|

Volatility returned to U.S. equity markets last week as concerns over the spread of the coronavirus worried investors. Reported cases on Covid have increased in every state in the country. The Delta variant now accounts for 83% of all new cases according to the CDC.

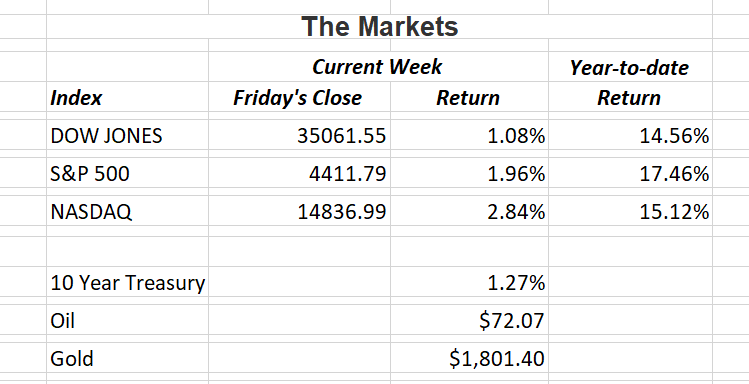

The Dow Jones Industrial Average saw a 2.1% loss on Monday as the S&P 500 dropped almost 1.6%. Equity markets staged a strong rally on Tuesday and Wednesday due to strong earnings reports. Monday’s losses were recouped by the close of Wednesday’s trading. By Friday’s close, the S&P 500 gained almost 2% on the week.

The U.S. economy is humming. Job growth is strong and investor confidence high. The Fed’s fiscal stimulus policies have resulted in investors and many corporations being flush with cash. The one concern now? The Delta variant.

We all remember what happened last spring when the pandemic hit hard. The economy slid deep and fast. However, it did recover quicker than anyone had anticipated. With Covid cases on the rise again, fears are mounting that the U.S. could face a phase three of this pandemic. If that happens, no one knows how it could affect the economy and the stock market.

For the time being, we’ll continue to hope we get the virus under control so we can all get back to business as usual. I’ll continue to keep you updated on second quarter earnings.

|

|

If you have any questions, please contact me.

|

|

The Markets and Economy

Offices in Chicago, Kansas City, St. Louis, Naples & Valparaiso.

The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is an unmanaged, market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Consult your financial professional before making any investment decision. You cannot invest directly in an index. Past performance does not guarantee future results.

Note: All figures exclude reinvested dividends (if any). Sources: Bloomberg, Dorsey Wright & Associates, Inc. and The Wall Street Journal. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly.

Securities offered through Triad Advisors, member FINRA/SIPC. Investment advice offered through Resources Investment Advisors, LLC, an SEC-registered investment adviser. Resources Investment Advisors. LLC and Vertical Financial Group are not affiliated with Triad Advisors.

|