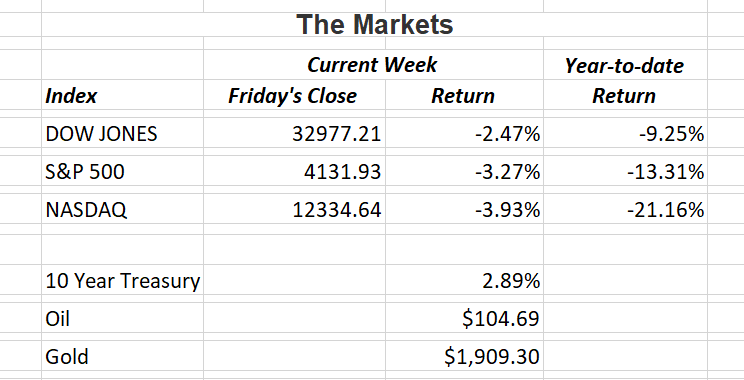

The Nasdaq officially entered bear market territory last week as it stands down a little over -21% year-to-date. A bear market is defined as an index being down at least 20% from its previous peak. That peak for the Nasdaq occurred on November 19, 2021 when the tech-heavy index closed at an all-time high of 16057. From that peak, the Nasdaq is down over -23%. While the other major indices are in negative territory too, they are not down nearly as much. Let’s dig into what is happening to equity markets in the U.S. and why is the Nasdaq feeling more of the effects.

Inflation is a major concern for equity markets globally. Higher prices are the result of the pandemic and the war in Ukraine. The war obviously affects agricultural prices as Russia and Ukraine account for about one-quarter of total global exports. That combined with the halting of oil shipments by many western nations of Russian oil is causing energy prices to skyrocket. Food and energy are considered the most volatile components of the consumer and producer price indices and the main source for calculating inflation.

The pandemic is also having an impact on inflation. In an effort to combat the economic challenges from Covid-19, the government has implemented several financial incentives for Americans. Extended unemployment benefits, increased child-tax credits and stimulus checks mailed to tax filers have created a sharp spike in a measurement of the money supply called M2. Even if you did not file a tax return, there is a procedure in place to apply for a stimulus check. M2 now stands at $21.8 trillion. A year ago, it was $19.65 trillion.

When governments around the world implemented shutdowns, it created supply chain issues that may be with us for several years. You may have noticed certain brands not available at the store. That, is just one example. Auto manufacturers are in dire need of computer chips to sell cars. The CEO of Intel was quoted last week as saying it will take years to get production back to where it should be.

The U.S. economy is now facing a perfect storm of too much money chasing too little goods. That is the recipe for inflation. Too much inflation can impede consumer buying. That is especially felt in the tech sector where companies count on accelerating sales growth to fuel higher stock prices. The majority of those companies are listed on the Nasdaq. Hence, the pullback is affecting growth companies more than blue chips.

What all of this has to do with the drop in the stock market is the question of how successful the Fed will be at combating inflation while avoiding a recession. That means there is uncertainty about the economy. And the one thing the stock market hates even more than bad news is uncertainty.

First quarter earnings continue to be extremely good. 83% of S&P 500 companies reporting are beating analysts estimates. That is why I am still bullish on the U.S. economy and stock market with a continued cautious eye. If you have any questions, please contact me.

_____________________________________________________________________________________

The Markets and Economy

- Business and government employers spent 4.5% more on worker costs in the first quarter of the year when compared to a year earlier. According to the Labor Department, that is the fastest increase in over 20 years.

- U.S. durable goods orders rose again in March. The 0.8% increase was the fifth increase in six months. Durable goods are products that are expected to last at least three years.

- The Congressional Budget Office’s most recent budget review indicated that U.S. corporate tax revenue was up 22% in the first six months of the current fiscal year (October-March) when compared to last year’s figures. Corporate tax revenue is on pace to hit $454 billion this fiscal year. That would significantly top last year’s all-time high of $372 billion.

- To put the number of deaths due to Covid-19 in perspective, the Center for Disease Control reports that the U.S. had a total of 3.459 million deaths in 2021, up from 3.382 million in 2020 and higher than the pre-pandemic number of 2.855 in 2019.

- For months I’ve been reporting that the number of homes existing homes for sale has been shrinking considerably. To illustrate the point: At the end of March 2022 that figure stood at 950,000. At the end of March 2017 it was 1.8 million. At the end of March 2021 it was 2.32 million and in March 2007 it was 3.81 million. With demand staying the same, you can see why home prices continue to skyrocket.

- An increasing number of U.S. workers who switched jobs during the pandemic appear to be having second thoughts. While the numbers are difficult to pin down, analysts say a number of job-switchers have returned to their former employer. Sometimes the grass just “looks” greener.

- The U.S. economy shrank -1.4% in the first quarter as supply chain disruptions weighed heavily on strong consumer demand. Analysts more growth throughout the remainder of 2022.

__________________________________________________________________

Offices in Chicago, Naples & Valparaiso.

The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is an unmanaged, market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Consult your financial professional before making any investment decision. You cannot invest directly in an index. Past performance does not guarantee future results.

This newsletter was prepared by David M. Kover®. To unsubscribe from the Weekly Market Update please write us at 555 Eastport Centre Dr., Suite B, Valparaiso, IN 46383 or click this link: Unsubscribe .

Note: All figures exclude reinvested dividends (if any). Sources: Bloomberg, Dorsey Wright & Associates, Inc. and The Wall Street Journal. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly.

Securities offered through Triad Advisors, member FINRA/SIPC. Investment advice offered through Resources Investment Advisors, LLC, an SEC-registered investment adviser. Resources Investment Advisors. LLC and Vertical Financial Group are not affiliated with Triad Advisors.