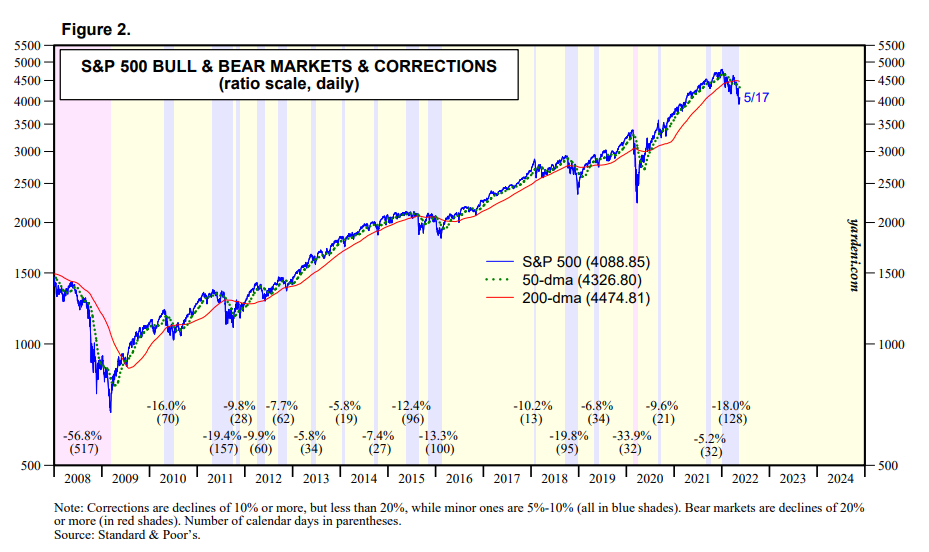

On Friday, the S&P 500 briefly dipped into bear correction status meaning it was down 20% or more from its previous high reached on January 3. However, the index rallied in the final hour of trading. The broad-based market index is still close to tipping into a bear market.

As I have written about before, the one thing the market hates more than anything else is uncertainty. Unfortunately, that, is not in short supply. Until there is some confirmation that the U.S. economy does slip into a recession or avoids one, we should be ready for more volatility.

During times like these, it is crucial to everyone’s financial well-being to hold on. We have been here before and we will recover again. To help withstand the volatility, I prefer to focus more on what the economy is actually doing rather than how the market is acting. Some things to consider:

The chart below is from Standard & Poor’s. At the far left you see the effects of the credit crisis of 2007-2008. It was not pretty. But since then, the stock market has posted significant gains. Even when you look at the pullback in March 2020 due to the pandemic, you see how well the market has recovered. This is why I say we view a market pullback differently when the market is in a strong overall uptrend. In a way, it gives the market time to catch its breath and consolidate.

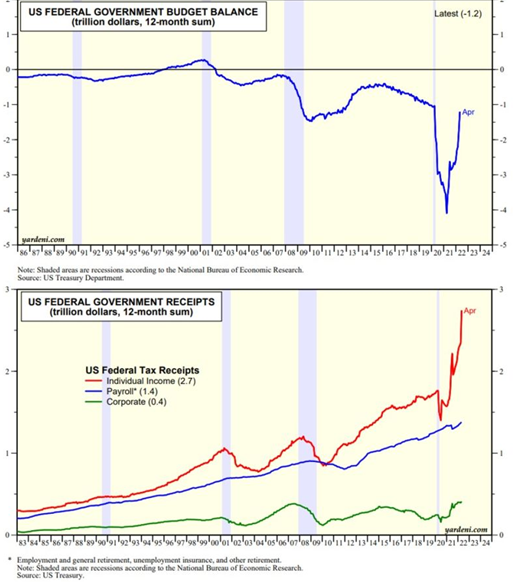

A benefit of just how strong the U.S. is can be seen from the two charts below. The first chart shows the federal government budget deficit. On a 12-month-moving-average basis, it has narrowed significantly from a record high of $4.1 trillion recorded through March 2021 to just $1.2 trillion through April of this year.

