Just when you thought things in 2020 couldn’t get any stranger, President Trump was admitted to Walter Reed Medical Center for being infected with the coronavirus. Netflix couldn’t develop a more surprising series for their streaming service than what we’ve experienced in the first nine months of 2020. So, let’s dig into how the markets did last week and last quarter and what might we expect for the fourth quarter.

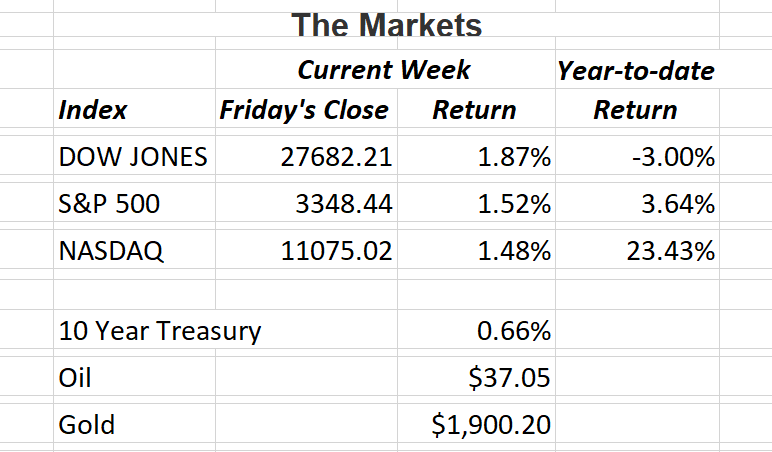

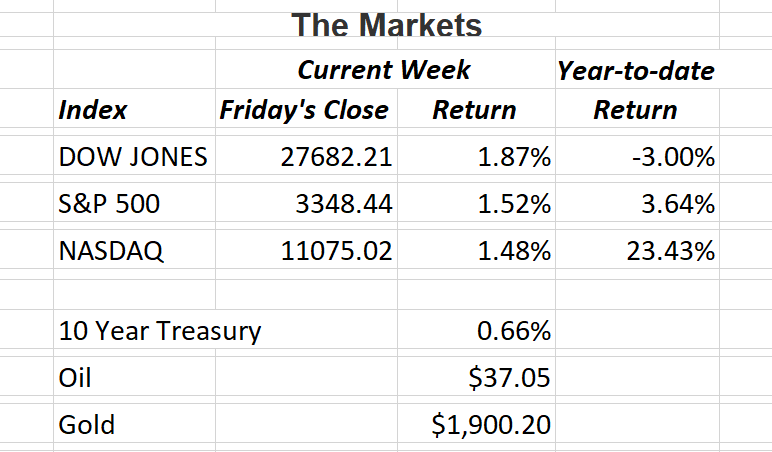

Halting a four-week losing streak, the Dow Jones Industrial Average managed a gain of almost 2% last week. This, in spite of the news that President Trump, the first lady and several members of president’s inner circle all tested positive for Covid-19. With the election about four weeks away, the remaining three months of 2020 are sure to be roller coaster ride. But let’s put it all into perspective.

