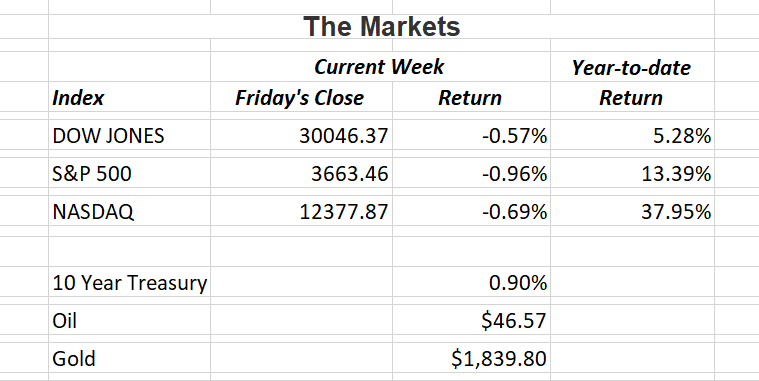

U.S. equity markets posted minor losses last week as Americans awaited FDA approval for the Covd-19 vaccine. The approval came early Saturday with the focus now turning to the logistically largest medical distribution in history. 21 million health-care workers and 3 million long-term care residents are expected to receive the immunization first.

While shots are expected within days, economists expect the U.S. economy will see its recovery slow over the next few quarters before the impact of the Covid-19 vaccine can take effect. We may already be seeing that as the number of people seeking unemployment benefits surged last week.

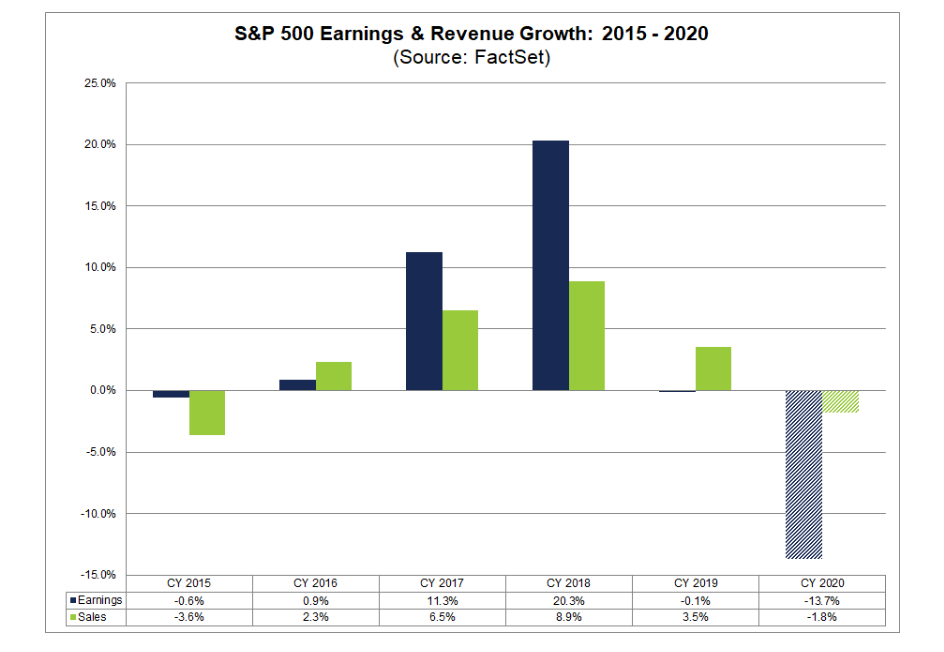

The estimated earnings decline for the S&P 500 for 2020 is -13.7%. If actual earnings do come in for 2020 at -13.7%, it will mark the largest annual earnings decline reported by the index since 2008 (-25.5%). The unusually large decrease in earnings can be attributed to the negative impact of COVID-19 on a number of industries in the index. At the sector level, four are projected to report year-over-growth in earnings, led by the Health Care sector. Seven sectors are expected to report a year-over-year decline in earnings, let by the Energy, Industrials, Consumer Discretionary, and Financial Sectors.

|

If you have any questions, please contact me. |

|

The Markets and Economy

|

Offices in Chicago, Kansas City, St. Louis, Naples & Valparaiso.

The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is an unmanaged, market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Consult your financial professional before making any investment decision. You cannot invest directly in an index. Past performance does not guarantee future results.

Note: All figures exclude reinvested dividends (if any). Sources: Bloomberg, Dorsey Wright & Associates, Inc. and The Wall Street Journal. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly.

Securities offered through Triad Advisors, member FINRA/SIPC. Investment advice offered through Resources Investment Advisors, LLC, an SEC-registered investment adviser. Resources Investment Advisors. LLC and Vertical Financial Group are not affiliated with Triad Advisors.