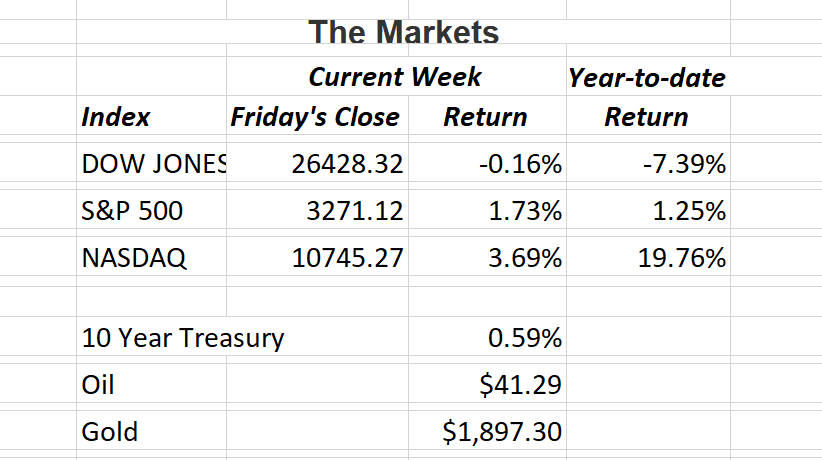

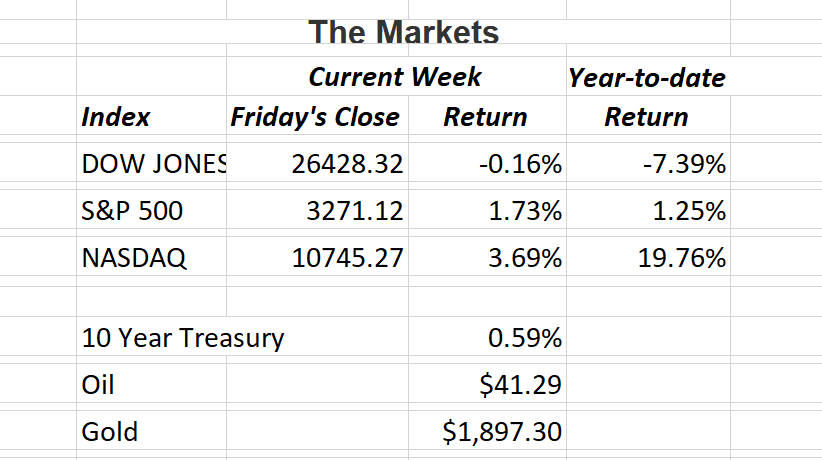

The market posted its fourth consecutive monthly gain at the close on Friday. Technology stocks were once again the winners as many blue chips declined. The market seems to be plateauing. It’s up a little one week then down slightly the next. Clearly it is looking for guidance. All this against the backdrop of one of the largest contractions in domestic growth in history. The value of all goods and services (GDP) produced in the U.S. shrank at an annualized rate of 32.9%. The drop was slightly more than analysts had expected.

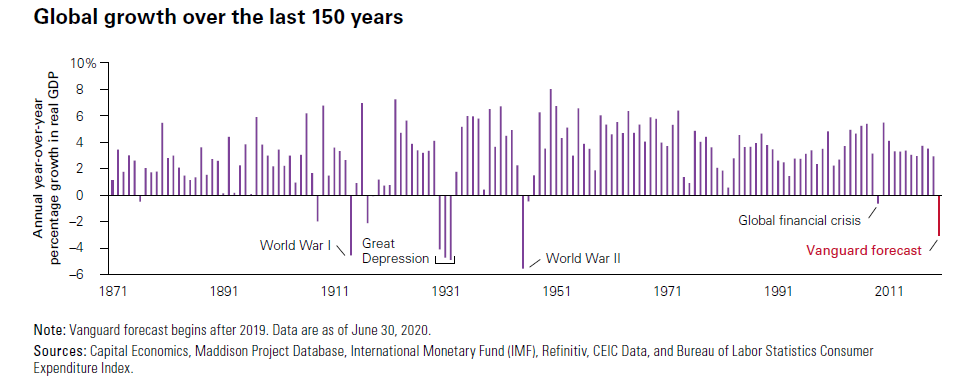

Vanguard recently released a “First Half of 2020” economic analysis. One of the more interesting charts shows Vanguard’s projection for global growth this year. By looking at the chart below, you can see the reduction in growth for all countries to be one of the worst in the last 100 years.

