Markets rallied for the second consecutive week in the U.S. as Pfizer’s Covid-19 vaccine is reportedly 90% effective. If final approval by the Food and Drug Administration comes soon, distribution could take place later this month or next. According to Time magazine, there are currently 214 vaccines for Covid-19 that are currently in the development stage, none of which have been approved by the FDA.

With last week’s market gains, we have seen numerous technical indicators turn positive. In addition, we have seen a major shift in a sentiment survey by the American Association of Individual Investors (AAII). This index surveys how investors feel about the next six-months for the U.S. stock market. Two week’s ago, their index of bullish sentiment stood at 38%. Last week, the AAII index shot up to a reading of 55%.

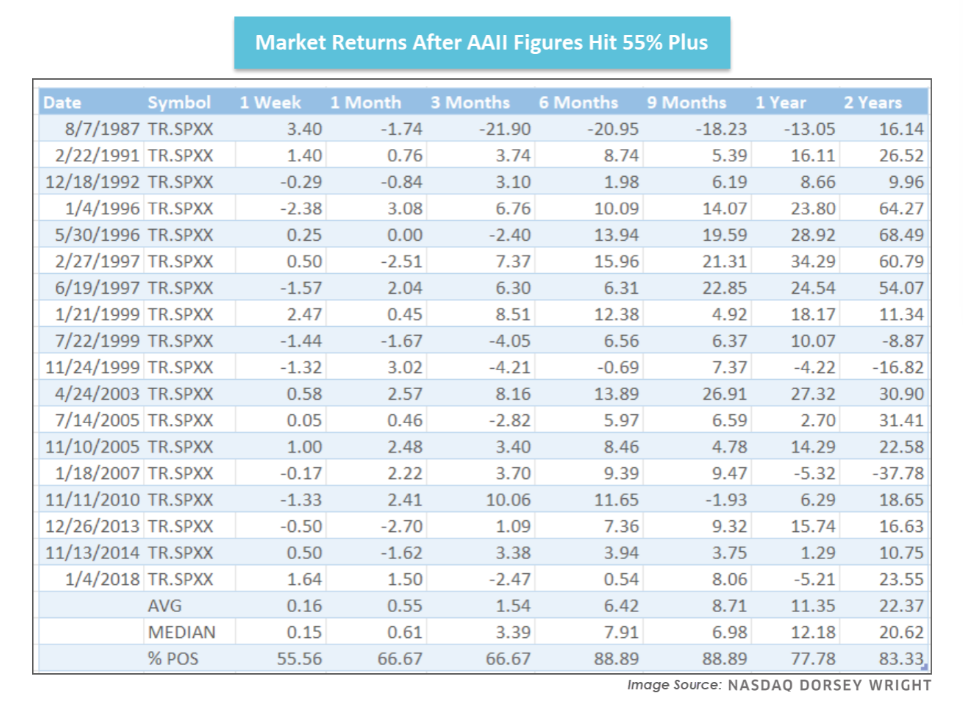

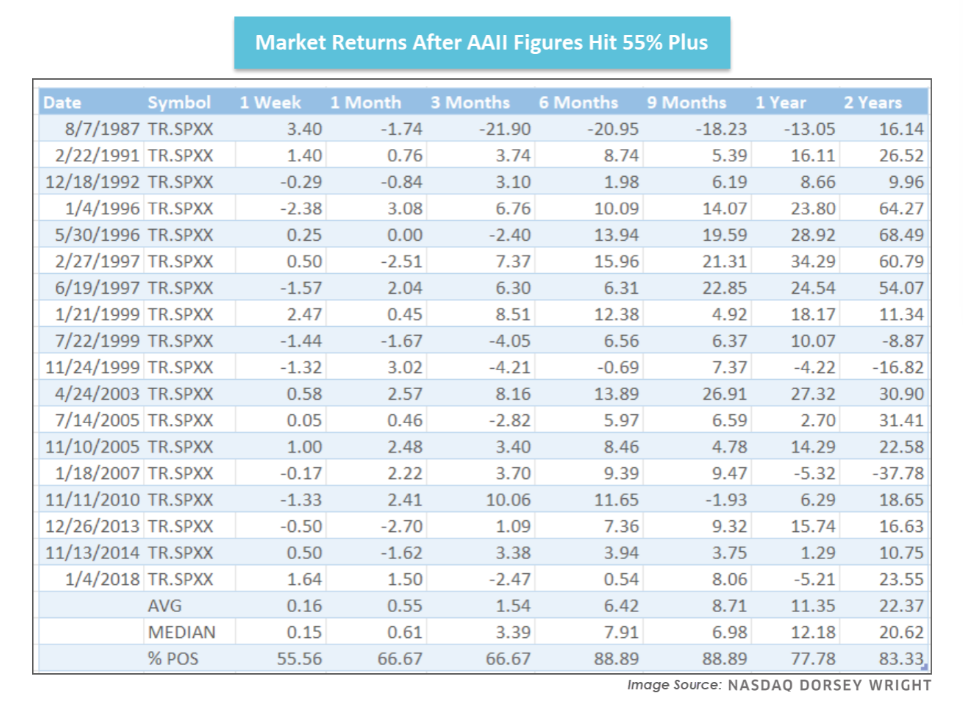

Interestingly, this index is viewed as a “contrarian” indicator, meaning the higher the reading (more bullish) the greater chance the market will decline. However, this isn’t always the case. The chart below from Nasdaq Dorsey Wright shows the market returns for various time periods once the AAII index hit

s 55% or above.

