Results for November’s market returns were the best since June. Not only did consumers dine on the estimated 46 million turkeys on Thanksgiving Day, they opened their wallets for holiday spending, much to retailers delight. True, the growth comes mostly from online purchases where shoppers can eat leftovers while sitting in their bath robes surfing the web for the best deals. However, purchases are purchases and at the end of the day, retailers will take the results any way they can get them.

As we enter the final month of 2019, many analyst are not anticipating anything near the sell-off we experienced last year. December, 2018 was the worst December since 1931 for the market. A year ago, concerns mounted about the trade dispute and a slowing U.S. economy. Sounds like today doesn’t it? So what’s different now?

Mostly, it’s growth in new jobs. The more people work, the more they pay in taxes and the more discretionary income they have. Considering the preliminary numbers for the official start to the holiday shopping season, there’s reason for optimism because consumers are spending more. This is extremely important as consumer spending accounts for two-thirds of economic growth.

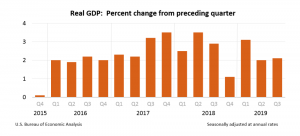

Last week, the U.S. Bureau for Economic Analysis released a slight improvement to third quarter 2019 GDP. The 2.0% growth rate was adjusted up to a reading of 2.1%. The chart below shows how growth has rebounded after stumbling at the end of 2018.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Consult your financial professional before making any investment decision. You cannot invest directly in an index. Past performance does not guarantee future results.

This blog was prepared by David M. Kover, CFP® C(k)P®

Sources: Bloomberg, Dorsey Wright & Associates, Inc. and The Wall Street Journal, FactSet. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly.

Securities offered through Triad Advisors, member FINRA/SIPC. Investment advice offered through Resources Investment Advisors, LLC, an SEC-registered investment adviser. Resources Investment Advisors. LLC and Vertical Financial Group are not affiliated with Triad Advisors, LLC.