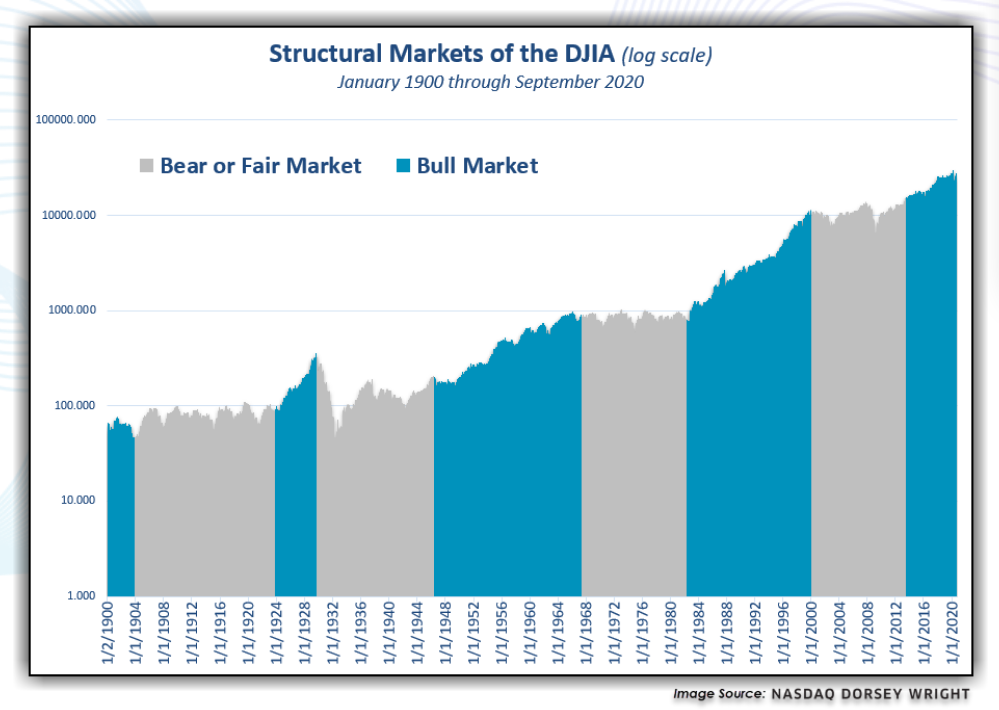

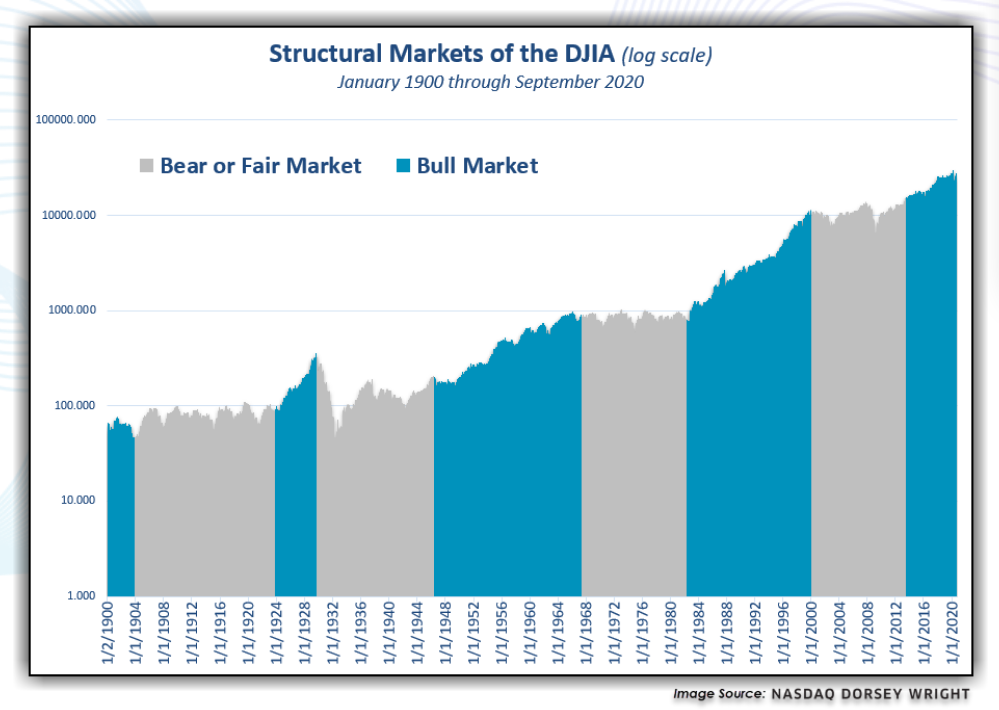

The chart below from Nasdaq Dorsey Wright illustrates the various markets we’ve seen since 1900. The shaded gray areas show a Bear or Fair Market and the blue areas show a Bull Market. There have been nine such alternating cycles completed since 1896, with each averaging 14 years. On its own, this is not earth-shattering information; however, the application of this concept to investing is integral to the importance of financial planning and protecting part of your assets to secure a guaranteed income stream for a secure retirement. Having a properly allocated plan can help you deal with the increased volatility we’ve experienced lately.

The third quarter continued the rebound from the dismal performance of the first three months of 2020. The Dow Jones Industrial Average posted a return of 7.63% during the third quarter. The S&P 500 came in with a gain of 8.47% and the Nasdaq posted a strong return of just over 11%.

The biggest concern I see in the fourth quarter for the markets is on the unemployment front. I’ve said many times before, the more Americans are working, the more they pay in taxes and the more products and services they use. This makes for a strong economy.

Job growth slowed sharply heading into the fall as more layoffs turned permanent, adding to signs that the U.S. economy faces a long haul to fully recover from the pandemic. The U.S. has replaced 11.4 million of the 22 million jobs lost in March and April at the beginning of the pandemic. Keep a close eye on more layoffs being announced over the next three months. And of course, keep reading our market commentary to stay up to date with the latest insights.

If you have any questions, please let me know.

The Markets and Economy

- The 9.1% drop in the size of the U.S. economy between the 2nd quarter of 2019 and the 2nd quarter of 2020 was a smaller decrease than the decline that took place in India (down 25.2%), the UK (down 20.4%), Mexico (down 17.1%), France (down 13.8%), Italy (down 12.8%) and Canada (down 11.5%).

- Consumers are feeling more confident about the U.S. economy, according to September surveys. The Conference Board, a private research group, said its index of consumer confidence surged to 101.8 in September from August’s reading of 86.3.

- Let’s hope they’re right! 159 of 224 global money managers surveyed (71%) in September 2020 anticipate that a “credible vaccine” for the COVID-19 pandemic will be found by 1/30/21 or within 4 months.

- Household income dropped 2.7% in August as enhanced unemployment checks shrank, according to the Commerce Department.

- Before the COVID-19 pandemic hit the U. S., the number of out-of-work Americans as of 2/29/20 was 5.79 million. As of 8/31/20, the number of out-of-work Americans was 13.55 million. Thus in the last 6 months, the pandemic is in part behind 7.76 million people losing their jobs according to the U.S. Labor Dept.

- A recent report by professional-services firm BDO USA, LLP states retail store closings in the U.S. reached a record in the first half of 2020. The report goes on to say this year is on pace for more record bankruptcies and liquidations as the Covid-19 pandemic accelerates industry changes and consumers shift to more online shopping.

- New residential construction in the U.S. totaled 139,100 housing units in July 2020, its highest monthly total recorded since September 2006.

- Auto sales rose in the third quarter as buyers returned to the showrooms. The increase is being driven (sorry no pun intended) by strong demand for trucks and sport-utility vehicles.

Offices in Chicago, Kansas City, St. Louis, Naples & Valparaiso.

The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is an unmanaged, market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Consult your financial professional before making any investment decision. You cannot invest directly in an index. Past performance does not guarantee future results.

Note: All figures exclude reinvested dividends (if any). Sources: Bloomberg, Dorsey Wright & Associates, Inc. and The Wall Street Journal. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly.

Securities offered through Triad Advisors, member FINRA/SIPC. Imvestment advice offered through Resources Investment Advisors, LLC, an SEC-registered investment adviser. Resources Investment Advisors. LLC and Vertical Financial Group are not affiliated with Triad Advisors.