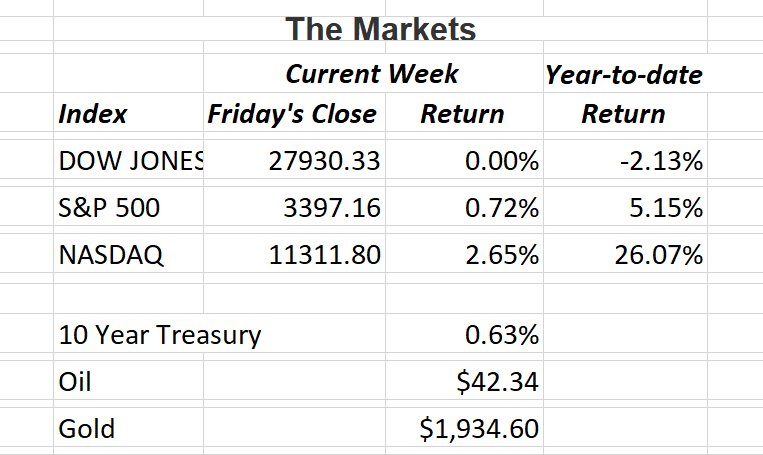

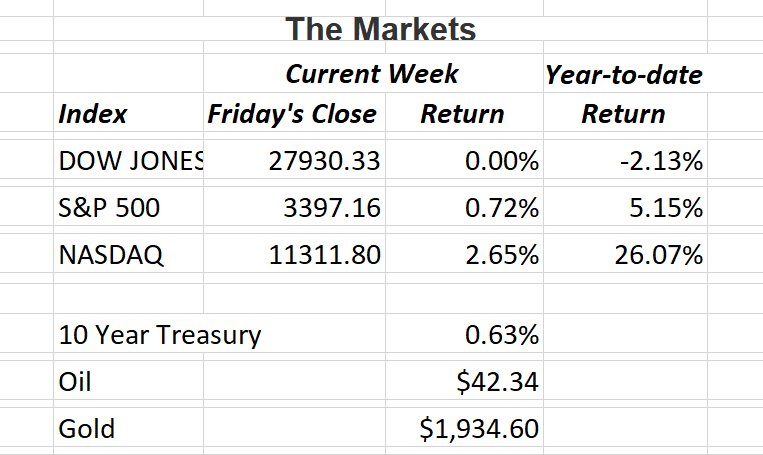

The S&P 500 hit another high on Friday and posted a fourth consecutive week of gains. Investors had to digest more good news/bad news as minutes from the Federal Reserve’s latest meeting showed a consensus in the central bank that more government support is needed to help the economy (good news). Investors also dealt with an increase in new weekly jobless claims (bad news). Weekly initial claims rose by 135,000 to a seasonally adjusted 1.1 million in the week that ended August 15, according to the Labor Department. Concerns are mounting over possible more layoffs planned by corporations as summer wraps up and we head into fall.

Last week I covered a few technical charts we follow and how they have signaled a return to a “positive position” for U.S. equity markets. This week, I thought I’d show you a couple of charts that illustrate what has caused that change back to positive.

The Global Purchasing Managers Index for both manufacturing and service sectors of the world’s economies have fully rebounded above 50. A reading above 50 shows an economy expanding. If the reading is below 50, it shows economies contracting. This indicator bodes well as it shows more companies are feeling confident about the future of their business.

