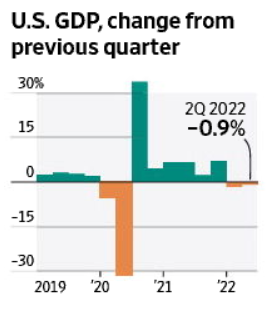

The second quarter Gross Domestic Product figure took center stage last week. The 0.9% decrease in goods and services across the U.S. economy follows the 1.6% decrease from the first quarter. The results indicate a commonly used definition of a recession; two consecutive quarters of declining economic output. However, the only real arbiter of a recession in the U.S. is the Bureau of Economic Research. Their Business Cycle Dating Committee considers several factors including employment, output and household income. Unfortunately, the BEC doesn’t make official recession announcements until several months later. We’ll just have to wait and see.

The chart below reprinted from the Wall Street Journal shows how GDP has varied over the last few years. Take particular note of how far GDP dropped in the first half of 2020 when the pandemic started. That was followed by an equally sharp rebound in the second half of that year.

The other big news last week came when the Fed raised interest rates 0.75%. July’s increase was expected and comes on the heels of a 0.75% increase in June. The Fed’s next meeting isn’t until September.

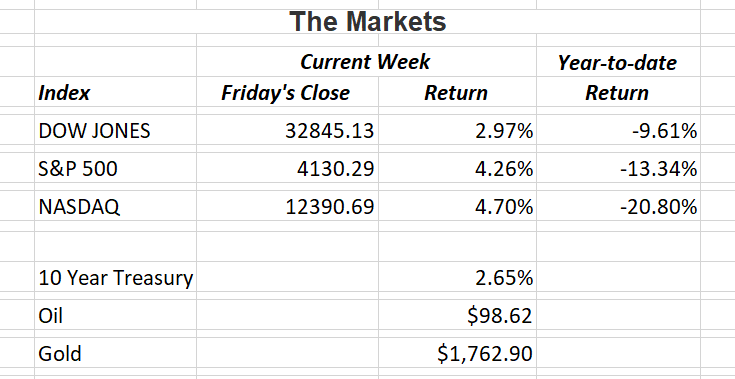

Given all of this news one would think stocks would continue to drop. But one would be wrong. The S&P 500 and Nasdaq both posted gains in excess for 4% on the week.

As second quarter corporate earnings continue to be reported, there have been many surprises to the upside. This along with the possibility that things may not be as bad as once was thought could be luring investors back into the stock market. For the first six months of 2022 stocks dropped in anticipation of a recession. Hopefully we will continue to see things moderate for the remainder of the year.

if you have any questions, please contact me.

The Markets and Economy

- S. lenders repossessed 20,750 properties during the first six months of 2022. That’s up 113% from the 9,739 that were repossessed during the first six months of 2021.

- The stock market closed out its strongest month since 2020 as equities clawed back some of the losses from a brutal first six-months.

- The maker of household staples such as Tide detergent, Pampers diapers and Gillette razors is predicting the slowest sales growth in years. Proctor & Gamble said consumers feeling the brunt of inflation will tighten their belts cutting back on household staples

- Chinaand India are the number one and two respectively in terms of total population today. That is expected to flip next year (2023) when India should become the world’s most populous country with 1.5 billion people according to the N.

- Investors in emerging market currencies are expected to feel the pain on two fronts; the rise of the S. dollar and the effects of slower growth due to global economic uncertainty.

- The Education Department will likely lose $197 billion on student loans it guaranteed over the last 25 years. That’s a massive increase from the expected loss of $114 billion according to the General Accounting Office.

Offices in Chicago, Naples & Valparaiso.

The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is an unmanaged, market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Consult your financial professional before making any investment decision. You cannot invest directly in an index. Past performance does not guarantee future results.

This newsletter was prepared by David M. Kover®. To unsubscribe from the Weekly Market Update please write us at 555 Eastport Centre Dr., Suite B, Valparaiso, IN 46383 or click this link: Unsubscribe .

Note: All figures exclude reinvested dividends (if any). Sources: Bloomberg, Dorsey Wright & Associates, Inc. and The Wall Street Journal. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly.

Securities offered through Triad Advisors, LLC, member FINRA/SIPC. Investment advice offered through Resources Investment Advisors, LLC, an SEC-registered investment adviser. Resources Investment Advisors. LLC and Vertical Financial Group are not affiliated with Triad Advisors, LLC.