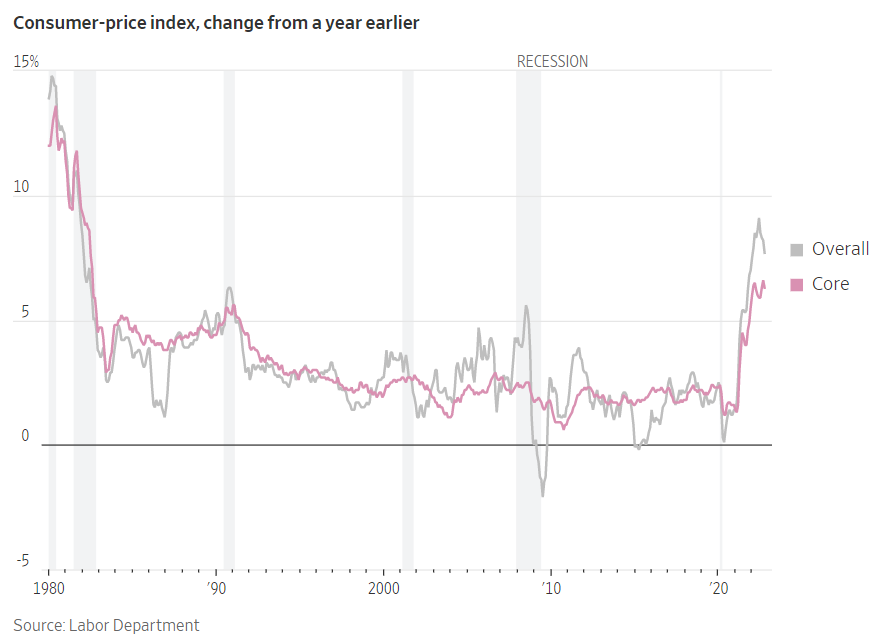

Who would have thought the headline; Consumer price index rises 7.7% last month year-over would result in a 1200 point rally in the Dow Jones Industrial Average? Well, that’s exactly what happened last Thursday as the U.S. stock market posted solid gains. It was the largest single-day gain for stock prices since 2020. In fact, the tech-heavy Nasdaq closed up 8% for the week. The chart below from the Labor Department shows the beginnings of a decline in both the overall and core components of the consumer price index.

The reason for the huge stock rally is simple; the decline in the rate of inflation might give the Fed pause in their aggressive interest rate campaign. This reduces the fear of the central bank overreacting thereby sending the U.S. economy into a full-blown recession. The Fed has hinted that they’re looking for signs inflation is easing before reducing interest rate increases. This report might just be the news the central bank needs to do just that. Analysts now expect the Fed to raise rates 0.50% at their December meeting.

I read an interesting statistic last week that said the U.S. suffered 10 separate bear markets between 1950 and 2022. Each time, the S&P 500 recovered and eventually achieved a new all-time high. The average length of time it took for the market to recover from its bear market low to a new all-time high was 25 1/2 months. Let’s hope this one plays out as all the others have.

If you have any questions, please contact me.

The Markets and Economy

- Over the last 12 months, China’s richest people saw the biggest drop in their collective wealth in decades. A slowing economy is experiencing plunging stock prices and declining real estate values.

- The K. economy is sliding towards a recession. The country’s gross domestic product was 0.7% lower on an annualized basis for the quarter ending September 30. Britain is facing a sluggish economy from lockdowns enacted to contain the spread of Covid-19 and the effects of inflation.

- An October survey by the National Federation of Independent Business reported small business owners remain pessimistic about the general business outlook. They are still struggling to find workers and to keep them. 32% said they are planning on raising worker compensation. That’s up from 23% the previous month. 34% also said they are planning on raising prices to deal with the cost increase.

- Americans appetite for travel and entertainment continues to be strong as we move through the final quarter of 2022. Concerns over inflation and the economy are being set aside by consumers. Hotel bookings, concert venues, cruise lines and car rental agencies are all seeing a huge increase in demand.

- According to Gavekal Research, the Chinese government has owned between 25% to 28% of the entire Chinese economy over the last 21 years.

- China’s manufacturing hub, Guangzhou faced a lockdown as the country struggles to contain the worst coronavirus outbreak in six months. About 4 million workers were told to stay home and allowed out only for essential travel.

Offices in Chicago, Naples & Valparaiso.

The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is an unmanaged, market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Consult your financial professional before making any investment decision. You cannot invest directly in an index. Past performance does not guarantee future results.

This newsletter was prepared by David M. Kover®. To unsubscribe from the Weekly Market Update please write us at 555 Eastport Centre Dr., Suite B, Valparaiso, IN 46383 or click this link: Unsubscribe .

Note: All figures exclude reinvested dividends (if any). Sources: Bloomberg, Dorsey Wright & Associates, Inc. and The Wall Street Journal. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly.

Securities offered through Triad Advisors, LLC, member FINRA/SIPC. Investment advice offered through Resources Investment Advisors, LLC, an SEC-registered investment adviser. Resources Investment Advisors. LLC and Vertical Financial Group are not affiliated with Triad Advisors, LLC.