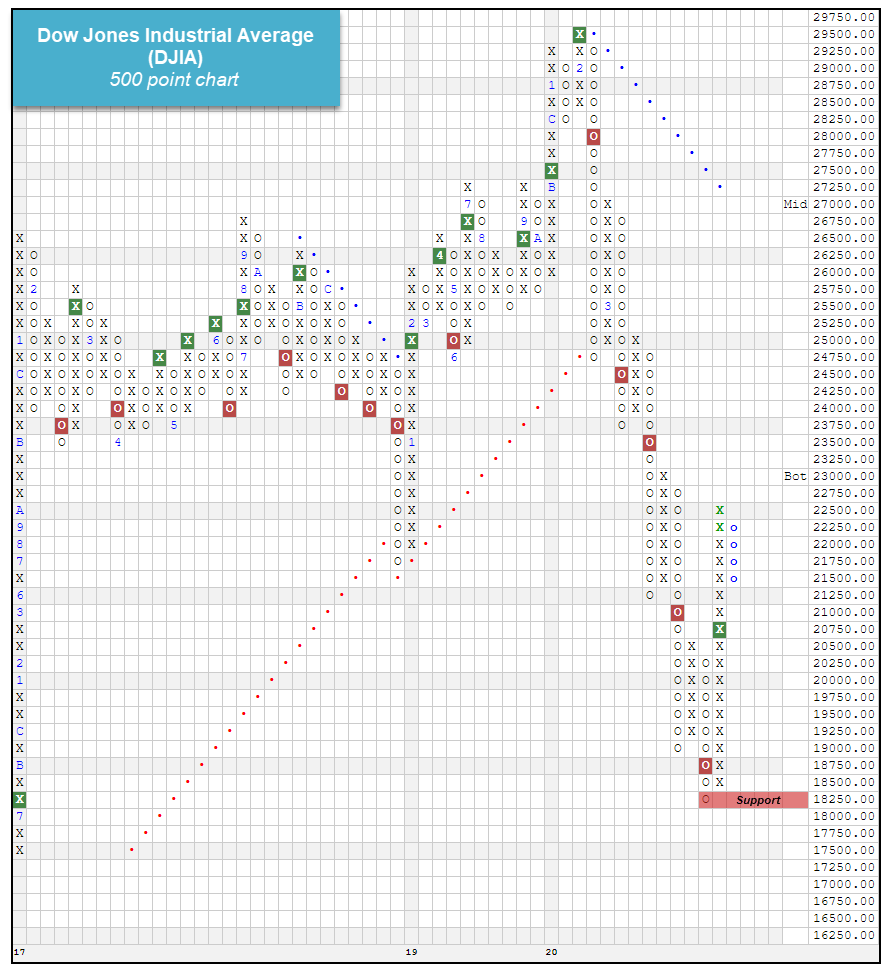

After one of the worst weeks in history for U.S. markets, major stock indexes reversed course last week and posted double-digit gains (the Nasdaq was only up 9%). Even with Friday’s 915 point decline, the Dow Jones Industrial Average (DJIA) managed to reverse course from a bear market to officially bull market status. As you may be aware, a bear market is defined by the DJIA falling by 20% or more from a previous high. This happened on March 11, although the market index ultimately ended up falling over 37% from its peak on February 12 through the bottom on March 23. In order to transition back to a bull market, the index needs to advance 20% from its low. That occurred last Thursday ending the shortest bear market in history lasting only 11 trading days.

The point and figure chart below comes from Nasdaq Dorsey Wright and illustrates the reversal up along with Friday’s decline.

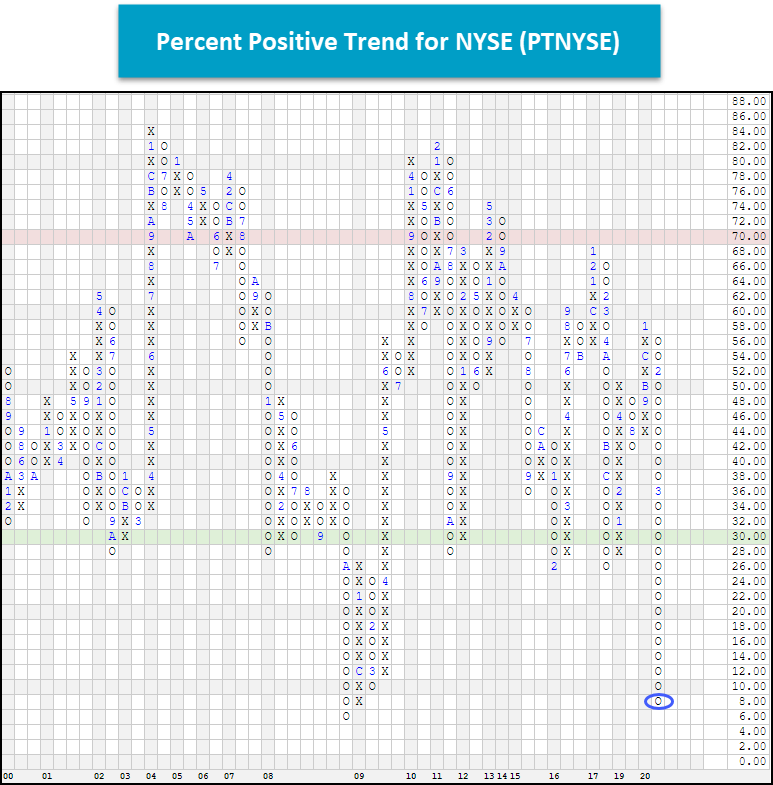

The welcomed rally doesn’t necessarily mean the market will continue to go straight up from here. There is still plenty of concern over how much of a hit corporate earnings will take and how soon will they recover. The chart below, again from Nasdaq Dorsey Wright, shows another important technical chart we follow. It shows the percent of stocks that trade on the New York Stock Exchange that are on a buy signal. Even with last weeks strong showing, the chart has yet to reverse upward.

All of this means we will likely see more volatile trading days for the foreseeable future. We welcome the reversal to bull market status but understand that the shortest bear market in history could be followed by the shortest bull market in history. If you have any questions, please call me at 888-411-2590.

Sources: Bloomberg, Dorsey Wright & Associates, Inc. and The Wall Street Journal, FactSet. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly.

Securities offered through Triad Advisors, member FINRA/SIPC. Investment advice offered through Resources Investment Advisors, LLC, an SEC-registered investment adviser. Resources Investment Advisors. LLC and Vertical Financial Group are not affiliated with Triad Advisors, LLC