As the stock market closed the books on the first half of 2022, investors continued to lick their wounds and search for positive signs for the remainder of the year. We are not out of the woods by any stretch of the imagination. However, there are still many positives to note.

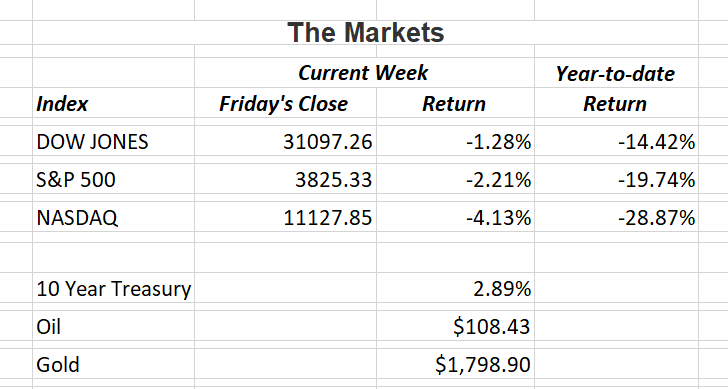

Interest rates have moderated the last few weeks with the benchmark 10-year treasury below 3%. Even 30-year mortgage rates have fallen back to about 5.5%. There are still two jobs available for every person unemployed and actively looking for work. And perhaps the most positive news is the amount analysts have cut second-quarter 2022 earnings estimates for the S&P 500.

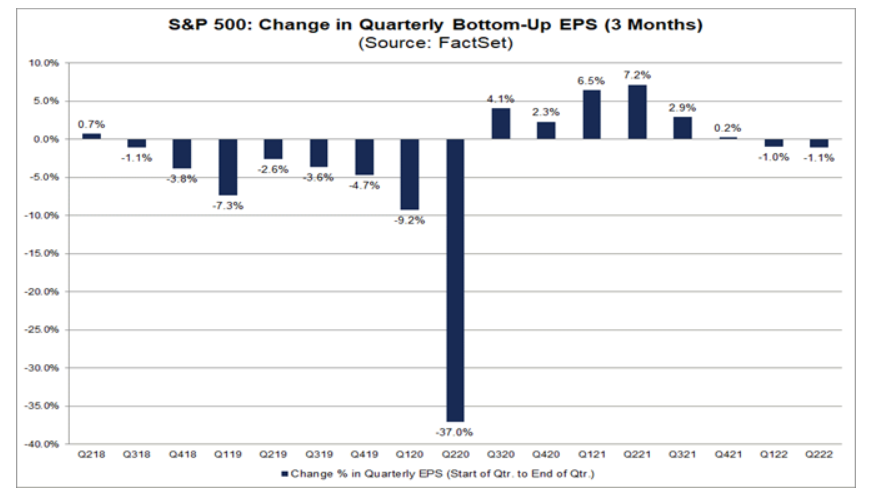

The chart below from FactSet shows only a slight reduction in second-quarter earnings. Analysts have trimmed earnings estimates to $55.44 from the previous estimate of $56.06. While it may be hard to make out, the last bar at the right-hand side shows the slight reduction of 1% in earnings estimates.

Any reduction in earnings for the S&P 500 is a reason for concern. But the slight amount is no reason for investors to run for the exits.

if you have any questions, please contact me.

The Markets and Economy

- The number of people passing through S. airports recently hit the highest level since February 2020. The problem is, not only are fliers dealing with the typical summer flight cancellations due to weather issues, but pilot and other airline worker shortages are stretching airlines beyond capacity.

- Beijing’s growth targets of 5.5% for 2022 may not be met. The world’s second-largest economy is still trying to recover from lockdowns in major Chinese cities in an effort to deal with another Covid-19 The upside to this is taming inflation for the global economy as demand wanes.

- On June 19, Businessweek ran a very bearish cover story that said the S&P 500 was very oversold based on its 200-day moving average. This could be considered to be a bullish indicator that the market may be close to bottoming out. Also worth noting is the Bull/Bear Ratio was the lowest it had been since March That was the bottom of the stock market after the 2007-2008 financial crisis and right before stocks began to move upward.

- Average credit card debt per household in the S. was $6,000 at the end of March 2022.

- Two regional Federal Reserve Bank Presidents have committed to controlling inflation but challenge the notion that a sharp economic downturn is inevitable. Mary Daly, San Francisco Federal Reserve Bank President said “I wouldn’t be surprised, and it’s actually in my forecast, that growth will slip below 2%. But it won’t actually pivot down into negative territory for a long period of time.” Her comments were echoed by New York Federal Bank President John Williams.

- The other side of the coin comes from Fed Chairman, Jerome Powell. Speaking at the European Central Bank annual economic policy conference in Portugal, Mr. Powell said he was more concerned about failing to stamp out inflation than the U.S. economy sliding into a recession.

Offices in Chicago, Naples & Valparaiso.

The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is an unmanaged, market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Consult your financial professional before making any investment decision. You cannot invest directly in an index. Past performance does not guarantee future results.

This newsletter was prepared by David M. Kover®. To unsubscribe from the Weekly Market Update please write us at 555 Eastport Centre Dr., Suite B, Valparaiso, IN 46383 or click this link: Unsubscribe .

Note: All figures exclude reinvested dividends (if any). Sources: Bloomberg, Dorsey Wright & Associates, Inc. and The Wall Street Journal. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly.

Securities offered through Triad Advisors, LLC, member FINRA/SIPC. Investment advice offered through Resources Investment Advisors, LLC, an SEC-registered investment adviser. Resources Investment Advisors. LLC and Vertical Financial Group are not affiliated with Triad Advisors, LLC.