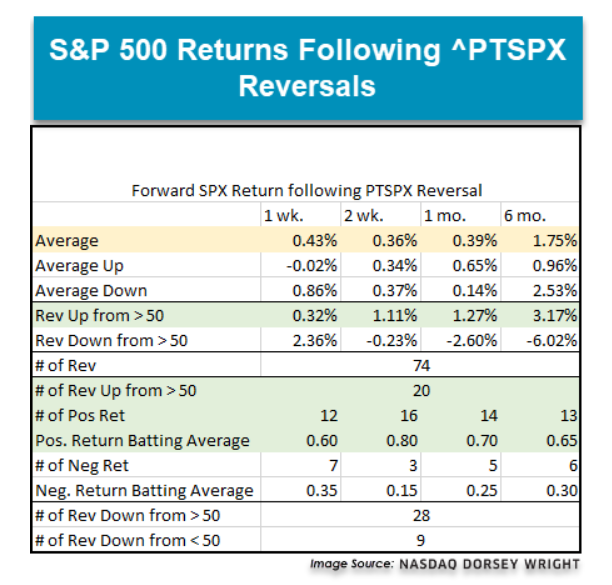

With that information, let’s examine how the market has typically performed when the PTSPX chart has reversed upward. Going back to mid-2000, there have been 20 reversals back to X’s that occur above a reading of 50%. In that situation, more often then not, it has been a positive sign for the market. Of the previous 20 times the PTSPX reversed up while above 50%, the average 1-week, 2-week, 1-month, and 6-month returns have been positive. The average 6-month return was 3.17% for the S&P 500 with 13 out of the 20 occurrences showing positive returns. While there have not been all that many occasions to examine, as the Positive Trend charts are typically viewed as a long-term indicator, the reversal back to X’s for trend indicators like PTSPX or PTNYSE are signs that more stocks are returning to positive trends, which has historically been a good sign for the market

- Auto sales in China are surging. Retail passenger-car sales increased 7.7% in July from a year earlier according to the China Passenger Car Association. Fueled by government incentives and bargain prices from dealerships, the state-backed China Automobile Dealers Association is trying to reduce excessive inventory levels that could cripple the auto industry.

- The largest mall owner in the U.S. has been in talks with Amazon.com, Inc. about the possibility of converting some of the mall owners properties into Amazon distribution hubs. Simon Property Group, Inc. said the talks have focused on stores formerly used by former retail giants J.C. Penney and Sears.

- The Global Business Travel Association estimates that over $2 trillion will be lost in business travel spending due to the pandemic. While tourism is starting to stage a small comeback, business travelers are nowhere to be seen. To understand how important business travel is, consider that corporate fliers make up 15% of passengers, but 40% of revenue and as much as three-quarters of airline profits on some routes.

- The U.K. has officially entered into recession after the coronavirus crisis caused the economy to contract by a record 20.4% between April and June. The Office for National Statistics said this is the worst recession on record and the first time a recession has been declared since the financial crisis of 2008.

- After steep declines earlier in the year, a range of products and services saw prices rise again in July. The Consumer Price Index climbed a seasonally adjusted 0.6% last month according to the Labor Department. It was the second consecutive month of price increases but most analysts believe it’s just a rebound in prices that were depressed earlier in the year.

- The federal deficit more than tripled in the first 10 months of this fiscal year, as government spending ramped up to deal with the economic effects of the coronavirus. Federal tax collection was off but it was the spending side that caused the budget deficit to hit $2.8 trillion so far this year.

- Americans shopping surpassed pre-pandemic levels last month. Retail sales for everything from stores, restaurants and online shopping rose 1.2% in July according to the Commerce Department. While the headwinds are strong going forward, the news is definitely welcomed.