S&P 500 financial companies were among the first to release second quarter earnings figures. For the most part, results were strong with 85% of those reporting so far easily beating analysts’ estimates. Analysts expect results to continue to be strong.

Rising inflation continued to concern investors last week. The consumer-price index for June rose 5.4%, the highest reading since 2008. Automobiles were the main cause for the spike as prices for cars and trucks jumped 10.5% from the previous month. Many economists believe the spike is transitory and related to pent-up demand from the effects of the pandemic. Most notably is a shortage of computer chips used in a host of electronic devices as well as automobiles.

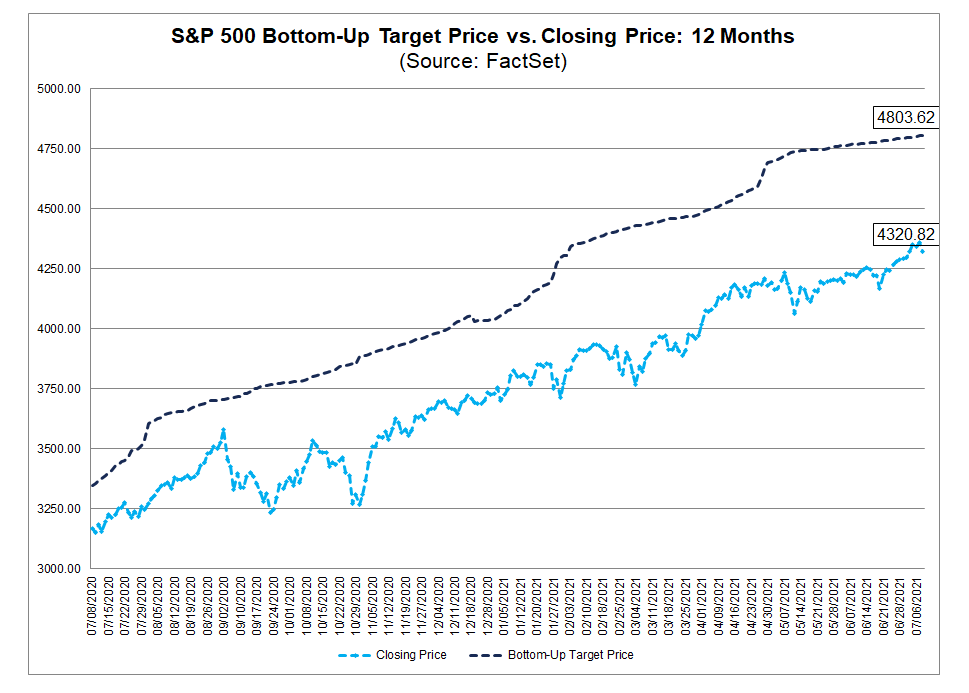

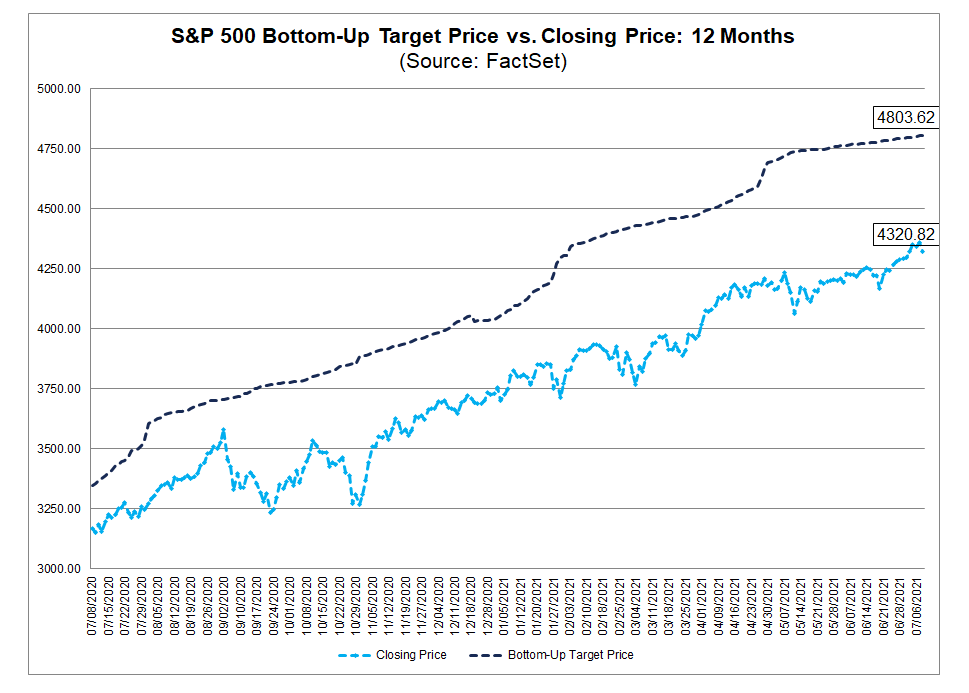

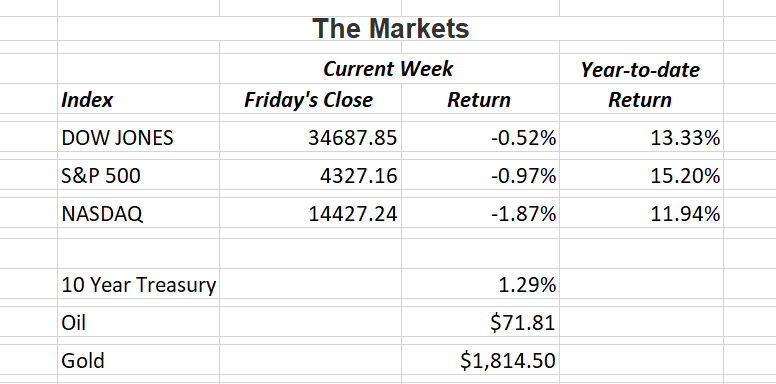

The chart below from FactSet shows industry analysts expect double-digit growth in the S&P 500 over the next 12 months. Between the pent-up demand from the pandemic, strong balance sheets of corporations and consumers flush with cash from the government stimulus programs, I believe growth in the U.S. economy and stock market will continue to be strong.

If you have any questions, please contact me.

|

The Markets and Economy

- According to the Federal Reserve Bank of New York, 19% of Americans that have outstanding student loan debt are over the age of 50.

- According to a recent Prudential worker survey, 24% of 2,000 Americans questioned are planning on looking for a new job in the post-pandemic world. In April 2021, nearly four million American workers quit their jobs, the largest number in U.S. history.

- After the pandemic’s effect on restaurant and other leisure/hospitality businesses, many workers have opted for careers in other areas. This may continue to plague those businesses as they struggle to find employees.

