A sharp increase in the number of new cases for Covid-19 in several states spooked investors last week. Whether this could possibly be a “second-wave” or a continuation of the first wave is anybody’s guess. The bottom line is, investors are concerned of the economic impact of any possible shutdown/restrictions for U.S. businesses.

One interesting item I’ve seen comes from a recent article in the Wall Street Journal about the U.S. economy. A few weeks ago I discussed if this recovery will be a long, slow recovery like the one we experienced after the financial crisis of 2007-2008, or a sharper rebound called a “V” recovery where the economy returns to normal growth in relatively short order. So far, it appears a V-shaped pattern may be developing.

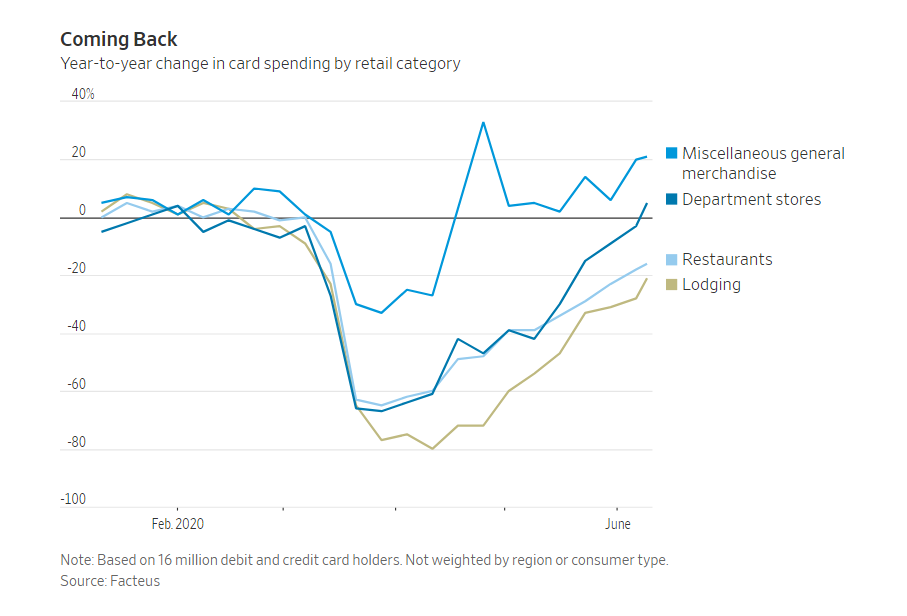

After bottoming out in April, economic activity has continued to rise into early June, recapturing some of the collapse that occurred when most of the country locked down to contain the spread of Covid-19. It’s still too early to tell if this pattern will remain, but the strongest positive news we’ve seen comes from consumer spending. In April, retail sales collapsed by 16%, the biggest one-month drop on record. In May, however, retail sales rebounded a strong 17.7%, the strongest on record. The chart below from FactSet shows how quickly and strong consumer spending has rebounded.

We are definitely in the strangest of times. Will the spike in new cases level off? Will a vaccine be developed this year? Will consumers continue to spend against the backdrop of uncertainty? Only time will tell how we come out the other end of this pandemic.

- Bets on the future prices of raw materials are increasing. Futures pricing for crude and metals have been in a sharp climb since the beginning of April.

- For years Chinese firms have had the upper hand on foreign competition doing business with the world’s second-largest economy. China has employed “boycott diplomacy” as a tool in its international disputes leveraging the country’s billion plus consumers to punish rival economies. Now, the shoe is on the other foot. Strong-arm tactics in Hong Kong and the recent border skirmish with India that resulted in the death of 20 Indian soldiers are causing other countries to take a stronger stance against Chinese aggression.

- Sales of previously owned homes plummeted 9.7% in May from the prior month. However, analysts expect record-low interest rates will lure buyers off the sidelines back into the housing game. They note a sharp increase in activity in the real estate market in many U.S. states.

- Hedge funds and traders using borrowed money to make speculative bets have taken the most positions against the British pound since last November, according to FactSet. Attention is shifting from the effects of the coronavirus to the stalled Brexit negotiations.

- A surge in big technology stocks has helped the Nasdaq Composite rally in 2020. This is the biggest gap between the Nasdaq and the S&P 500 since 1983.

- The number of workers seeking jobless benefits has held steady at about 1.5 million each week so far in June. The numbers signal a slow recovery for the U.S. economy as states face increases in new infections.

The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is an unmanaged, market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Consult your financial professional before making any investment decision. You cannot invest directly in an index. Past performance does not guarantee future results.

Note: All figures exclude reinvested dividends (if any). Sources: Bloomberg, Dorsey Wright & Associates, Inc. and The Wall Street Journal. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly.

Securities offered through Triad Advisors, member FINRA/SIPC. Imvestment advice offered through Resources Investment Advisors, LLC, an SEC-registered investment adviser. Resources Investment Advisors. LLC and Vertical Financial Group are not affiliated with Triad Advisors.