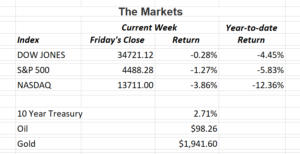

All three major indexes posted slight losses last week as the benchmark 10-year treasury rose above 2.7% by week’s end. Fed Chairman Jerome Powell said the central bank could easily raise interest rates by 0.50% at their next meeting in May. The Fed’s first rate increase in March was 0.25 %. Also, the Fed is ready to stop its monthly bond buying program and begin reducing its balance sheet by $95 billion a month. The central banks balance sheet stands at $9 trillion currently.

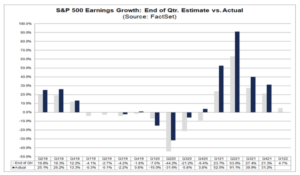

While inflation continues to be a main concern for U.S. stock markets, we turn our attention to first quarter earnings. Announcements get under way this week and expectations are for more solid growth. According to FactSet, earnings are expected to grow by more than 10% during the first three months of 2022. If that happens, it will be the fifth consecutive quarter of earnings growth above 10%. The shaded gray bar is where estimates stood at the end of the previous quarter and the dark blue bar shows where actual results finally came in.

I will report next week how earnings season starts. The results could be important for analysts projections for the rest of 2022.

I am still bullish on the U.S. economy and stock market, especially with the information I’ve written about above. If you have any questions, please contact me.

The Markets and Economy

- In a recent Harris Poll survey for USA Today, about one in five workers who quit their job over the last two years are regretting their decision. Dubbed the Great Resignation, millions of Americans quit their job for other opportunities, or to stay at home due to the pandemic. Other findings in the poll were; just 26% of those who changed jobs said they were content enough to stay, and, fewer than four in ten job quitters feel happy, successful or valued in their new roles.

- As inflation continues to rise, American consumers are feeling the pinch. Consumers are starting to cut back on household staples and switch to lower-cost brands to save money.

- New York warehouse workers voted to form the first union at Amazon. This is the latest example of renewed interest in labor activism among U.S. workers.

- The 10-year treasury soared to close the week at a yield slightly above 2.7%. The spike was due to the Fed stating they plan to combat inflation that is being more persistent than previously thought. This means more interest rates increases for the remainder of 2022.

- The United Nations said global food prices hit a high in March as the war in Ukraine threatens food shortages in some of the world’s poorest countries.

Offices in Chicago, Naples & Valparaiso.

The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is an unmanaged, market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Consult your financial professional before making any investment decision. You cannot invest directly in an index. Past performance does not guarantee future results.

Note: All figures exclude reinvested dividends (if any). Sources: Bloomberg, Dorsey Wright & Associates, Inc. and The Wall Street Journal. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly.

Securities offered through Triad Advisors, member FINRA/SIPC. Investment advice offered through Resources Investment Advisors, LLC, an SEC-registered investment adviser. Resources Investment Advisors. LLC and Vertical Financial Group are not affiliated with Triad Advisors.