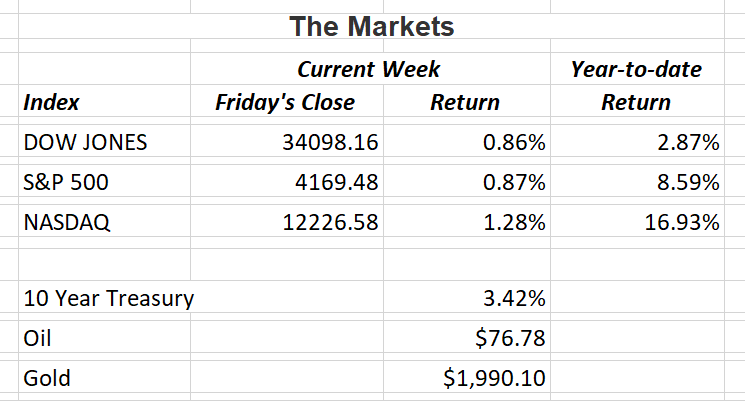

It was a roller coaster week for U.S. stocks as the focus turned toward the latest inflationary statistics. Both the Dow Jones Industrial Average and the S&P 500 were up less than one percent while the tech-heavy Nasdaq was up 1.28%. Investor concerns about a possible recession were addressed when growth in the U.S. economy continues to gradually slow without falling off a cliff. Helping fuel strong up days for the market last week was due to earnings from Amazon, Microsoft and Google’s parent, Meta.

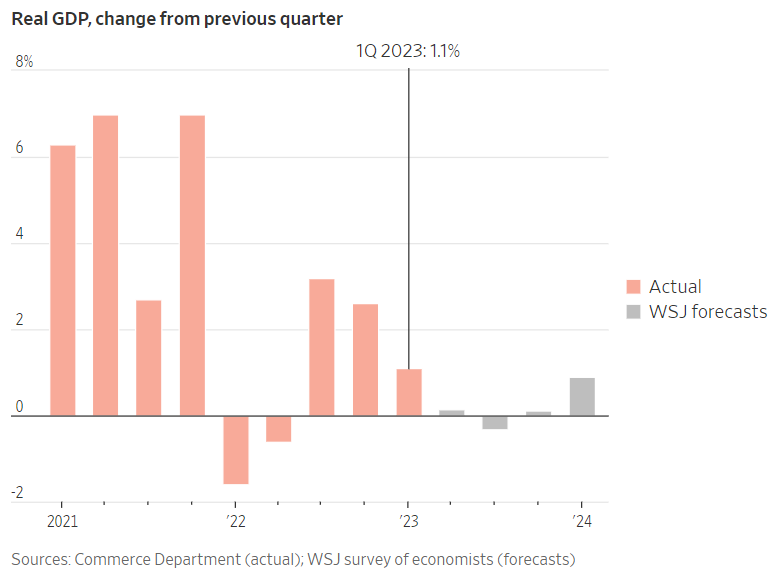

The chart below from the Wall Street Journal shows the recent announcement from the Commerce Department that the U.S. grew 1.1% in the first quarter of 2023. While that is down significantly from the 2.6% rate of growth in the last quarter of 2022, it still shows an economy expanding. Consumer spending supported growth over the last three months as businesses pulled back sharply on expenditures. They worked to reduce their inventories, cut equipment expenses and in-house expenses in anticipation of the pending economic slowdown.

Wage growth stayed elevated in the first quarter keeping inflation higher than the Fed would like. It’s a vicious cycle of higher prices causing workers to seek higher wages to offset their increased household expenses. That in turn fuels additional higher prices by business. It’s an issue caused by the pandemic and fueled by too much money in circulation chasing too few goods and services.

We can still expect another 0.25% interest rate increase by the Fed at it’s May meeting. After that, we will have to wait and see how further economics numbers are reported.

If you have any questions, please contact me.

The Markets and Economy

- The Consumer Confidence Index fell to 101.3 in April from March’s reading of 104.0. That was the lowest reading since July

- Bed Bath & Beyond filed for bankruptcy protection last week after years of struggling to turn around the beleaguered retailer. Gone are tight aisles with merchandise stacked high and probably the widest selection of home goods imaginable. All 360 stores will be closed as well as 120 Buybuy Baby retail locations.

- As one door closes, another opens. Chains including TJMaxx, Home Goods and Ross have scooped up some vacant stores of Bed Bath & Beyond. Burlington, Five Below, Nordstrom Rack and budget gym Planet Fitness are also eyeing space for expansion.

- Investors poured more than $12.6 billion into equity Exchange Traded Funds (ETFs) in April. That was the largest influx since January and more than twice the rate of February and March.

- The Philadelphia Fed Manufacturing Index fell to a reading of -31.3 in April, down from March’s reading of -23.2. That was the lowest reading since March

- 3M, the Minnesota manufacturer of Scotch tape and Post-it-Notes said it will eliminate 6,000 positions across all parts of the company in order to streamline operations, consolidate it’s supply chain and reduce management layers. These cuts are in addition to the 2,500 manufacturing jobs 3M said it would eliminate in January of this year.

- The Conference Board’s Index of Leading Economic Indicators (LEI) declined for the 12th consecutive month in March, tying the 12 month streak of declines from May 1980 as the third longest since 1959. In each of those three prior periods when the LEI declined for 12 or more months in a row, the U.S. economy was in a recession.

- According to the Federal Reserve, since 2009, total U.S. debt owed by governments, business and households has risen 90% to a record $68 trillion. In 1976 economist Milton Friedman won the Nobel Prize in Economics for showing the effects the money supply has on inflation. It’s no surprise we’re struggling with higher prices. Flooding the economy with money through government stimulus and quantitative easing is like throwing gasoline on the fire.

Offices in Chicago, Naples & Valparaiso.

The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is an unmanaged, market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Consult your financial professional before making any investment decision. You cannot invest directly in an index. Past performance does not guarantee future results.

This newsletter was prepared by David M. Kover®. To unsubscribe from the Weekly Market Update please write us at 555 Eastport Centre Dr., Suite B, Valparaiso, IN 46383 or click this link: Unsubscribe .

Note: All figures exclude reinvested dividends (if any). Sources: Bloomberg, Dorsey Wright & Associates, Inc. and The Wall Street Journal. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly.

Securities offered through Triad Advisors LLC, member FINRA/SIPC. Triad is separately owned and other entities and/or marketing names, products or services referenced here are independent of Triad Advisors LLC.

Investment advice offered through One Digital Investment Advisors, LLC, an SEC-registered investment adviser. One Digital Investment Advisors. LLC and Vertical Financial Group are not affiliated with Triad Advisors LLC.