The second chart below shows the federal government’s tax receipts. Total federal tax receipts are up 31.5% through April led by a huge 53.8% jump in individual income-tax receipts. Some of this increase is the result of the IRS pushing back the 2021 filing deadline for a second year, but the figures are still extremely strong.

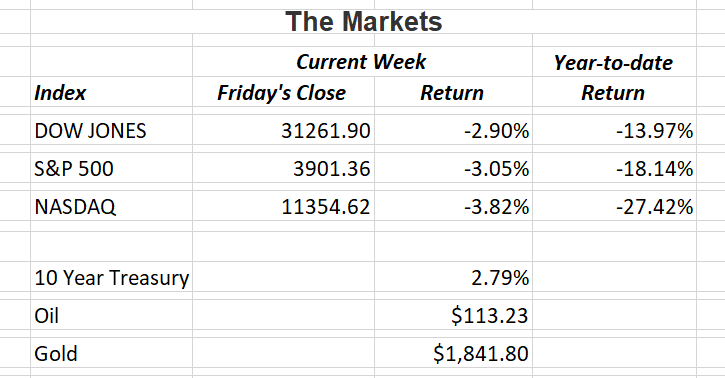

More things to remember: 77% of S&P 500 companies that have reported earnings have beaten estimates. Still, those companies have experienced a negative price reaction on average. There’s an old phrase about throwing the baby out with the bath water that comes to mind.

Market pullbacks are never easy to experience, and I know there are several challenges out there. But if you look deeply, there are so many positive things that makes me still believe the U.S. economy is strong and we will get through this. If you have any questions, please contact me.

The Markets and Economy

- A rise in interest rates is creating the side effect of a strong dollar. The U.S. dollar is up about 8% so far this year. When the dollar is strong, imported goods are less costly, which should also help hold down inflation.

- Existing home sales for the month of April fell to their lowest level since June 2020. High prices, rising interest rates and a dwindling inventory of available homes for sale are all playing a part in the decline.

- The U.S. isn’t the only nation facing rising prices. Inflation in the U.K. rose to its highest level in 40 years. Consumer prices were up 9% in April over March. That’s slightly higher than the 8.5% rate for the U.S.

- According to the Treasury Department, tax receipts collected by the federal government in April 2022 were $863.6 billion, creating a monthly surplus of $308.2 billion. Both numbers represent all-time monthly records for the U.S.

- Retail sales rose for the fourth consecutive month in April. The 0.9% month-over-month increase is not adjusted for inflation which means consumers are likely getting less for the amount they are spending. On a year-over-year basis the figure is 8.2%. March’s figure was increased from a previously reported 0.7% to a strong 1.4%. Still a few large retailers (Target & Walmart) reported disappointing earnings.

- After more than three decades in Russia, McDonald’s said it would sell its business and exit the country due to the invasion of Ukraine. The move marks a swift reversal from the 1990’s when western companies worked diligently to expand operations there to take advantage of the country’s shift from communism to capitalism.

- Renewed lockdowns in China are challenging that country’s economic climb back from the start of the pandemic in 2020. Consumer spending and factory output tumbled in April while growth in infrastructure investment has slowed sharply. Meanwhile, China’s jobless rate surged to a two-year high of 6.1%.

- Famous investor Warren Buffet is putting his money where his mouth is. Noted for telling investors to, “be greedy when others are fearful”, his Berkshire Hathaway company has invested tens of billions of dollars over the last several months.

Offices in Chicago, Naples & Valparaiso.

The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is an unmanaged, market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Consult your financial professional before making any investment decision. You cannot invest directly in an index. Past performance does not guarantee future results.

This newsletter was prepared by David M. Kover®. To unsubscribe from the Weekly Market Update please write us at 555 Eastport Centre Dr., Suite B, Valparaiso, IN 46383 or click this link: Unsubscribe .

Note: All figures exclude reinvested dividends (if any). Sources: Bloomberg, Dorsey Wright & Associates, Inc. and The Wall Street Journal. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly.

Securities offered through Triad Advisors, member FINRA/SIPC. Investment advice offered through Resources Investment Advisors, LLC, an SEC-registered investment adviser. Resources Investment Advisors. LLC and Vertical Financial Group are not affiliated with Triad Advisors.