U.S. equity markets suffered their worst day since March as the Dow Jones Industrial Average fell 1,800 points or, 6.9% last Thursday. For the week, the DJIA was down 5.5%. Much of the recent rally in stocks has been tied to investors believing the U.S. will be able to reopen its economy without seeing a spike in the virus. However, last week, several states including Florida, California, Arizona and Texas reported a sharp rise in the number of new cases.This puts into question how soon or how strong our economy will recover.

In other developments last week, it became official that the U.S. entered a recession in February of this year. This ended a historic 128-month economic expansion; one of the most significant in our lifetime. The Fed projected no interest rate increases through 2022 to help assure investors. The central bank is concerned about the pandemic’s potential to weaken the U.S. economy over the long-term. This dovetails with Fed Chairman, Jerome Powell’s statement a couple of weeks ago that the labor market could take years to recover, and millions of people may not be able to return to their old jobs. Fed officials also believe any economic recovery from the recession will be slow and uneven.

On the positive side of things, the number of people seeking unemployment benefits continues to fall and those receiving benefits appears to have plateaued. Both of these are signs the U.S. labor market is slowly on the mend from the coronavirus employment shock. Also, a survey of economists by the Wall Street Journal found that 68.4% expect an economic recovery to start in the third quarter of this year.

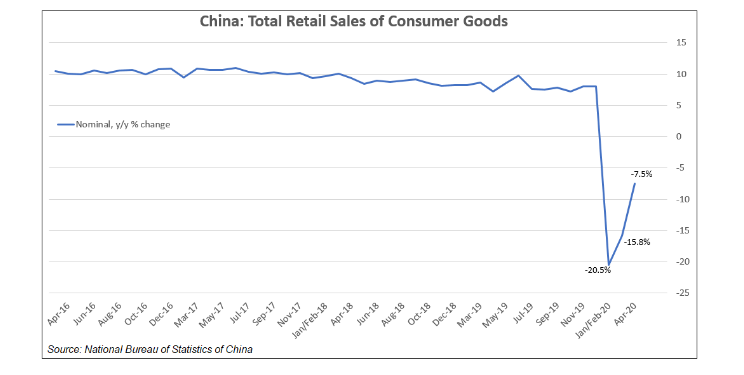

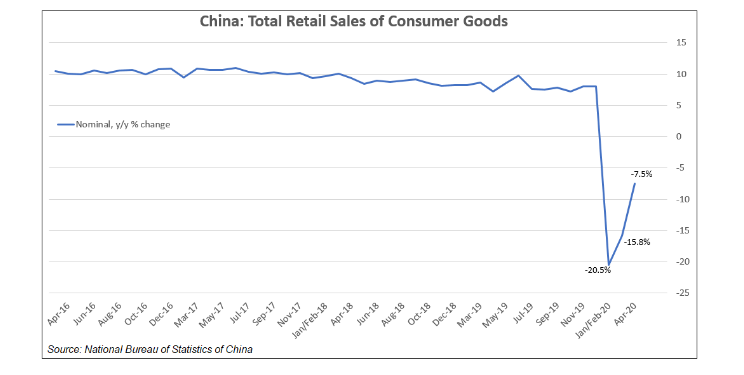

Since it is widely accepted that the coronavirus started in China, it makes sense to track the progress of their economy since our outbreak occurred several months after theirs. The chart below comes from the National Bureau of Statistics of China. It shows how retail sales in China have rebounded during January – February. As U.S. businesses gear up for a return to work, we will report on their progress here in our weekly market commentary.

The Markets and Economy

- Airline executives say they plan to reduce their workforce on October 1 unless travel picks up significantly. The U.S. government provided $25 billion to airlines as a bridge to keep employees on the payroll. Those restrictions expire on September 30.

- Many analysts are questioning the validity of China’s recently released unemployment data. According to Beijing, the pandemic barley touched their official jobless rate which rose to 6% from 5.3% in January. By contrast, the U.S. jobless rate dropped slightly to 13.3% from April’s 14.7%. The world’s second largest economy has a reputation for massaging the figures to look better than they actually are.

- The U.S. officially entered a recession in February of this year. The announcement last week by the National Bureau of Economic Research didn’t come as a surprise to economists who already suspected a recession had started.

- Along the same lines, the World Bank announced the global economy is expected to shrink by about 5.2% in 2020 due to the coronavirus pandemic.

- As would be expected with the economic downturn, prices at the consumer level fell again in May for the third consecutive month. At the producer level, prices rose 0,4%.

- The U.S. budget gap more than doubled in May, pushing the deficit for fiscal 2020 to near $2 trillion as federal revenue plunged.

- It appears the surge in job losses due to the coronavirus pandemic have subsided. Layoffs in the month of April dropped to 7.7 million from 11.5 million in March.

- Globally, the airline industry is forecast to lose a record $84 billion in 2020. The International Air Transport Association projects a 55% drop in passenger traffic this year. North America is the best-performing region but still stands to lose about $23.1 billion. Overall, 32 million related jobs are projected to be lost and the industry isn’t expected to return to profitability until 2022.

The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is an unmanaged, market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance. Consult your financial professional before making any investment decision. You cannot invest directly in an index. Past performance does not guarantee future results.

Note: All figures exclude reinvested dividends (if any). Sources: Bloomberg, Dorsey Wright & Associates, Inc. and The Wall Street Journal. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly.

Securities offered through Triad Advisors, member FINRA/SIPC. Imvestment advice offered through Resources Investment Advisors, LLC, an SEC-registered investment adviser. Resources Investment Advisors. LLC and Vertical Financial Group are not affiliated with Triad Advisors.