The strong labor market appears to be feeling the effects of the Fed’s inflation fight. Employers added 263,000 positions in September, down from August’s 315,000 job gains. However, the official unemployment rate fell to 3.5% from 3.7%. Currently open positions fell 10% in August. That means there are currently about 10 million positions available, down from the previous month’s 11 million. The U.S. stock market gave back the majority of the gains posted at the beginning of the week but still managed to eke out a slight gain by Friday’s close.

The share of adults holding or actively looking for jobs, called the labor-force participation rate, remains stubbornly below pre-pandemic levels. According to the Census Bureau, 4.8 million people cited caring for children as their main reason for not re-entering the workforce. Another 1.7 million cited caring for an elderly family member for deciding to stay at home.

This brings us to my title this week, When is the Good News the Bad News? The stock market and economy are in a conundrum. While declining job growth should help bring down inflation (good news) we don’t want to see it drop significantly. That would push the U.S. economy into a recession (bad news). The Fed’s daunting task is to slow down the economy by means of a soft landing. However, it will be interesting to see what other forces may come into play domestically.

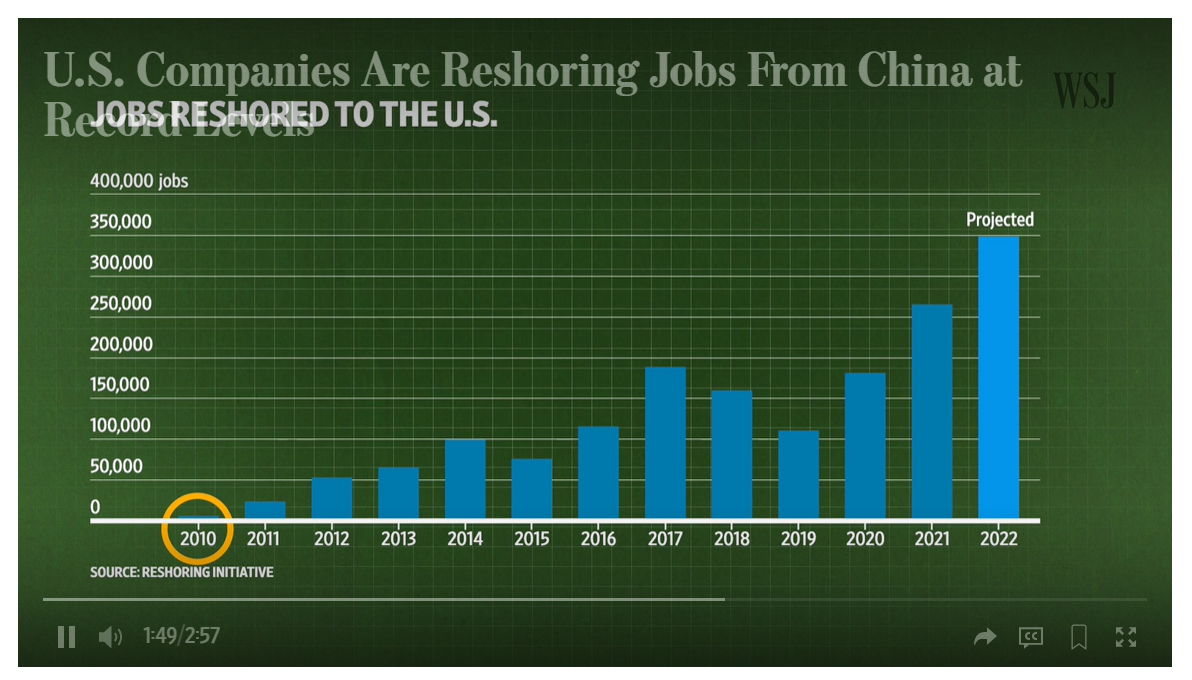

For years, U.S. manufacturers off-shored jobs to foreign countries at lower pay. China and other Asian countries were the main benefactors of this. Now, that trend has started reversing as American companies are beginning to “re-shore” jobs. Over the last decade, GE and Caterpillar both re-shored about 2,000 jobs to the U.S. And in 2022 chip manufacturers Intel and Micron Technology have announced plans to bring jobs back home. Even foreign companies like Honda and LG Energy Solutions have said they are planning for new U.S. based factories.

This is great news for America as any increase in manufacturing jobs is crucial to our economic success (good news) but may end up challenging the Fed’s plan to slow down the pace of economic growth (bad news). The chart below from the Wall Street Journal shows the significant increase over the years.

The reasons for this shift is two-fold. First, Covid-19 showed many corporations their just-in-time supply chains weren’t strong enough to handle the major shock the pandemic caused. Add to this the geo-political uncertainty around the globe. Russia’s invasion of Ukraine, North Korea firing missiles over Japan and China’s stance on Taiwan have all shown companies that having a supply source that is more economically and politically stable could be more important than finding the lowest cost producer. Yes, the Fed definitely has their job cut out for them. That’s the good news and bad news of it.

Next week I’ll report on the latest results for the beginning of third quarter earnings season.

If you have any questions, please contact me

The Markets and Economy

- Higher energy prices are beginning to hit European German factory output fell in August driven by cutbacks in energy-intensive industries.

- U.S. tax receipts collected by the Treasury in April were $863.6 billion creating a monthly surplus of $308.2 billion. Both of those numbers represent all-time monthly highs according to the Treasury Department.

- Home prices are falling at their fastest rate since the Great Recession of 2008-2009 showing that the Fed’s interest rate policies are taking effect. Median home prices fell 0.98% in August from a month earlier. That follows a 1.05% drop in July.

- OPEC and its Russian-led allies agreed to reduce output by 2 million barrels of oil a day. The move is resulting in crude prices moving upward again. Oil closed at $92.64 last week.

- U.S. computer chip production is on a tear. Micron Technology is the latest semi-conductor manufacturer to announce plans for a new factory. The upstate New York facility is expected to cost the chip producer about $100 billion. When completed, it will be the largest semi-conductor-fabrication facility in the U.S.

- The Chinese government has placed travel restrictions on yet another area. The sprawling Xinjiang region is home to 22 million people. A notice from the regional government said the measures were enacted to “strictly prevent the risk of spillover” of the virus.

Offices in Chicago, Naples & Valparaiso.

The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is an unmanaged, market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Consult your financial professional before making any investment decision. You cannot invest directly in an index. Past performance does not guarantee future results.

This newsletter was prepared by David M. Kover®. To unsubscribe from the Weekly Market Update please write us at 555 Eastport Centre Dr., Suite B, Valparaiso, IN 46383 or click this link: Unsubscribe .

Note: All figures exclude reinvested dividends (if any). Sources: Bloomberg, Dorsey Wright & Associates, Inc. and The Wall Street Journal. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly.

Securities offered through Triad Advisors, LLC, member FINRA/SIPC. Investment advice offered through Resources Investment Advisors, LLC, an SEC-registered investment adviser. Resources Investment Advisors. LLC and Vertical Financial Group are not affiliated with Triad Advisors, LLC.