U.S. equity indexes were mostly flat going into the final trading day of last week. However, that all changed on Friday when comments by Fed Chairman Jerome Powell gave traders and investors pause. The head of the central bank reiterated the Fed’s commitment to reign in inflation. Concern is mounting that the Fed will have to act more aggressively and by doing so, tip the U.S. into a recession. But, more on that in a minute.

As you know, first quarter earnings season has recently gotten under way and the results are surprisingly upbeat. 99 companies in the S&P 500 have reported figures so far. Of those reporting, almost 80% have beaten analysts estimates. Typically about 66% beat analysts estimates according to Refinitiv data.

Part of the problem is the name of the companies that have disappointed. Netflix, Verizon, Gap and Snap are well known names that have not met analyst estimates. But sometimes even the baby gets thrown out with the bath water. American Express beat estimates but fell almost 3%. Ok, now back to that recession concern.

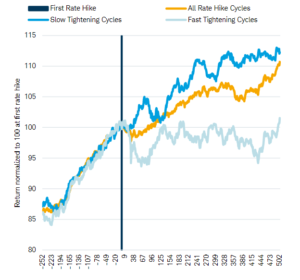

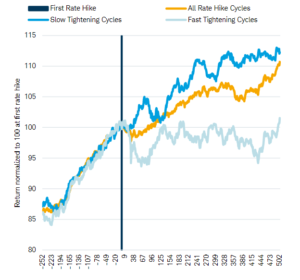

The economy behaves differently during times of tightening by the central bank. That difference depends on the quickness of the pace of rate increases. The chart below is reprinted from Nasdaq Dorsey Wright. It shows that when the Fed raises interest rates at consecutive meetings – as is expected in 2022 – the market has historically struggled (light blue line). When rate hikes occur at a slower pace, the markets typically rise on average (darker blue line). One constant in all of this is an increase in volatility. We have seen a lot of that this year. The Chicago Board of Options Exchange volatility index (VIX) is up 70% year-to-date.

Many analysts believe that market has overcorrected for more rate increases than the Fed will end up implementing. Only time will tell, but I am still bullish on the U.S. economy and stock market with a continued cautious eye. If you have any questions, please contact me.

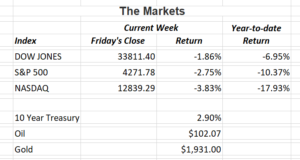

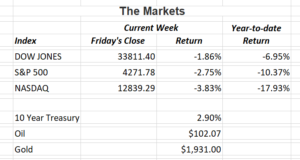

The Markets and Economy

- The International Monetary Fund said it expects global economic growth to slow significantly this year as the repercussions of the invasion of Ukraine are felt. Many countries are still grappling with the pandemic and skyrocketing inflation.

- Beginning in May, the Fed will start reversing the quantitative easing program where the central bank purchased $120 billion a month in bonds. In a few weeks, the Fed will let about $95 billion in maturing debt to roll off its balance sheet. By reducing the amount of bonds the Fed buys/holds, it is expected to help combat inflation by rising interest rates.

- The President plans to make it easier for lower-income student-loan borrowers to receive debt forgiveness through an existing program that has seen little results. More than 40 million people owe about $1.6 trillion in federal student debt. That figure is larger than the national total for credit-card debt or auto-loan debt. Federal loans account for more than 90% of outstanding student debt.

- The cost to finance a U.S. home continues to rise. Last week, 30-year mortgage rates were quoted at 5.11%, the seventh consecutive week of increasing borrowing costs.

- According to Freddie Mac, the U.S. is short an estimated 3.8 million houses to meet the average demand for single-family homes.

- Surveys of purchasing managers conducted over recent weeks indicate a loss of momentum in major global economies such as Germany, the U.S. and the U.K.

Offices in Chicago, Naples & Valparaiso.

The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is an unmanaged, market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Consult your financial professional before making any investment decision. You cannot invest directly in an index. Past performance does not guarantee future results.

Note: All figures exclude reinvested dividends (if any). Sources: Bloomberg, Dorsey Wright & Associates, Inc. and The Wall Street Journal. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly.

Securities offered through Triad Advisors, member FINRA/SIPC. Investment advice offered through Resources Investment Advisors, LLC, an SEC-registered investment adviser. Resources Investment Advisors. LLC and Vertical Financial Group are not affiliated with Triad Advisors.