There was nothing spooky about the stock market’s performance last week. Even when the largest tech companies disappointed investors with their earnings shortfall, the Nasdaq managed to squeeze out a 2.24% gain. Another non-spooky consideration is how it appears the month of October will turn out. Typically not one of investors favorite months, October 2022 is on track to post an approximate gain of 8.8% with just one trading day left in the month.

The significant news last week was that the U.S. economy grew at an annual rate of 2.6% in the third quarter. Exports were strong, especially with oil & natural gas being shipped to Europe to help deal with the effects of the war in Ukraine. There were some chinks in the armor though. Consumer spending is showing signs of slowing down and higher mortgage rates are affecting the interest-rate sensitive housing industry. New home sales were down almost 11% in September and analyst believe we are beginning to see weakness in home prices. Something we haven’t seen in years.

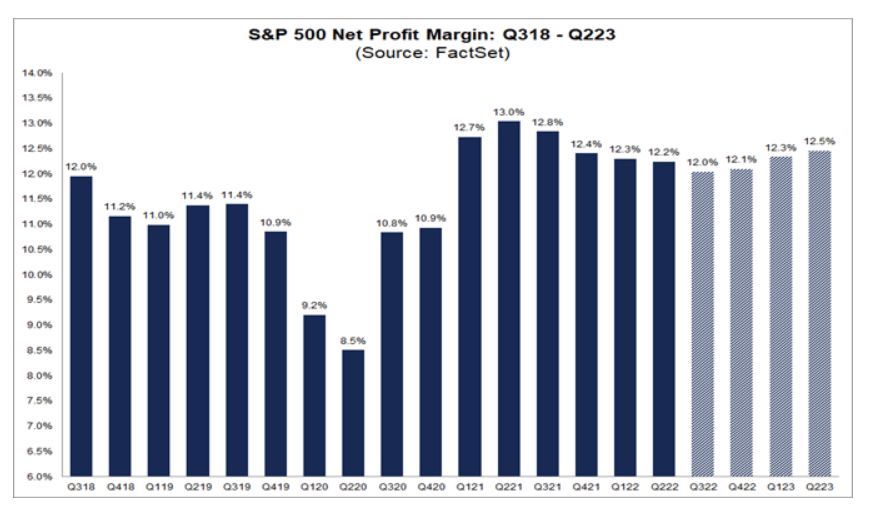

One thing Wall Street is always concerned with is corporate profits. The better companies do, the better for the entire economy. It’s a win-win for everyone. The chart below from FactSet shows where corporate profits have come in so far (the dark blue bars) and where they are expected to be going forward (the light blue bars). We can see that profits for companies in the S&P 500 peaked in the second quarter of 2021 at 13%. Since then, they have steadily declined just slightly where they should bottom around 12% for the third quarter of 2022. From there, they are expected to gradually increase again.

The point of this is as I have said numerous times during 2022, profits will pull back, but no one expects them to fall off a cliff as they did in 2020 (or even 2008). The U.S. economy is very strong and should be able to handle higher interest rates. Maybe this is why October turned out to be a much better month than analysts expected.

If you have any questions, please contact me.

The Markets and Economy

- Analysts are calling for a “more significant” recession in the K. Missteps by government officials and blistering inflation will challenge Britons for several years.

- The Inflation Reduction Act includes $80 billion for the IRS over the next decade. The IRS is expected to hire some 87,000 new employees by the year 2031. The additional workers along with upgrades to technology platforms is estimated to bring in $124 billion of new tax revenue according to the S. Senate.

- Americans are renting fewer apartments as demand in the third quarter fell to its lowest level in 13 years. Some renters are taking on roommates while others are staying longer with family or friends according to a recent UBS

- Federal estate tax exemptions are rising, according to the Internal Revenue Service. The new adjustments will allow individuals to pass $12.9 million to heirs without incurring federal estate tax liabilities. With proper planning, families can pass $25.8 million to their heirs avoiding the tax.

- As expected, the European Central Bank raised interest rates by 0.75%. The eurozone is battling inflation as it teeters close to a recession.

- According to the National Bureau of Statistics, the two worst quarters for China’s economy in the last 30 years have occurred since the pandemic began. The first was a decline of 6.8% posted in the first quarter of 2020. The second worst quarter was a slight gain of 0.4% in the second quarter of 2022.

- Credit card debt for Americans is on the rise again as It reached a level not seen since the beginning of the pandemic. Total credit card balances in the U.S. hit $916 billion in September, nearly identical to the level seen in December 2019.

Offices in Chicago, Naples & Valparaiso.

The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is an unmanaged, market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Consult your financial professional before making any investment decision. You cannot invest directly in an index. Past performance does not guarantee future results.

This newsletter was prepared by David M. Kover®. To unsubscribe from the Weekly Market Update please write us at 555 Eastport Centre Dr., Suite B, Valparaiso, IN 46383 or click this link: Unsubscribe .

Note: All figures exclude reinvested dividends (if any). Sources: Bloomberg, Dorsey Wright & Associates, Inc. and The Wall Street Journal. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly.

Securities offered through Triad Advisors, LLC, member FINRA/SIPC. Investment advice offered through Resources Investment Advisors, LLC, an SEC-registered investment adviser. Resources Investment Advisors. LLC and Vertical Financial Group are not affiliated with Triad Advisors, LLC.