Still investors wonder how the S&P 500 could be up slightly for the year with the economy contracting almost 33%. Interestingly, in three of the last five recessions, the S&P 500 dating back to 1980, was higher before the recession had ended. Keep in mind, the stock market is not the economy. It’s not unusual for the market to have long movements that seem to be completely disconnected from reality. Clearly, investors believe the worst has happened to the economy and expect a speedy return to normalcy. We’ll see.

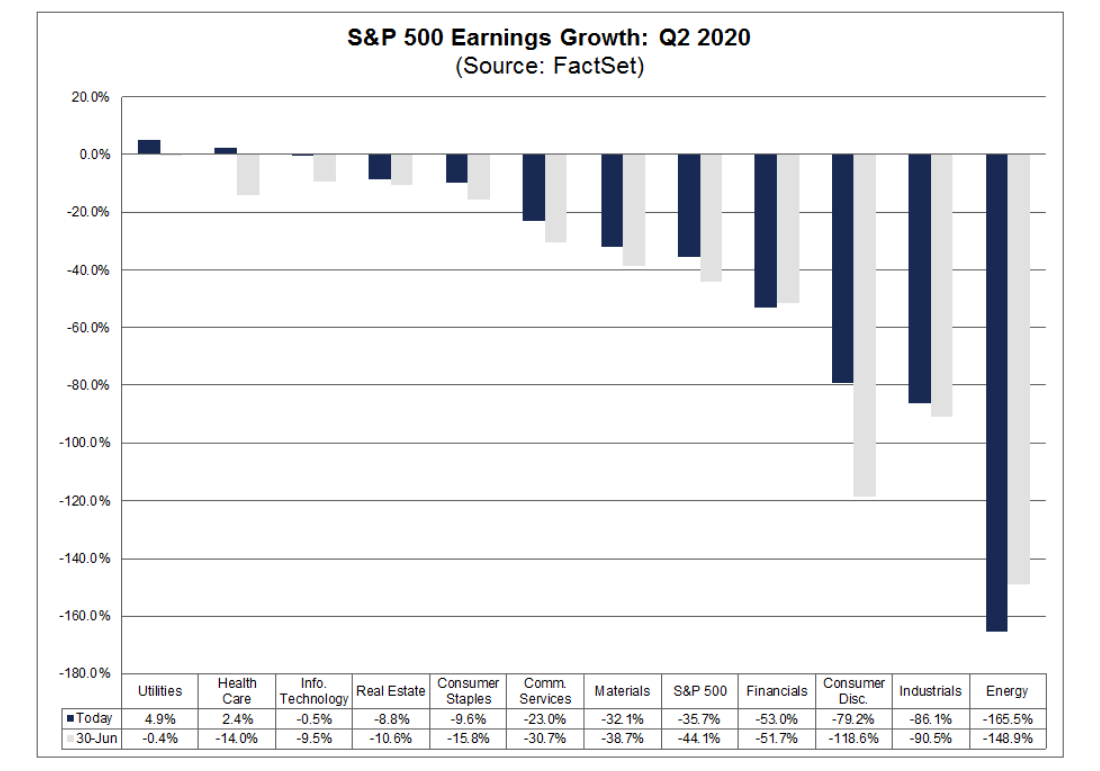

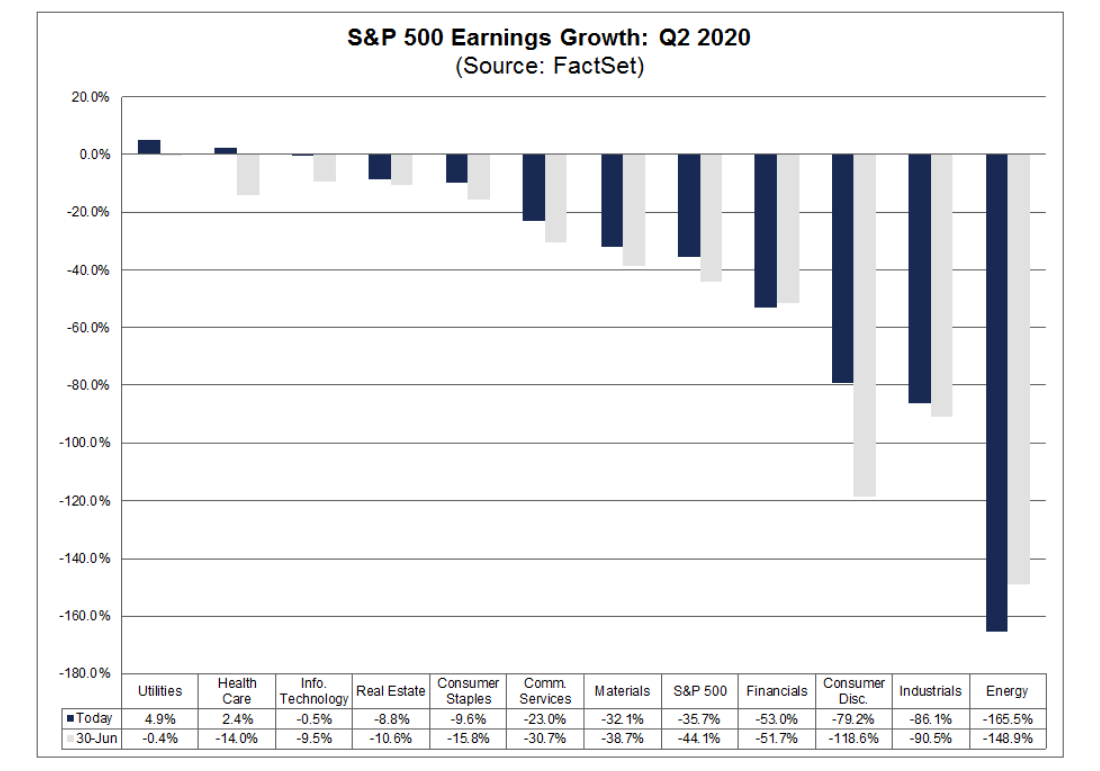

The chart below, courtesy of FactSet, shows year-to-date earnings growth for S&P 500 companies. The two sectors that are (not surprisingly) experiencing the most growth in earnings are technology and health care. It also comes as no surprise that the Nasdaq where many technology stocks trade is up almost 20% so far this year. Energy is fairing the worst as consumer demand has slumped and the price of oil hovering around $40 a barrel.

If you have any questions about what’s taking place in the economy or the markets, please contact me.

|

The Markets and Economy

- Search engine giant, Google, said they would keep employees working from home at least until July 2021. Google is the first major U.S. corporation to formalize such and extended timetable in the face of the coronavirus pandemic.

- Federal Reserve officials met last Tuesday and Wednesday. Concerns continue to mount over whether the economic rebound can be sustained in the face of higher Covid-19 cases being reported by several states. Lately, Fed officials have warned in speeches and interviews that the economy faces a deeper downturn and more difficult recovery if the the country doesn’t take more effective action to slow the spread of the virus. At the conclusion of their meetings, the Fed didn’t announce any new measures but reiterated their pledge to maintain aggressive measures to support the economy.