There are a lot of figures here. You should focus on the last two columns on the right-hand side to really put this into perspective. And, keep in mind my comments in last week’s market commentary about our moving into a historically strong six-month period for the U.S. stock market, November thru April.

If you have any questions, please contact me.

The Markets and Economy

- The number of job openings in the U.S. has climbed since the spring and is now nearly back to the levels before the coronavirus pandemic hit the labor market. The results in labor market activity suggests that the recovery is continuing amid numerous headwinds.

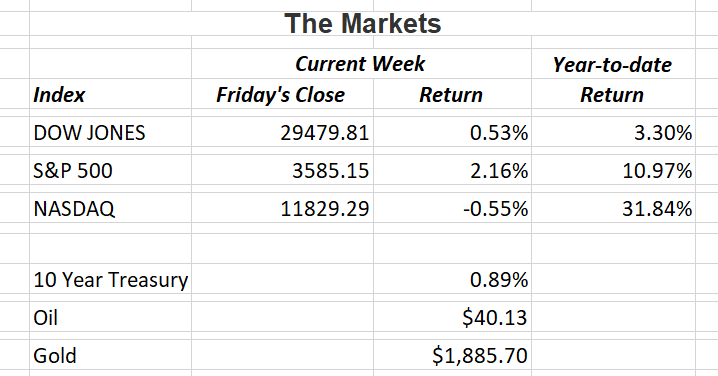

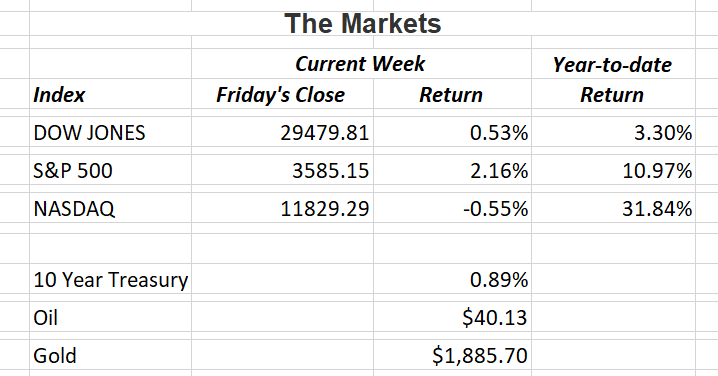

- Investors are losing their appetite for U.K. stocks as deadlocked Brexit talks and rising coronavirus infections continue to plague Britain. The FTSE 100 index, which measures the largest British companies, is down about 18% so far this year. Other European nations are also posting losses on their stock markets. However, Germany’s DAX index is up 5% this year while the S&P 500 in the U.S. is up about 10%.

- Auto sales rose for the fourth consecutive month in China. Sales increased 8% in October from a year earlier according to the China Passenger Car Association. Growth in high-end vehicles outpaced cars for the mass market as the world’s second-largest economy continues to rebound from the economic effects of the pandemic.

- According to OPEC, coronavirus lockdowns in Europe and weakening demand in America will result in global oil demand taking a larger hit in 2020 than previously projected.

- Consumers continue to pour large sums of cash into U.S. bank accounts. At the beginning of 2020, total bank deposits were $13.2 trillion. Last week, that number hit $15.9 trillion.

- As President Trump continues to fight election results, President-Elect Biden is focusing on fighting the coronavirus and sustaining the recovering U.S. economy. According to a Wall Street Journal article, many businesses are hoping for more predictability from the White House.

- American farmers whipsawed by turbulent years during the Trump presidency are finding themselves concerned about the likely-hood of stricter rules governing water quality, meatpacking plant operations and green-house gas emissions with Joe Biden in the White House. Many farmers welcome more stability over the tariff-heavy policies of the last four years that have sent prices in the commodity markets swooning,

- A whopping 66.8% of all voting-eligible Americans voted in the 2020 presidential election. The 159.8 million who voted set an all-time U.S. record for voting and the 66.8% is the highest percentage turnout in 120 years.

Offices in Chicago, Kansas City, St. Louis, Naples & Valparaiso.

The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is an unmanaged, market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Consult your financial professional before making any investment decision. You cannot invest directly in an index. Past performance does not guarantee future results.

Note: All figures exclude reinvested dividends (if any). Sources: Bloomberg, Dorsey Wright & Associates, Inc. and The Wall Street Journal. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly.

Securities offered through Triad Advisors, member FINRA/SIPC. Imvestment advice offered through Resources Investment Advisors, LLC, an SEC-registered investment adviser. Resources Investment Advisors. LLC and Vertical Financial Group are not affiliated with Triad Advisors.