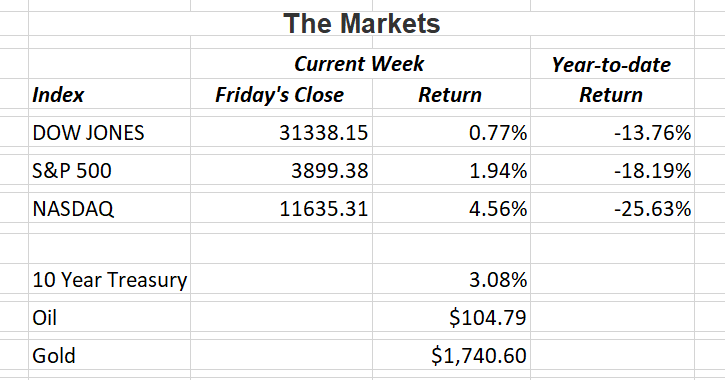

After the strong rebound two weeks ago, the U.S. stock market closed last week with another gain. The major indices still have a long way to go as we are still in the red year-to-date, but some believe we may be at or near the bottom of this correction. Which brings me to this week’s topic; Why does the stock market behave the way it does.

The short answer to this is, the stock market is a “leading indicator.” That means it is not necessarily reacting to current events, but mostly to events it believes will happen six-to-nine months from now. That is why when things look the best, the stock market begins to falter. It is also the reason why the market typically starts to rebound when things look their worst.

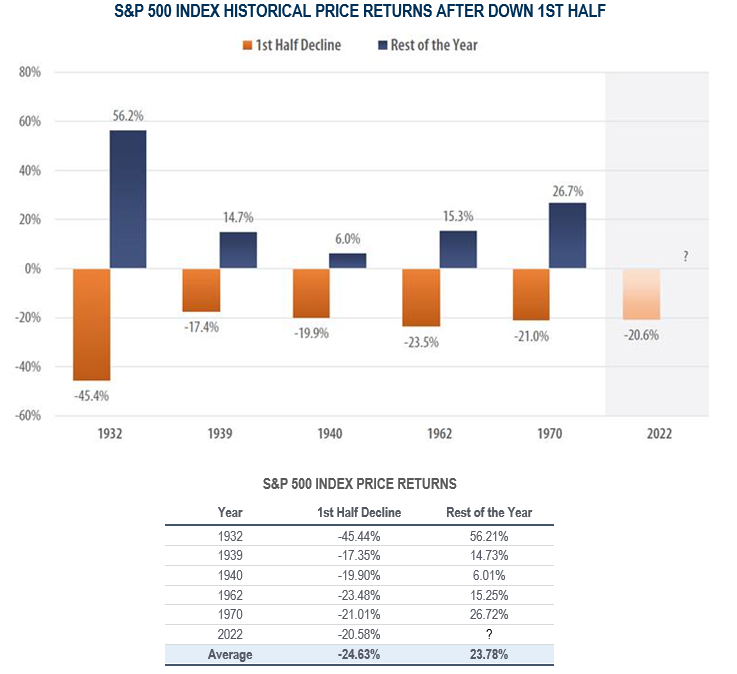

Case in point is shown in the chart from First Trust. After the steep sell-off during the first half of 2022, many investors are wondering what may be in store in the second half of the year. While it is impossible to predict with any certainty, we can look at history for guidance. From 1930 – 2021 (91 years), there were only five first halves with a decline greater than 15%. In each of those five situations, the second half of the year has provided a positive return, with an average price gain of 23.78%.

Again, we never attempt to predict what the future holds, but we can gain insight from looking at history.

if you have any questions, please contact me.

The Markets and Economy

- Germany posted a trade deficit for the first time in more than three decades in May. Economists are stressing the Ukrainian war is having an impact on European countries that rely heavily on manufacturing and exports like the Bavarian

- As fears of an economic downturn plague corporate executives, S. businesses are taking steps to reduce their office footprint. The effort will help reduce overhead costs while fitting with workers new desire to work more from home.

- As the S. economy cools down and consumers buy fewer cars and computers, the price of semiconductor chips is beginning to fall, showing the demand boom from last year is likely over.

- Consumer confidence fell to its lowest level in nearly a decade as higher prices batter Americans. As a result, spending is beginning to show signs of weakness due to inflation. Retailers report that sales have drifted lower during the first few weeks of June.

- Record home prices and higher mortgage rates in May made it the most expensive month since 2006 to buy a home.

- After hitting a record last month, gasoline prices have fallen for 24 consecutive weeks. It appears S. drivers are parking their cars in the driveway a little more as demand has steadily been slipping. The average cost of a gallon of unleaded gas was $4.72 last week. That’s 6% lower than the peak of $5.02 on June 14.

According to the Labor Department, U.S. employers added 372,000 jobs in June. Analysts believe the labor market is cooling off from its overheated pace, but job growth is still strong. The unemployment rate held steady at 3.6%. Overall, the U.S. economy is still short about 500,000 jobs from pre-pandemic levels.

Offices in Chicago, Naples & Valparaiso.

The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is an unmanaged, market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Consult your financial professional before making any investment decision. You cannot invest directly in an index. Past performance does not guarantee future results.

This newsletter was prepared by David M. Kover®. To unsubscribe from the Weekly Market Update please write us at 555 Eastport Centre Dr., Suite B, Valparaiso, IN 46383 or click this link: Unsubscribe .

Note: All figures exclude reinvested dividends (if any). Sources: Bloomberg, Dorsey Wright & Associates, Inc. and The Wall Street Journal. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly.

Securities offered through Triad Advisors, LLC, member FINRA/SIPC. Investment advice offered through Resources Investment Advisors, LLC, an SEC-registered investment adviser. Resources Investment Advisors. LLC and Vertical Financial Group are not affiliated with Triad Advisors, LLC.