After a strong early-week rebound in stock prices that made investors believe the Santa Claus rally might come through this year, equities did an abrupt about-face at week’s end. This brings U.S. stocks to a two-week losing streak and dashed hopes of a year-end rally. Here is what happened.

Investors were encouraged by the release of inflation data on Tuesday that showed consumer prices rose at their slowest pace in nearly a year. The news made investors believe the Fed would raise interest rates 0.5% on Wednesday (they did) and then hit the pause button in 2023 until they can gauge the effectiveness of past rate increases (they won’t). Fed chairman Jerome Powell said twice in last week’s comments that the Fed hasn’t made any decisions about upcoming meetings in 2023. In economic projections now, the central bank isn’t expected to stop interest rate increases until the federal funds rate hits between 5% and 5.5%. Currently, the rate is between 4.25% to 4.5%.

More bad news came with the release of November retail sales. Analysts had projected retail sales would drop 0.3% last month. Instead, sales decreased twice that amount to post a decrease of 0.6%. Concerns are mounting that consumers are feeling the pinch of higher prices and may continue to reduce their spending during the holiday shopping season.

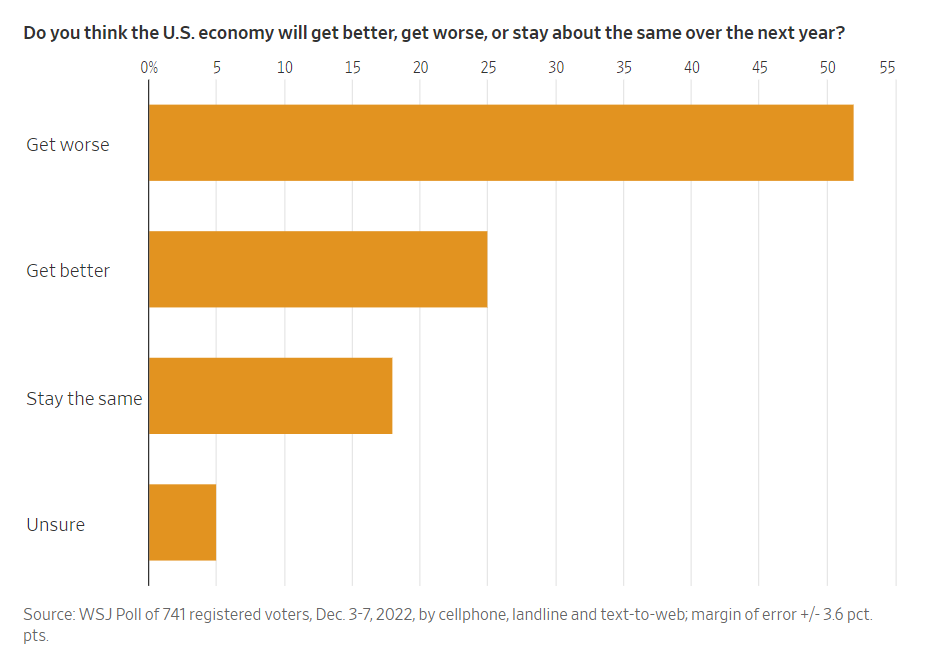

A recent survey of voters by the Wall Street Journal shows that a majority of them believe the U.S. economy will be in worse shape in 2023. Further, almost two-thirds say the economic trajectory is headed in the wrong direction. Interestingly, younger voters were more pessimistic about the economy’s prospects next year than older ones. The chart below shows the results of the poll.

Several economists I follow have been calling for the Fed to start raising interest rates and reduce their quantitative easing program last year. The government fiscal stimulus programs and the money that flooded the market from the central banks aggressive bond-buying program created a sharp spike in M2, the measure of money in circulation. As the U.S. was still recovering from the supply chain issues from the pandemic, we ended up with too much money chasing too few goods and services. That, is the recipe for inflation. And that is the situation the Fed is dealing with now.

Whether our economy makes a soft-landing or we do slide into a recession, is yet to be seen. But we are in much better financial shape as a nation than ever before. Manufacturing is making a comeback at home and jobs are still plentiful. No matter what happens, we will go through this period and emerge stronger on the other side of it. That, I am sure of.

I would like to wish our readers a very Merry Christmas, Happy Chanukah and much health. wealth and happiness in the new year.

If you have any questions, please contact me.

The Markets and Economy

- The percentage of the S. population aged 65+ in 2020 stood at 17% or 56 million. That number is expected to grow due to an aging population. By 2060, the figure is projected to be 25% or 95 million.

- Microsoft is taking a 4% stake in the parent company of the London Stock Exchange. The deal calls for the exchange to spend $2.8 billion over the next decade on Microsoft “We are building substantially new products together on an entirely different scale”, said the exchange’s CEO David Schwimmer.

- Tesla investors are becoming more concerned with Elon Musk’s obsession with his recent purchase of Twitter. “Who is running Tesla day to day during this critical time for the company”, voiced one major shareholder in a tweet to Tesla’s Tesla’s shares are down 54% year-to-date while the Dow Jones Industrial Average and S&P 500 are both down 9.4% and 19.1% respectively.

- The monthly federal deficit was a record-setting $249 billion in November. That’s $57 billion more than the same month last year. Broad government fiscal support and a rebound in the S. economy at the end of the pandemic are coming to an end. With the Fed raising interest rates, experts expect the deficit to widen even more as tax receipts would likely fall.

- OPEC maintained its outlook for global oil supply and demand last Tuesday. The announcement suggests the oil cartel doesn’t expect Western attempts to set a price cap at $60 a barrel for Russian oil to have much of an impact on global crude output.

- United Airlines said it would purchase 100 of Boeing’s 787 Dreamliners with options to buy 100 more; a win for the plane maker after a streak of manufacturing, engineering and regulatory setbacks. The deal, worth $30 billion is a victory for Boeing over European rival Airbus.

- Suffering from lingering effects of its zero-tolerance Covid policies, China’s economy continued to struggle in November. Although Beijing has mostly abandoned it’s strict lockdown measures, many analysts fear it will take months for the world’s second-largest economy to bounce back

Offices in Chicago, Naples & Valparaiso.

The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is an unmanaged, market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Consult your financial professional before making any investment decision. You cannot invest directly in an index. Past performance does not guarantee future results.

This newsletter was prepared by David M. Kover®. To unsubscribe from the Weekly Market Update please write us at 555 Eastport Centre Dr., Suite B, Valparaiso, IN 46383 or click this link: Unsubscribe .

Note: All figures exclude reinvested dividends (if any). Sources: Bloomberg, Dorsey Wright & Associates, Inc. and The Wall Street Journal. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly.

Securities offered through Triad Advisors, LLC, member FINRA/SIPC. Investment advice offered through Resources Investment Advisors, LLC, an SEC-registered investment adviser. Resources Investment Advisors. LLC and Vertical Financial Group are not affiliated with Triad Advisors, LLC.