Both the Dow Jones Industrial Average (DJIA) and the S&P 500 posted returns of well over 12%. It was, the strongest weekly performance of the DJIA in over 45 years. Let’s look at what happened over the last several weeks and what we might expect for the rest of April.

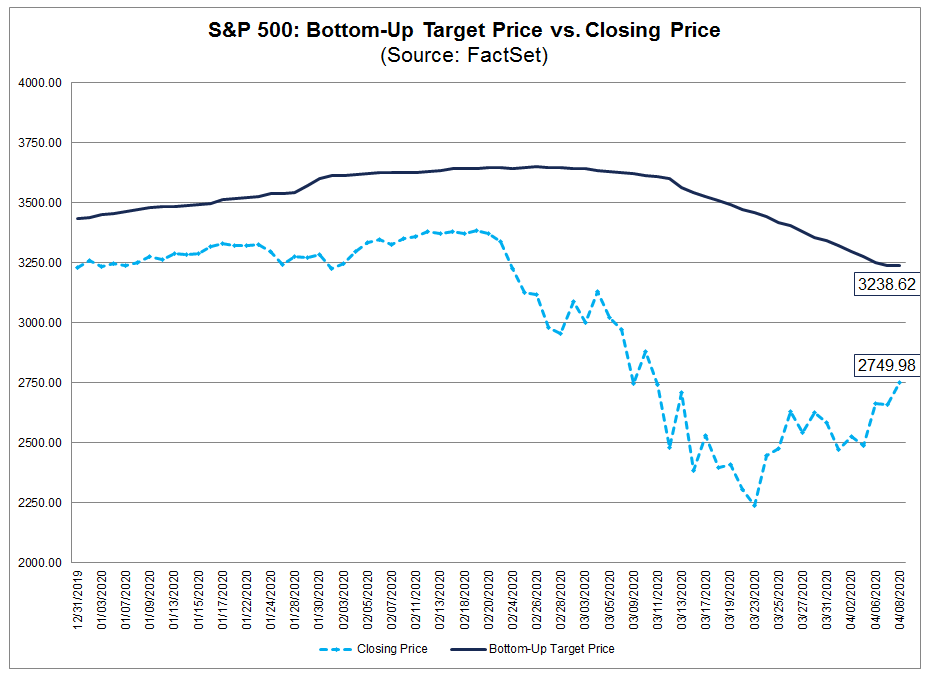

From February 19 to March 23, the value of the S&P 500 decreased by 34% (to 2237.40 from 3386.15). Since March 23, the value of the S&P 500 has increased by 23% (to 2749.98 from 2237.40). Going forward, industry analysts, in the aggregate, predict the S&P 500 will see a 17.8% increase over the next 12 months. Their prediction is based on the difference between the bottom-up target price and the closing price of the index as of April 8th. The bottom-up target price is the median target price estimate for all companies in the index based on analysts earnings estimates.

The chart below from FactSet shows the closing price of the S&P 500 (light blue broken line) and the bottom-up target price (dark blue solid line).

On the technical side of market analysis, we are seeing more and more evidence that this rally may well last. Remember that in this stint of world-wide crisis, the Fed has been a step ahead of all negative market news, which has not been the case throughout most of the market’s history. So, “Don’t Fight the Fed”, or at least not for now, in this short run.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Consult your financial professional before making any investment decision. You cannot invest directly in an index. Past performance does not guarantee future results.

This blog was prepared by David M. Kover, CFP® C(k)P®

Sources: Bloomberg, Dorsey Wright & Associates, Inc. and The Wall Street Journal, FactSet. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly.

Securities offered through Triad Advisors, member FINRA/SIPC. Investment advice offered through Resources Investment Advisors, LLC, an SEC-registered investment adviser. Resources Investment Advisors. LLC and Vertical Financial Group are not affiliated with Triad Advisors, LLC