Stocks closed the week modestly lower over concerns the Fed plans to continue increasing interest rates for the foreseeable future. Investors had hoped the central bank might pause the rate increases to asses what affect past ones will have on the U.S. economy and the war on inflation. However, when Fed Chairman Jerome Powell stated they still have a “ways to Go” and that “It is very premature to be thinking about pausing.” Investor’s hopes were quickly dashed.

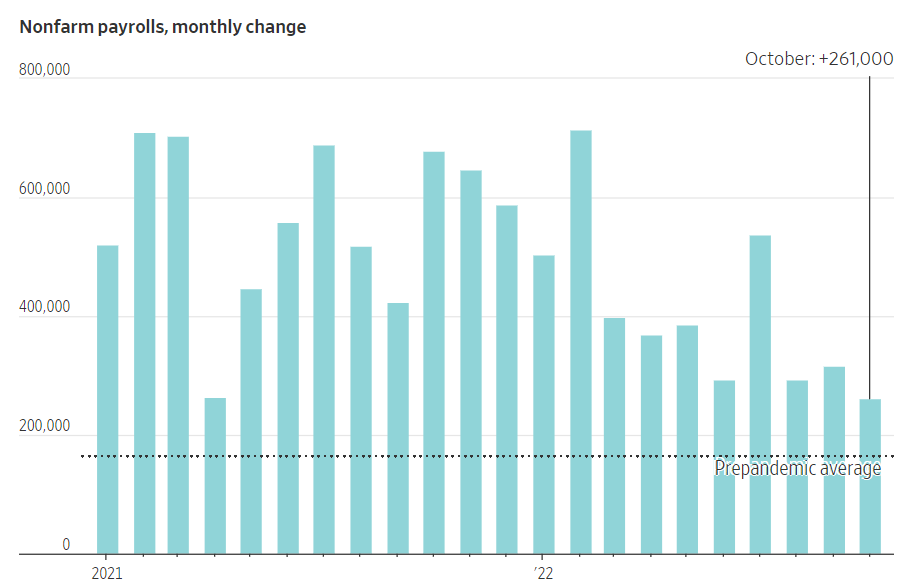

Adding fuel to the Fed’s argument that inflation is still a threat to consumers, employers added a robust 261,000 jobs in October. While the figure is strong, it is the fewest since December 2020. The official unemployment rate ticked up slightly to 3.7%.

The October jobs report shows the U.S. economy is beginning to lose momentum following tremendous growth since recovering from the effects of the pandemic. The chart below from the Labor Department shows the rate of new jobs drifting lower but still above the pre-pandemic average. This is why the Fed chairman said their work is not over.

Companies face a conundrum. On one hand, they still struggle to replace workers lost at the height of the pandemic. On the other, they are concerned the workers may not be needed if the economy continues to slow. It seems the Fed and businesses face the same conundrum.

If you have any questions, please contact me.

The Markets and Economy

- Inflation in the eurozone hit double-digits in October highlighting the challenges the European Central Bank faces after it signaled an economic slowdown from increasing interest rates.

- The Bank of England raised interest rates by the largest amount since 1989. The 0.75% increase in the bank’s benchmark lending rate took it to 3%, the highest level since 2008.

- U.S. passengers aren’t the only people frustrated with the airlines. Employees at airline carriers have been picketing at airports for months. Complaints that too many employees were offered early retirement during the pandemic have created challenges for pilots, mechanics and flight attendants as demand for travel surges to pre-pandemic levels.

- CVS Health Corp. and Walgreens Boots Alliance Inc. have agreed to pay more than $10 billion to settle opioid crisis lawsuits brought by states, citizens and other governments.

- According to Fannie Mae, less than one-in-five Americans surveyed in April 2022 believe it’s a good time to buy a new home in today’s market.

Offices in Chicago, Naples & Valparaiso.

The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is an unmanaged, market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Consult your financial professional before making any investment decision. You cannot invest directly in an index. Past performance does not guarantee future results.

This newsletter was prepared by David M. Kover®. To unsubscribe from the Weekly Market Update please write us at 555 Eastport Centre Dr., Suite B, Valparaiso, IN 46383 or click this link: Unsubscribe .

Note: All figures exclude reinvested dividends (if any). Sources: Bloomberg, Dorsey Wright & Associates, Inc. and The Wall Street Journal. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly.

Securities offered through Triad Advisors, LLC, member FINRA/SIPC. Investment advice offered through Resources Investment Advisors, LLC, an SEC-registered investment adviser. Resources Investment Advisors. LLC and Vertical Financial Group are not affiliated with Triad Advisors, LLC.