I know I’m dating myself here with this week’s title but I couldn’t resist it, as it seems so appropriate. Some of you may remember back in the1960’s a publication called Mad Magazine. It was very funny, irreverent and a staple of many teenage boys reading. Alfred E. Neuman was the poster child for the magazine with the phrase “What, me worry?” It seems today, that saying applies to those on Wall Street.

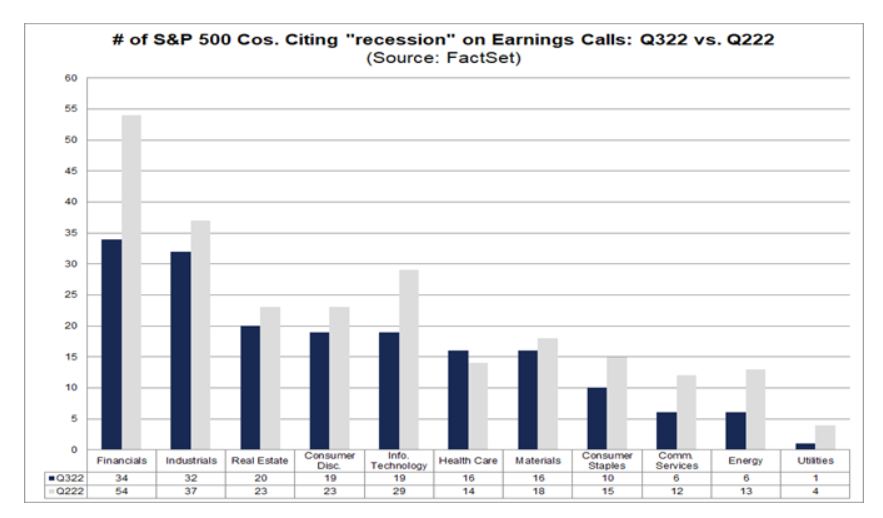

One would think with all the concern over mass layoffs, wars on eastern European soil and inflation running at 40-year highs, corporations would be sounding the alarm. However, that definitely isn’t the case. According to FactSet, on recent third quarter earnings calls, 179 S&P 500 companies cited the term “recession” during their call. Last quarter, 242 mentioned the R-word. It seems especially strange as most companies tend to play up concerns to reduce expectations. The chart below from FactSet shows the comparison between last quarters numbers (shaded gray) and current numbers (dark blue).

After the U.S. posted a solid 2.6 growth rate for GDP in the third quarter of 2022, companies may believe the Fed will be able to engineer a “soft landing” for the stronger-than-expected economy. That may be especially true when you consider that 2.6% growth rate comes on the heels of two back-to-back quarters of negative growth.

More evidence can be found in corporate spending. It seems companies are ramping up their capital projects, putting expenditures on pace to set a quarterly record. Those expansion plans are up 20% from a year earlier. Not exactly what you would expect if corporate leaders believed a recession was imminent.

If you have any questions, please contact me.

The Markets and Economy

- On the heels of news that inflation at the consumer level may be starting to recede, figures for prices at the supplier level are following suit. The producer-price index rose 8% in October vs September’s 5%. That was the second consecutive monthly decline according to the Labor Department.

- Home sales in the S. fell for the ninth consecutive month in October as a lack of inventory and higher mortgage rates plague the housing market. Sales of previously owned homes are down about 32% from their peak in January of this year.

- Warren Buffet’s Berkshire Hathaway purchased $9 billion worth of stocks in the third quarter. Energy, semiconductor, building material manufacturers and retail were the main areas of focus for Berkshire. It shows the Oracle of Omaha’s belief in the strength of the S. economy and stock market.

- Fed Vice Chair Lael Brainard suggested the central bank could begin a slower pace of interest rate increases given recent economic numbers. She said, “I think what’s really important to emphasize is we’ve done a lot of work but we have additional work to do both on raising interest rates and sustaining restraint to bring inflation down to 2% over time.”

- Several challenges continue to plague small business owners in the S. In a recent National Federation of Independent Business survey, 33% said inflation is their single-most important problem. 31% cited supply chain disruptions have had a significant impact on their business and 46% reported having job openings that have been difficult to fill. In spite of this, small businesses are the backbone of the U.S. economy.

- While many differences still remain, President Biden met with China’s President Xi in Bali ahead of the G20 summit. Both parties acknowledged areas of deep disagreement but signaled a willingness to keep an open dialog between the two super powers.

- The world’s population reached the 8 billion mark last Tuesday marking a “milestone in human development” according to a projection by the United Nations. However, falling birth rates mean it will take about 15 years before another billion in human population is added.

Offices in Chicago, Naples & Valparaiso.

The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is an unmanaged, market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Consult your financial professional before making any investment decision. You cannot invest directly in an index. Past performance does not guarantee future results.

This newsletter was prepared by David M. Kover®. To unsubscribe from the Weekly Market Update please write us at 555 Eastport Centre Dr., Suite B, Valparaiso, IN 46383 or click this link: Unsubscribe .

Note: All figures exclude reinvested dividends (if any). Sources: Bloomberg, Dorsey Wright & Associates, Inc. and The Wall Street Journal. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly.

Securities offered through Triad Advisors, LLC, member FINRA/SIPC. Investment advice offered through Resources Investment Advisors, LLC, an SEC-registered investment adviser. Resources Investment Advisors. LLC and Vertical Financial Group are not affiliated with Triad Advisors, LLC.