U.S. equity markets dropped last week as Investors dealt with the uncertainty of the Fed’s actions this month and for the remainder of 2022. It was generally believed that the central bank might raise interest rates by 0.5% in a couple of weeks and then take a wait-and-see attitude for the last three months of the year to see what actions might be warranted. Hopes were dashed at the Fed’s meeting in Jackson Hole, Wyoming as Chairman Jerome Powell shifted to a very hawkish view on inflation.

At this point investors are not sure if the Fed can engineer a “soft” landing for the economy. It seems likely the central bank might raise interest rates by another 0.75% at their September meeting. If that happens, it will be the third increase of 0.75% in the last four months. And those were on top of a 0.5% increase in March.

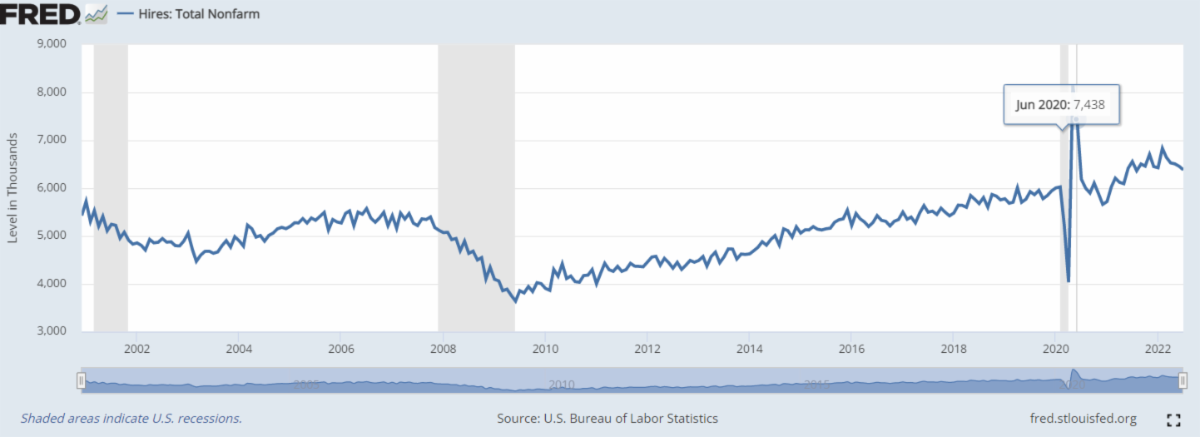

The Fed watches several indicators to see how strong inflation is. One indicator is new hiring’s at companies. August’s increase in new jobs came in at 315,000. That’s still strong but much less than the 526,000 reported in July. You can see at the far right in the chart below from the Department of Labor that new jobs are beginning to drop. If this trend continues, it could help slow down the economy and inflation.

The unemployment rate ticked up slightly to 3.7%. Analysts believe the figure increased because more Americans are actively looking for work.

If you have any questions, please contact me.

The Markets and Economy

- Job openings continue to be plentiful. The S. Labor Department said there were 11.2 million jobs available in July, up from the previous months revised 11 million. The news may give the Fed more reason to continue their interest rate increase policy.

- Another Chinese city is about to face quarantine restrictions. Chengdu is the capital of the Sichuan province with over 16 million people. Local officials have ordered residents to stay home from 6:00 p.m. last Thursday evening as authorities conduct citywide Covid-19 tests through the weekend. Among other challenges residents face is the postponement of the beginning of the school year.

- Russia is pumping almost as much oil into the global market as it did before it invaded Ukraine. And with crude prices around $100 a barrel, they are making a lot more money. One analyst noted; “Russia is swimming in cash.” The sanctions imposed by Europe, the S. and many other nations are being more than offset by the increase in crude prices.

- The Internal Revenue Service inadvertently posted confidential information on about 120,000 S. taxpayers before discovering the error and removed the data from its website. The disclosures included names, contact information and financial data about certain types of business income earned inside some IRA accounts.

- The bottom 50% of Americans are building wealth even as inflation hits. Economists at the University of California, Berkeley created a Realtime Inequality tracker that gauges how the economy is affecting households across the wealth spectrum. It recently showed the bottom 50% of households have developed the strongest financial position in decades due mostly to increases in wages.

- Airlines and airports around the world are extending passenger caps and flight schedule cuts through the fall and winter in hopes of stabilizing operations. Major carriers faced staff shortages that resulted in long flight delays and cancellations. A particularly brutal summer has also contributed to the problem in the S. and Europe. By some estimates, airlines are at about 80% of pre-pandemic servic

As U.S. employers continue to add to their depleted ranks, another problem is taking shape; struggling with an inexperienced workforce. From airlines to restaurants employers are dealing with an influx of new employees, many of whom have little to no experience in their newly selected job. Many companies are holding multiple “orientation” meetings for new hires and pairing up new workers with seasoned employees.

Offices in Chicago, Naples & Valparaiso.

The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is an unmanaged, market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Consult your financial professional before making any investment decision. You cannot invest directly in an index. Past performance does not guarantee future results.

This newsletter was prepared by David M. Kover®. To unsubscribe from the Weekly Market Update please write us at 555 Eastport Centre Dr., Suite B, Valparaiso, IN 46383 or click this link: Unsubscribe .

Note: All figures exclude reinvested dividends (if any). Sources: Bloomberg, Dorsey Wright & Associates, Inc. and The Wall Street Journal. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly.

Securities offered through Triad Advisors, LLC, member FINRA/SIPC. Investment advice offered through Resources Investment Advisors, LLC, an SEC-registered investment adviser. Resources Investment Advisors. LLC and Vertical Financial Group are not affiliated with Triad Advisors, LLC