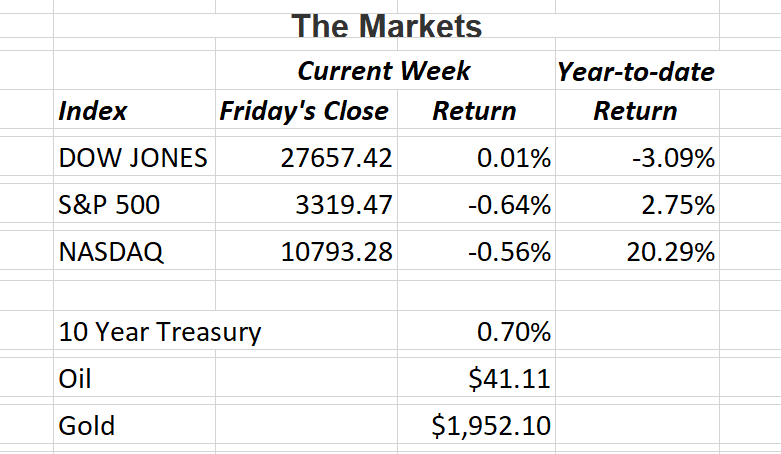

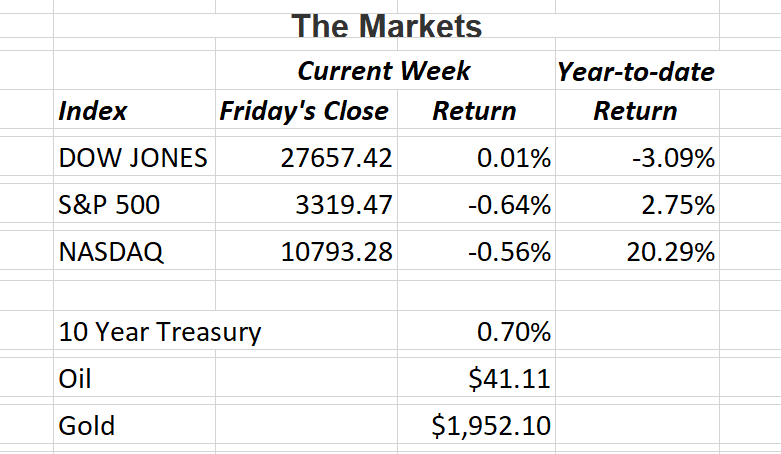

Stocks fell for the third consecutive week. Although the Dow Jones Industrial Average fell a scant 0.01%, the S&P 500 and the tech-heavy Nasdaq both fell a little over half a percent. Friday’s market action continued recent volatile sessions where indexes quickly retreated after rising strongly in the morning.

