Even though the U.S. equity market is well aware of the Fed’s intentions to raise interest rates to approximately 2.5% this year, stocks continue to act as if it is a surprise. True, inflation is currently running the highest we’ve seen in nearly 40 years, but many analysts believe the numbers have peaked and should start receding over the rest of the year. The Fed has been very clear about their intentions in raising interest rates, however, investors are still worried. A little more on that in a minute.

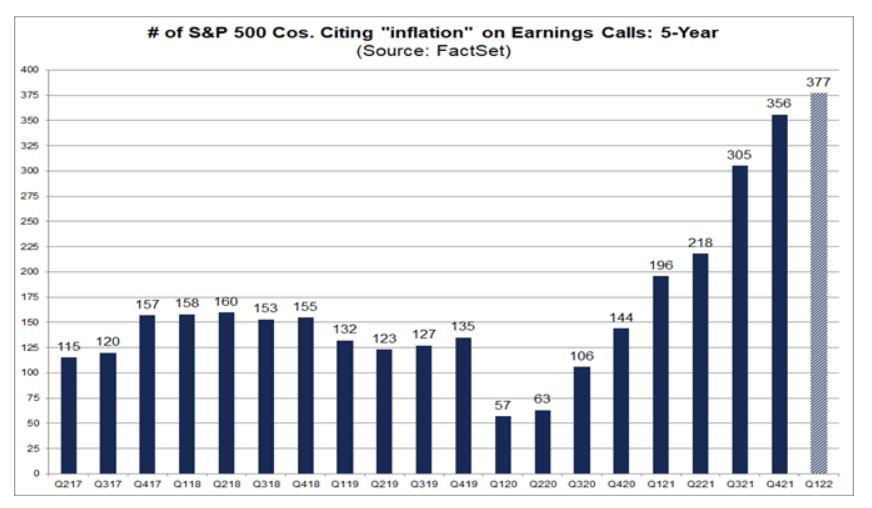

Inflation is also on the minds of U.S. corporations. The chart below from FactSet shows about 85% of S&P 500 companies (372) have cited inflation as a concern during their recent earnings calls. Supply chain issues were enough for corporations to worry about. And don’t forget the challenge in hiring qualified workers too. Now, on top of those two concerns, corporate executives are concerned with the effects inflation might have on their future profitability.

Part of investor’s concerns may stem from the difference in the Fed’s actions from previous bouts of inflation. The following is a synopsis of a recent article I read from Brian Wesbury, Chief Economist with First Trust.

Under monetary policy prior to 2008, interest rates and bank reserves were connected. The Fed typically kept reserves low. If they pulled reserves down even lower, the federal funds rate would increase. If they added reserves, the rate would fall. But now, interest rates and bank reserves have been decoupled. In other words, the Fed can push rates up without changing the amount of money on its balance sheet.

In fact, this is exactly what the central bank has done in recent months. The Fed has lifted interest rates twice (by a total of 0.75%) but they have not done any quantitative tightening. In other words, the Fed has not become tight, just moderately less loose.

The reason for this could be due to the central bank’s huge balance sheet. As of May 4, the Fed has approximately $8.9 trillion on its books. During the pandemic, the Fed wanted to keep interest rates low to help the U.S. economy so they dropped interest rates and bought trillions of dollars of bonds to add to their reserves. Now, faced with rising inflation and a huge balance sheet, the central bank needs to move more gradually to reduce its debt while raising interest rates. I believe it is this concern that is plaguing the markets. No one is sure if the Fed will be successful or not in their endeavors.

I still believe the U.S. economy is strong and corporate profits healthy. At some point, this should translate into a stronger stock market. But for now, we need to continue to watch for a reversal upward and be patient. If you have any questions, please contact me.

The Markets and Economy

- Inflation slipped a little in April, but there is little evidence that prices are beginning to cool. The 8.3% consumer inflation rate in April was slightly better than March’s 8.5% by a very thin margin. At the producer level, April’s inflation rate was 11%, down from the previous months reading of 11.5%. While these numbers are still high, analysts believe they will continue to drop over the rest of 2022.

- China’s trade with the rest of the world dropped significantly in April. The decrease was due to lockdowns in Shanghai and other parts of China as well as lessening demand from its global trading partners. The world’s second-largest economy also reported a 36% drop in car sales in April, and new home sales in 23 major Chinese cities are down 33% year-over-year.

- Household debt rose to $15.84 trillion in the first quarter; an all-time high. The Federal Reserve Bank of New York says the increase was driven mostly by a $250 billion increase in home loan balances.

- The IRS paid $3.3 billion in interest to tax filers in 2021. The money was from the IRS paying filer refunds later than the 45-day limit. According to administration officials, the tax agency has been moving slower than usual to process tax returns.

- A product recall and supply chain issues continue to plague the baby formula market. Nationally, 43% of baby formula is out of stock. On average, the weekly out of stock figure is about 10%.

- The U.S. had 7.27 million births in the back-to-back years 2020-2021 (the pandemic years). That’s the fewest number of American births in back-to-back years in over 40 years.