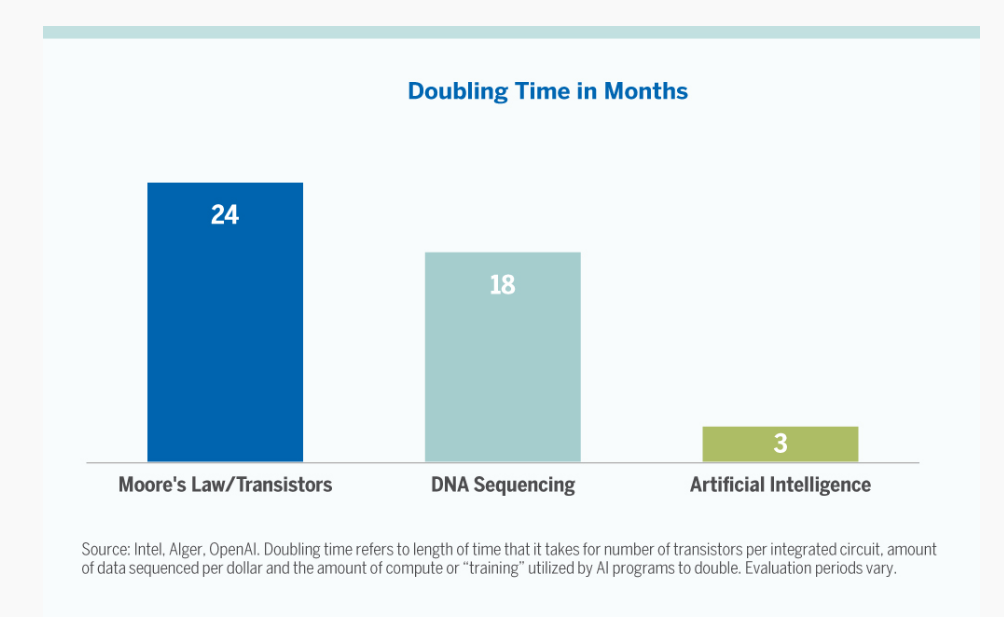

The technology sector has been one of the best performing areas in the market for several years. That’s evidenced by the tech-heavy Nasdaq rising more than 22% year-to-date.

- Growth rates can be characterized by how long it would take to cause a doubling in the underlying data. For example, Moore’s Law stated that the number of transistors on a chip was growing so rapidly that it would cause them to double every two years. In 1965, when Moore wrote his seminal paper there had been six doublings and so there were 64 transistors on an integrated circuit. After decades of doubling, the current iPhone has some 8.5 billion transistors, ushering in productivity that we could never have imagined in the early days of integrated circuits.

- DNA sequencing is evolving even faster with the cost of a human genome declining from over $10 million 15 years ago to under $1,000 today. The amount of genetic data that can be sequenced per dollar is doubling every 18 months or so.

- The speed at which artificial intelligence (AI) programs can “train” or how much computation they can utilize is doubling approximately every 3.4 months, propelled forward by not only advances in hardware but in software as well. Given that 30 doublings is more than a billionfold increase and that AI is on pace to achieve that in less than a decade, future technology is bound to be awe inspiring.

- Airlines are asking the U.S. government for more financial help to prevent massive layoffs affecting tens of thousands of workers. Airlines received $25 billion in aid under the broad economic stimulus package passed in March. The layoff restrictions in that package expire on October 1. What looked like the beginning of a rebound earlier this summer flatlined as coronavirus cases surged, triggering a new wave of travel restrictions. Corporate officials are working closely with union leadership to press the government for increased assistance until next March when a vaccine is expected to be available.

- After setting a target inflation rate of around 2% for over three decades, the Federal Reserve is expected to announce plans to abandon its strategy of preemptively raising interest rates to head off higher inflation. Fed officials would take a more relaxed view by allowing periods in which inflation would run slightly above the central bank’s 2% target, to make up for past episodes in which inflation ran below the target.

- According to the U.S. Census Bureau there were 40.8 million households that were renters. That represents 32% of the 126.8 million total households. A July survey estimates that 23.6 million of that 40.8 million (58%) fear they have “no to slight” chance of being able to pay their rent in August.

- Since cutting short-term interest rates to near zero on 3/15/20, the Fed has purchased $1.7 trillion of treasuries through Wednesday 7/29/20. The Fed now owns $4.3 trillion of U.S. government debt or 25% of the total Treasury securities outstanding.

- The U.S. and China have agreed to high-level talks on August 15 to asses Beijing’s compliance with the bilateral trade agreement signed early this year. The trade agreement is one of the few avenues for the two superpowers to engage on matters of mutual concern. Relations have deteriorated significantly this year as the Trump administration hammers Beijing over concealing the effects, timing and source of the coronavirus, the treatment of Uighurs in western China and the crack down on liberties in Hong Kong.

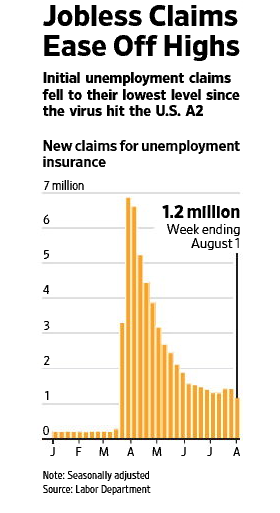

- As the White House and Congress remain at odds over another package of enhanced unemployment benefits, many economists are expecting a sharp drop-off in household spending. More than 12 million people were receiving benefits that ended on July 31. Some analysts believe spending could fall 4.3% in August.

- The beginnings of an economic recovery in the U.S. saw June’s imports and exports increase for the first time in six months. While trade rebounded, it is still far below where it was in February. Economists are concerned the recent resurgence in Covid-19 cases in the U.S. and other countries could reverse the gains.