With our stomachs full of turkey, stuffing and pumpkin pie, we turn the corner and head full-steam into the final five weeks of 2022. Will the stock market advance investors have enjoyed over the last several weeks turn into an extended Santa Claus rally? Or will the stock market feel as bloated as several of us after Thanksgiving dinner and look to take a nap? While U.S. markets have become a little overheated, there is reason to believe we may just see the indexes hold onto the gains they’ve recently posted.

The National Retail Federation expects holiday sales to increase by 8% this year. According to NPR Broadcasting, $9 billion was spent over the Black Friday shopping weekend, just for online purchases. Consumers are expected to spend and travel as this is the first year the U.S. is without any Covid restrictions.

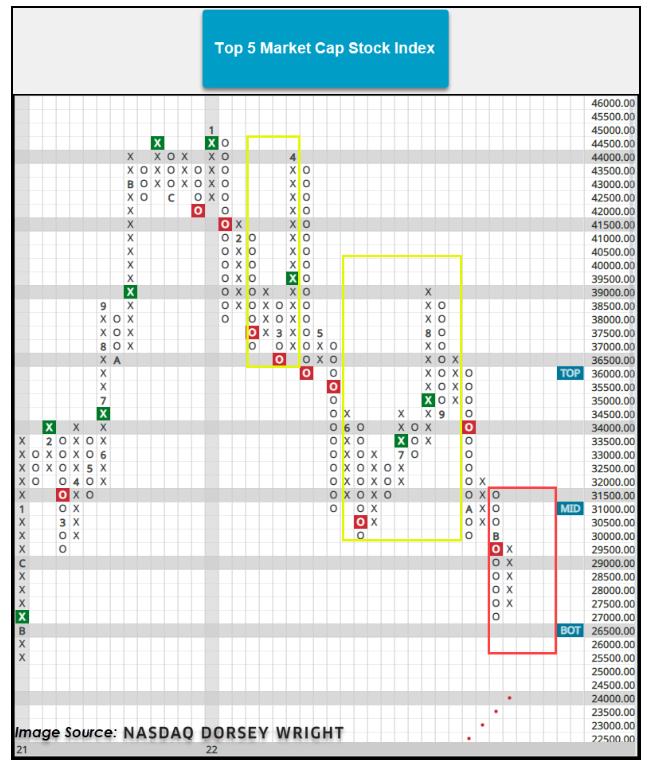

I mentioned the rally the stock market has seen over the last several weeks. While it was broad-based, there was one notable area that hasn’t participated along with the overall market. The market generals, the five largest companies by capitalization, have mostly been absent during the rally. An equal weighted index of these five companies, Apple, Amazon, Microsoft, Google (Alphabet) and Tesla are down 6.3% over the last 30 days while the S&P 500 has gained 7.3%. according to our technical research source, Nasdaq Dorsey Wright. The dispersion in performance is extremely wide considering those five stocks make up 20% of the S&P 500. Of those five, Apple has performed the best and still shows strong technical attributes.

The chart below from Nasdaq Dorsey Wright shows the equal-weighted chart of those five stocks. You can see how they have continued to break down during 2022.

If you have any questions, please contact me.

The Markets and Economy

- After several years of record breaking revenue, S. law firms are bracing for economic uncertainty. A slowing economy and hesitant consumers are giving pause to significant growth and signing bonuses.

- U.S. consumers and businesses have trimmed spending plans for gifts, charitable contributions and holiday events, data shows. The crucial holiday selling season is being plagued by both the Grinch and Ebenezer Scrooge in the form of inflation and a slowing economy.

- China’s consumers are reeling from Beijing’s dual campaign against rising property prices and Covid-19 Retail sales unexpectedly dropped in October and are expected to continue to struggle through the rest of 2022.

- Inflation is hitting holiday shoppers in the wallet (or purse) as they cut back on toy purchases retailers noted. Toy inventories are high and discounts steep. Holiday shoppers are waiting and watching to see if the deals get any better.

- Even as the stock market is shaping up for a decline in 2022, investors aren’t deterred. $86 billion has been poured into S. equities through the end of October, the second-highest sum since 2013 according to rating agency Morningstar.

- Worker unrest at the world’s largest iPhone factory in China is causing production problems for Apple. Police were filmed beating protesting employees at the plant as labor groups criticize Apple for failing to adequately protect the rights of workers at the vast Zhengzhou site operated by Foxconn Technology Group. In a press release, Apple said it has staff at the site working closely with Foxconn to ensure their employee’s concerns are addressed.

Offices in Chicago, Naples & Valparaiso.

The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is an unmanaged, market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Consult your financial professional before making any investment decision. You cannot invest directly in an index. Past performance does not guarantee future results.

This newsletter was prepared by David M. Kover®. To unsubscribe from the Weekly Market Update please write us at 555 Eastport Centre Dr., Suite B, Valparaiso, IN 46383 or click this link: Unsubscribe .

Note: All figures exclude reinvested dividends (if any). Sources: Bloomberg, Dorsey Wright & Associates, Inc. and The Wall Street Journal. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly.

Securities offered through Triad Advisors, LLC, member FINRA/SIPC. Investment advice offered through Resources Investment Advisors, LLC, an SEC-registered investment adviser. Resources Investment Advisors. LLC and Vertical Financial Group are not affiliated with Triad Advisors, LLC.