U.S. equity markets continued their rebound posting gains for the second consecutive week. Most notably, this occurred as Federal Reserve Chairman Jerome Powell said the central bank was ready to move more aggressively with interest rate increases in 2022. Investors are no doubt finding comfort in the Fed’s commitment to battle inflation. Short-term interest rates are still historically low and will not be at a point to strangle the economy when the Fed finishes its job.

I was talking with a client last week who informed me about a recent technical development that has occurred in equity markets. It’s called the “50% Retracement Rule.” It states that, when the stock market regains 50% of its decline, the market will continue to improve. In fact, in the 21 times this has happened since the Great Depression, it has never failed. I make no guarantee that it will happen again and we know any rebound will have its ups and downs, but we have great odds on our side. In fact, even Jim Cramer noted this occurrence on a recent show.

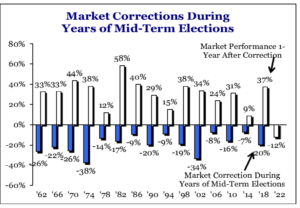

On my last observation for this week, I’ve had several conversations with clients and colleagues recently about this being a “mid-term election year.” Most were not only asking about the political implications but also what the possible impact might be for the stock market. Well the chart below from Fidelity shows that the market typically declines for the year where mid-term elections take place. But more importantly is what markets do the following year. Again, there is no guarantee this will play out again, but, I’ll take all the positive statistics I can get.

I am still bullish on the U.S. economy and stock market, especially with the information I’ve written about above. If you have any questions, please contact me.

The Markets and Economy

- Federal Reserve Chairman Jerome Powell said the central bank supports innovation in digital financial products but warned that it is “easy to see the risks” of certain new technologies, including cryptocurrencies that would demand a regulatory overhaul.

- American lenders repossessed 7,418 homes in the first two months of 2022. That’s up 150% from the 2,973 homes that were repossessed in the first two months of 2021.

- Talks between Canadian Pacific Railway and the Teamsters restarted last week with the help of federal regulators. Trains have been halted over a week now stalling global shipments of manufactured goods and commodities such as fertilizers after an impasse between the company and its conductors and engineers.

- U.S. Jobless claims fell to their lowest level in 52 years as employers held on to their workers in the midst of a labor shortage.

- During a discussion after a speech before the National Association for Business Economics in DC, Fed Chairman Jerome Powell, said the central bank stands ready to be more aggressive to battle inflation. “if we think it’s appropriate to raise (by half a point) at a meeting or meetings, we will do so.”

- 74% of the land in the western United States covering nine states is in a severe drought.

- In a new world where supply-chain issues are foremost on CEOs’ minds, the typical winner has been the lowest-cost producer. That is now taking a back seat with multiple suppliers in different geographic locations.

- U.S. companies saw an upswing in business activity in March. The increase is due to higher demand as supply-chain bottlenecks begin to resolve themselves. Also, the number of Covid cases from the Omicron variant continue to fall helping boost business activity.

Offices in Chicago, Naples & Valparaiso.

The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is an unmanaged, market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Consult your financial professional before making any investment decision. You cannot invest directly in an index. Past performance does not guarantee future results.

Note: All figures exclude reinvested dividends (if any). Sources: Bloomberg, Dorsey Wright & Associates, Inc. and The Wall Street Journal. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly.

Securities offered through Triad Advisors, member FINRA/SIPC. Investment advice offered through Resources Investment Advisors, LLC, an SEC-registered investment adviser. Resources Investment Advisors. LLC and Vertical Financial Group are not affiliated with Triad Advisors.