The first quarter of 2020 came to an end last Tuesday. The Dow Jones Industrial Average saw the biggest drop posting a loss of 23%. The S&P 500 was close behind losing 20% and the tech-heavy Nasdaq held up the best posting a decrease of 14%.

Employers cut over 700,000 jobs in March. This is the first time since 2010 that employers shed more workers than they added. There is still more pain to come as the U.S. deals with a possible peak this week of new cases/deaths from COVID-19.

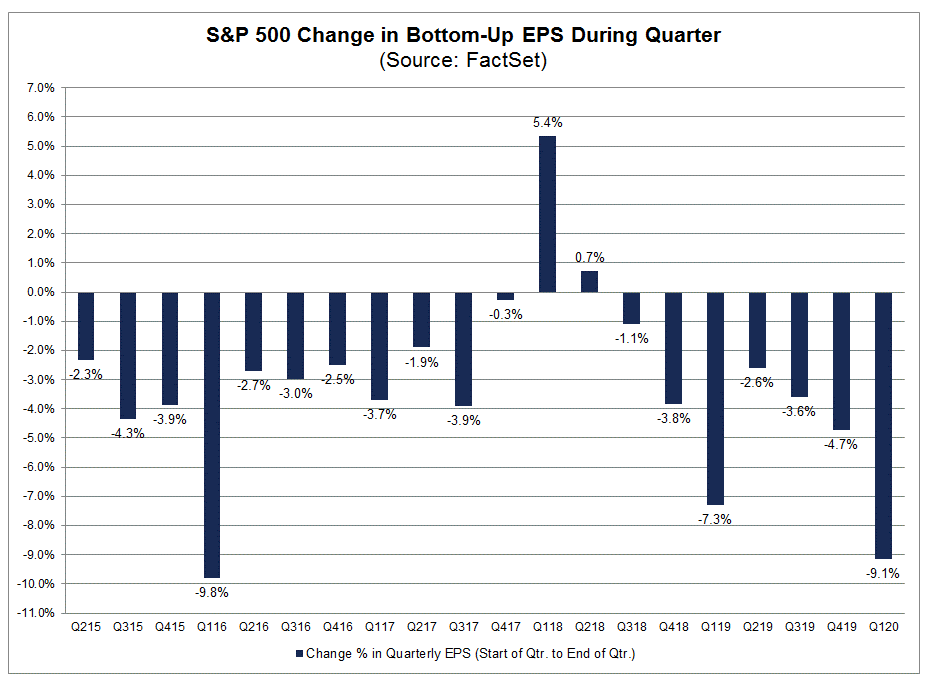

As expected, earnings for the first quarter are expected to decline over 9% to $36.97 from the previous quarters $40.68. The chart below from FactSet shows this is close to the 9.8% drop in earnings in the first quarter of 2016. This time, however, analysts expect second quarter earnings to be even worse than the first quarter.

That said, let’s focus on the positives, and there are many. First, one of the provisions in the recently passed CARES Act, allows retirees to suspend their required minimum distributions for 2020. Since the account value of most IRA’s is much lower than they were at the end of 2019, retirees have the option of leaving their money invested until markets rebound. Second, many technical analysts believe the market may have well bottomed on March 23 when the Dow Jones Industrial Average closed at 18,591. Friday’s close at 21,502 shows a strong rebound over the last couple of weeks. However, analysts believe that it would actually be healthy for the markets to re-test the March 23 lows and rebound again. This would show strong support at that level and any upswing from there stands a better chance of carrying through. The third positive is the global decline of the spread of the pandemic in China and possibly Europe according to news reports. This means the peak in the U.S. may happen this week and hopefully begin to decline in another week or two.

If you would like more information on how to suspend your required minimum distribution for 2020, please call Diana at 219-477-3830. Be safe and heed your local authorities guidance in reducing the risk of catching the virus.

Sources: Bloomberg, Dorsey Wright & Associates, Inc. and The Wall Street Journal, FactSet. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly.

Securities offered through Triad Advisors, member FINRA/SIPC. Investment advice offered through Resources Investment Advisors, LLC, an SEC-registered investment adviser. Resources Investment Advisors. LLC and Vertical Financial Group are not affiliated with Triad Advisors, LLC