- Economists surveyed by the Wall Street Journal raised their inflation forecast recently. The average annual increase of 2.58% from 2021 through 2023 puts inflation at a level not seen since 1993.

- Retail sales rose a strong 0.6% last month compared to May. The increase beat analysts’ expectations and reverses a slowdown earlier in the spring.

- The Biden administration is warning American businesses about the increasing risks of operating in Hong Kong as China’s tightening grip on the city causes business conditions to deteriorate.

- China continues to exert authority over tech companies based within its borders. The latest comes as regulators, state security and police descended on ride-hailing firm, Didi Global. Neither Didi nor Chinese officials responded for comment when asked about the recent actions.

- The U.S. birthrate is at a record low and economists believe it will stay that way. In 2020 the U.S. birthrate dropped a surprising 4% over 2019 figures.

|

Offices in Chicago, Kansas City, St. Louis, Naples & Valparaiso.

The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is an unmanaged, market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Consult your financial professional before making any investment decision. You cannot invest directly in an index. Past performance does not guarantee future results.

Note: All figures exclude reinvested dividends (if any). Sources: Bloomberg, Dorsey Wright & Associates, Inc. and The Wall Street Journal. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly.

Securities offered through Triad Advisors, member FINRA/SIPC. Investment advice offered through Resources Investment Advisors, LLC, an SEC-registered investment adviser. Resources Investment Advisors. LLC and Vertical Financial Group are not affiliated with Triad Advisors.