- A couple of weeks ago I reported about some of the pending massive layoffs at the major airlines. Now, Bloomberg is reporting that according to their calculations, about 400,000 airline workers globally may permanently lose their jobs due to reduced travel since the pandemic began earlier this year.

- Second quarter earnings are not only hurting blue chip companies like McDonalds, GM, Starbucks, but also some in the tech area. Google’s digital advertising has been a constant growth engine for the company for years. However, for the first time in the company’s history, it reported an 8% drop in advertising revenue for the second quarter.

- British banks have also been hit hard. Reduced consumer spending and customers asking for deferral on loan payment requirements have hit the sector hard during the pandemic. Negotiating a “post-brexit” trade agreement with the EU also adds uncertainty to banking conditions in the U.K.

- The Commerce Department reported a larger-than-expected drop in second quarter GDP in the U.S. The value of all goods and services produced across the economy fell at a seasonally and inflation adjusted 32.9%. That is after reporting a drop of 9.5% in the first quarter of 2020.

- The Labor Department reported workers applying for initial unemployment benefits rose for the second consecutive week by a seasonally adjusted 12,000 to 1.43 million for the week ending July 25.

Offices in Chicago, Kansas City, St. Louis, Naples & Valparaiso.

The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is an unmanaged, market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Consult your financial professional before making any investment decision. You cannot invest directly in an index. Past performance does not guarantee future results.

Note: All figures exclude reinvested dividends (if any). Sources: Bloomberg, Dorsey Wright & Associates, Inc. and The Wall Street Journal. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly.

Securities offered through Triad Advisors, member FINRA/SIPC. Imvestment advice offered through Resources Investment Advisors, LLC, an SEC-registered investment adviser. Resources Investment Advisors. LLC and Vertical Financial Group are not affiliated with Triad Advisors.

|