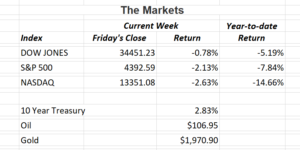

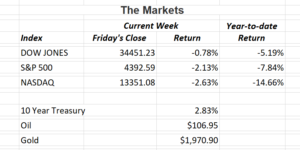

U.S. equity indexes were lower last week as inflationary concerns continue to take center stage. Analysts and consumers are beginning to worry that current inflationary problems may last longer than the Fed anticipated. To help allay consumers fears about runaway inflation, the central bank said to expect a 0.50% interest rate increase in May with more throughout 2022.

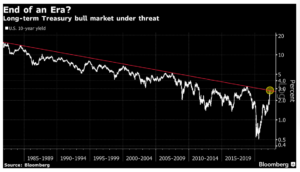

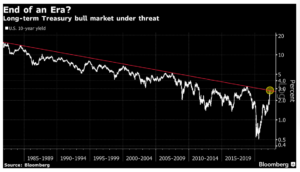

The 10-year U.S. Treasury is testing its long-term trend line (chart below), which has been in place since the early 1980s. During that 40-year timeframe, interest rates have been in a long-term downtrend. Ideally, the challenges facing the U.S. and the world will soon be resolved. We don’t expect interest rates to return to their historic lows, but would hope they level off.

First quarter earnings season got under way last week with mixed results. JPMorgan Chase reported profits sank 42% from a year ago. The results were due to the Ukraine invasion as well as inflation issues and supply chain problems. This is going to be a recurring theme as we continue through through first quarter earnings season. The same problems are affecting corporations and business around the world. Still, the largest U.S. bank by assets reported a per-share profit of $2.63 vs. the $2.69 analyst estimate. Goldman Sachs, Morgan Stanley and Citigroup all reported similar lower results.

On the positive side, the world’s largest asset manager, BlackRock saw its profit increase 20% during the first three months of 2022. And while Delta Air Lines reported a loss for the quarter, the airline reported it returned to profitability in March. So, what do we make of all of this?

In light of the uncertainty due mostly to inflationary issues, I am still bullish on the U.S. economy and stock market but with a cautious eye. We need to keep a close watch on inflation, and if the Fed can slow its advance without throwing the U.S. into a recession. The U.S. economy is strong as consumers are still flush with cash and corporate operations are chugging along. As challenging as the last two years were, 2022 is shaping up to be the third consecutive one. If you have any questions, please contact me.

The Markets and Economy

- U.S. retail sales rose for the third consecutive month in March. Retail and restaurant sales increased 0.5% even though inflation continues to hammer consumers.

- Inflation hit a 40-year high as the Labor Department reported its consumer price index rose last month at its fastest annual pace since December, 1981. The 8.5% annualized increase was the sixth consecutive month prices rose above 6%.

- National health-care spending was $4.3 trillion in 2021. That’s 18% of our nation’s $24 trillion economy last year. That figure is expected to grow.

- 1.13 million single-family homes began construction in 2021. That’s the 10th consecutive year of new housing starts.

- Taiwan Semiconductor Manufacturing said the global computer chip shortage was likely to continue for various types of chips it produces. The world’s largest chip manufa

cturer said its suppliers are grappling with labor challenges and material shortages. The invasion of Ukraine and the shutdown in Shanghai due to rising Covid-19 cases are also compounding the problem.

- The 27-nation European Union announced on March 8 that it will end its purchase of Russian natural gas “well before 2030.” Russia currently supplies 40% of the EU’s natural gas.

Offices in Chicago, Naples & Valparaiso.

The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is an unmanaged, market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Consult your financial professional before making any investment decision. You cannot invest directly in an index. Past performance does not guarantee future results.

Note: All figures exclude reinvested dividends (if any). Sources: Bloomberg, Dorsey Wright & Associates, Inc. and The Wall Street Journal. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly.

Securities offered through Triad Advisors, member FINRA/SIPC. Investment advice offered through Resources Investment Advisors, LLC, an SEC-registered investment adviser. Resources Investment Advisors. LLC and Vertical Financial Group are not affiliated with Triad Advisors.