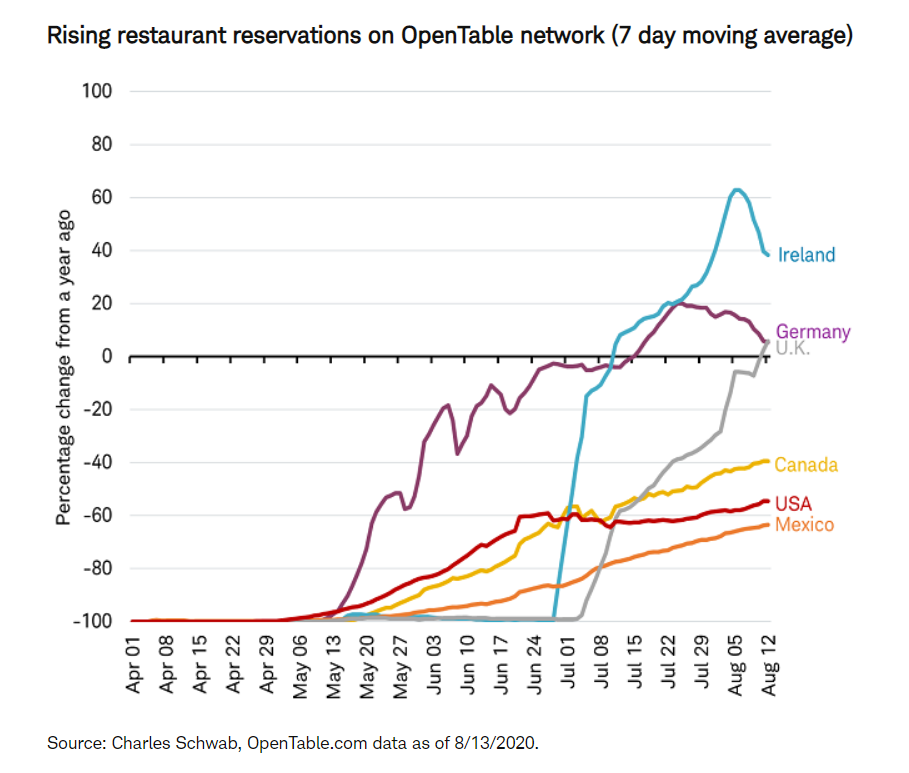

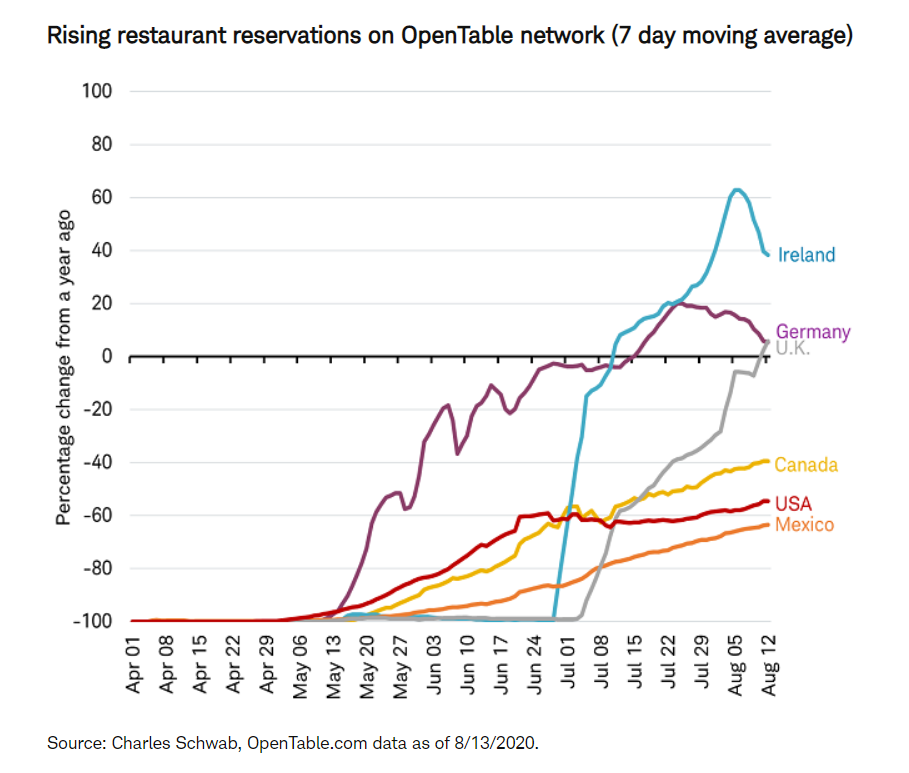

Considered a “real-time gauge” of consumer confidence, restaurant reservations is a great indicator of how secure people feel about the economy and their future. Since May, the global trend in seated diners at restaurants on the Open Table reservation network have been on the rise. While there has been some weakness recently out of Ireland and Germany, the numbers still show growth when compared to a year ago. Similar results can be seen in cinema box office revenue and retail store traffic.

It’s all about the consumer. When people feel confident about their job security they become better consumers. That causes businesses to increase production and service. A win-win for global economy.

To keep this growth going, we need to see how successful students are at returning to school and staying safe. And of course, how the election goes.

If you have any questions, please let me know.

The Markets and Economy

- Banks repossessed 230,305 homes in 2018. In 2019, they repossessed 143,955 homes. So far in 2020, just 40,080 homes have been repossessed by banks. Could this be the calm before the storm?

- According to the Treasury Department, the U.S. government expects to borrow some $4.5 trillion in fiscal year 2020 (ending 9/30/2020)

- Investors continue to sit on a large pile of cash. Since the beginning of 2020, assets in money-market funds grew to 4.8 trillion from 3.6 trillion. Money market funds are mutual funds that invest in high-quality, short-term debt instruments, cash, and cash equivalents. While they are not guaranteed, investors consider them a great place to park cash that is easily accessible.

- With mortgage rates so low, lenders are finding themselves in a crunch to deal with the sharp spike in demand. To deal with it, mortgage bankers are favoring home purchases over existing clients who want to refinance. By offering lower rates to new purchasers, they can secure new business instead of refinancing existing mortgages at lower interest rates.

- Just when companies are having more employees work remotely, Amazon.com Inc. is expanding its physical offices in six major U.S. cities. The unexpected move is in direct contrast with other tech companies that have embraced the “work from home” mantra.

- New housing starts dropped significantly when the coronavirus struck. After hitting a multi-year low in April, new construction has been increasing. So much so that the index now stands just 7% below its pre-coronavirus high.

Offices in Chicago, Kansas City, St. Louis, Naples & Valparaiso.

The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is an unmanaged, market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Consult your financial professional before making any investment decision. You cannot invest directly in an index. Past performance does not guarantee future results.

Note: All figures exclude reinvested dividends (if any). Sources: Bloomberg, Dorsey Wright & Associates, Inc. and The Wall Street Journal. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly.

Securities offered through Triad Advisors, member FINRA/SIPC. Imvestment advice offered through Resources Investment Advisors, LLC, an SEC-registered investment adviser. Resources Investment Advisors. LLC and Vertical Financial Group are not affiliated with Triad Advisors.