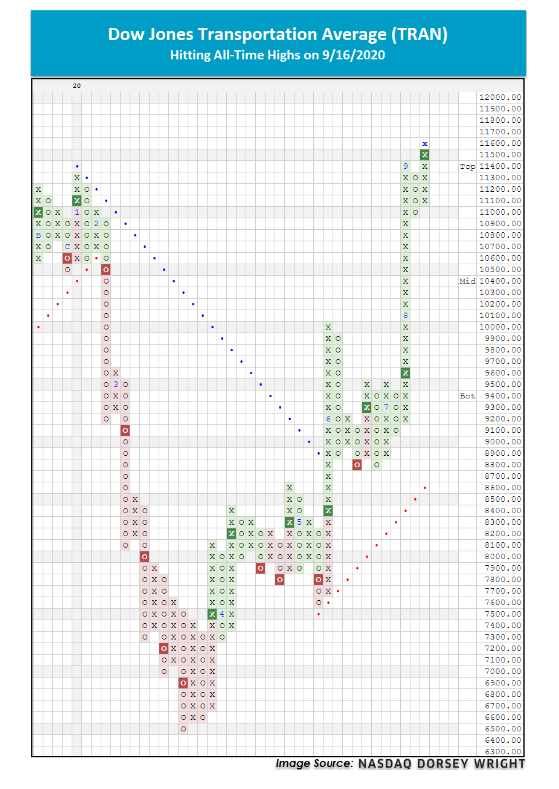

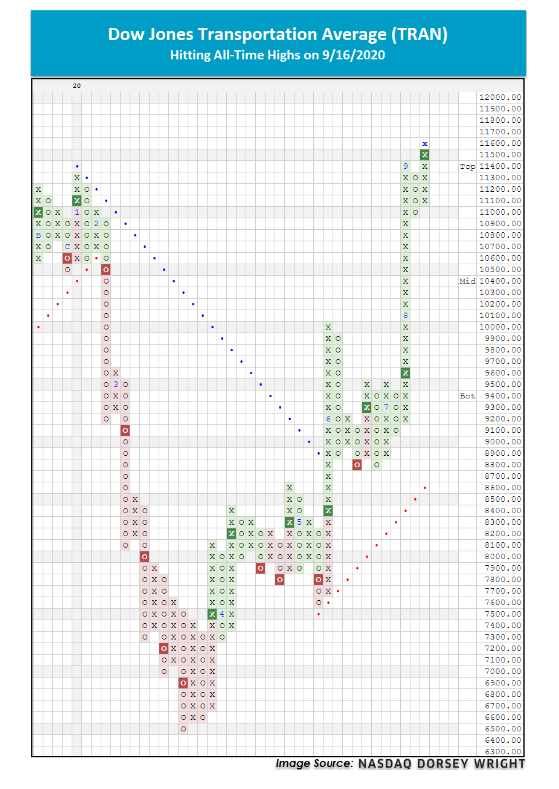

In stark contrast to the weakness we’ve seen in the market over the last three weeks, there has been an interesting development in one major sectors of the Dow Jones Industrial Average; the Transportation Index. According to Dow theory. this index has a reputation of serving as a catalyst for the rest of the market. The Dow theory is a financial theory which, according to Investopedia, says, “The market is in an upward trend if one of its averages (i.e. industrials or transportation) advances above a previous important high and is accompanied or followed by a similar advance in the other average.” While the Dow Jones Industrial Average has seen a nice rally since the bottom in March, it has not quite moved above its all-time highs it made earlier this year in February. In fact, a couple of weeks ago it was about 1.2% away from hitting that target. In the meantime, the Dow Jones Transportation Average, as viewed by many as a key indicator of the market’s and the economy’s heath, has advanced above its previous high in January and last Wednesday, made an intraday high of $1,1679 which is a new all-time high for the index. On a year-to-date basis, the Transportation Average has a gain of 6.91% while Dow Jones Industrial Average is down -1.77%.

We’ll be watching closely to see if the Dow Jones Industrial Average can rise above it’s February high and keeping you informed here.

If you have any questions, please let me know.

The Markets and Economy

- Industrial production in the U.S. rose for a fourth consecutive month in August. However, at a much lower rate than earlier in the summer, a sign that the manufacturing recovery is slowing.

- According to the National Association of Realtors, there were 400,000 fewer existing homes for sale nationwide at the end of July 2020 (1.5 million) than there were at the end of July 2019 (1.9 million), a drop of 21% on a year-over-year basis. This is why housing prices keep rising. Same demand with less supply will force prices higher.

- Amazon.com Inc. announced plans to hire 100,000 additional employees in the U.S. and Canada. The move continues a rapid expansion that began as the coronavirus pandemic forced many people to stay home and shop online.

- The Bureau of Labor Statistics reports jobs in the hard copy publishing industry (i.e., newspapers, magazines, books, directories, mailing lists, calendars, greeting cards and maps) are projected to drop by 33% between 2019 and 2029, a forecasted loss of 99,200 jobs.

- Data from Brivo, a company that provides access-control systems for workplaces, shows that “unlocks” at offices—when someone uses their credentials to enter an office—in late August were down 51% from the end of February. By comparison, visits to manufacturing and warehouse locations, where fewer jobs can be done remotely, remained down by a third.

- The Fed has pledged to support the U.S. economic recovery by setting a higher bar to raise interest rates. It now appears there will be no interest rate increase until 2023 at the earliest.

- A survey of U.S. building occupancy reveals that much of the country’s commercial property is still half empty. The data comes from Brivo, a company that provides access-control systems for workplaces.

Offices in Chicago, Kansas City, St. Louis, Naples & Valparaiso.

The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is an unmanaged, market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Consult your financial professional before making any investment decision. You cannot invest directly in an index. Past performance does not guarantee future results.

Note: All figures exclude reinvested dividends (if any). Sources: Bloomberg, Dorsey Wright & Associates, Inc. and The Wall Street Journal. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly.

Securities offered through Triad Advisors, member FINRA/SIPC. Imvestment advice offered through Resources Investment Advisors, LLC, an SEC-registered investment adviser. Resources Investment Advisors. LLC and Vertical Financial Group are not affiliated with Triad Advisors.