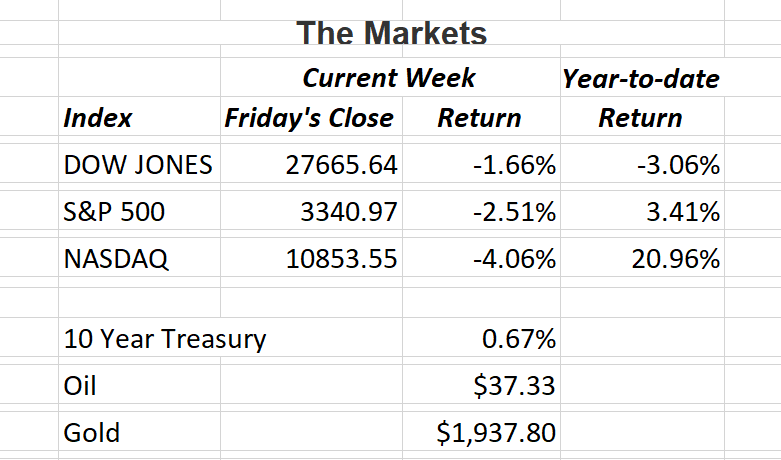

Over the last two weeks, the S&P 500 and tech-heavy Nasdaq have lost 4.8% and 7.2% respectively. That’s their worst performance since March. The big question facing investors is; with the markets sharp run-up since April, is this a “pause that refreshes” or signs of a more serious breakdown?

Last week I wrote about Softbank and their multi-billion dollar bet on tech stocks back in the spring. The Japanese conglomerate’s investment obviously helped fuel the rally in tech stocks, but so has the Fed’s flooding the market with money. The central bank’s low-interest rates and aggressive bond-buying program have significantly contributed to the market’s sharp rebound after March’s steep decline.

September is typically a rough month for the stock market. This ushers in the beginning of fall where some of the most volatile price swings have historically occurred. As usual, analysts and investors are finding it difficult to navigate the choppy waters of information.

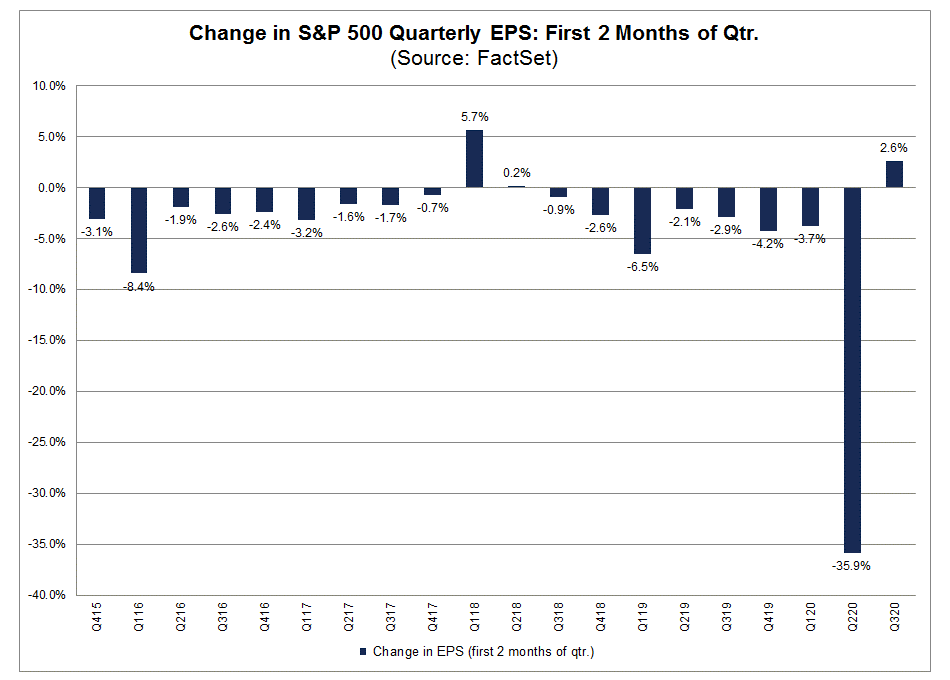

One of the most positive bits of information we’ve seen is projections for third quarter corporate earnings. During the first two months of the third quarter, analysts increased earnings estimates for S&P 500 companies by 2.6% (in the aggregate). That’s an increase of $32.62 from earlier estimates of $31.78. While that may not seem like much of an increase, it shows a continued rebound in earnings. After S&P 500 earnings of $33.13 in the first quarter of this year, we saw them drop to $28.09 in the second quarter as the effects of the pandemic were felt through the entire economy. Now, we are seeing the rebound continue.

The chart below from FactSet shows this is the first time analysts have increased earnings estimates since the first quarter of 2018.

We are still about four weeks away from the beginning of third quarter earnings announcements. Let’s hope the positive news continues.

If you have any questions, please let me know.

The Markets and Economy

- According to congressional reports, negotiations for another stimulus bill continue. Currently, Democrats would support no less than a $2.2 trillion bill, while Republicans would support no more than a $1.3 trillion bill.

- The maximum Social Security benefit paid to a worker retiring at full retirement age in 2020 is $3,011 per month, triple the $975 per month maximum benefit paid 30 years ago.

- In the first six months of 2020, U.S. banks set aside $114.7 billion for loan loss provisions. The loan provisions are funds that banks set aside for default write-offs due to bankruptcies or renegotiated loans. In all of 2019, banks had set aside $55.5 billion.

- As demand for goods continues to rebound, consumer prices are rising. August prices for consumers rose 0.4%. The figure excludes the volatile energy and food categories that can skew inflation expectations.

- Emergency rooms visits nationwide during the month of April 2020 were down 42% when compared to emergency rooms visits from April 2019.

- European nations are facing renewed concerns over the recent spike in coronavirus cases. The U.K., Spain, France and Italy have, or are considering new limits on social gatherings due to a surge in cases.

- Mortgage refinancing is still a booming business. With mortgage rates hitting new lows several times this year, refinancing’s compared to a year ago are up a whopping 200%.

- Going back to work? JPMorgan Chase & Co. executives told senior employees of the bank’s giant sales and trading operation that they and their teams must return to the office by Sept. 21.

Offices in Chicago, Kansas City, St. Louis, Naples & Valparaiso.

The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is an unmanaged, market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Consult your financial professional before making any investment decision. You cannot invest directly in an index. Past performance does not guarantee future results.

Note: All figures exclude reinvested dividends (if any). Sources: Bloomberg, Dorsey Wright & Associates, Inc. and The Wall Street Journal. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly.

Securities offered through Triad Advisors, member FINRA/SIPC. Imvestment advice offered through Resources Investment Advisors, LLC, an SEC-registered investment adviser. Resources Investment Advisors. LLC and Vertical Financial Group are not affiliated with Triad Advisors.