Markets were off slightly last week as filings for weekly unemployment benefits rose for the first time in nearly four months. Analysts believe states rolling back reopenings could be faltering and weighing on recent job gains. Also, shares of technology stocks dragged the S&P 500 lower on Friday.

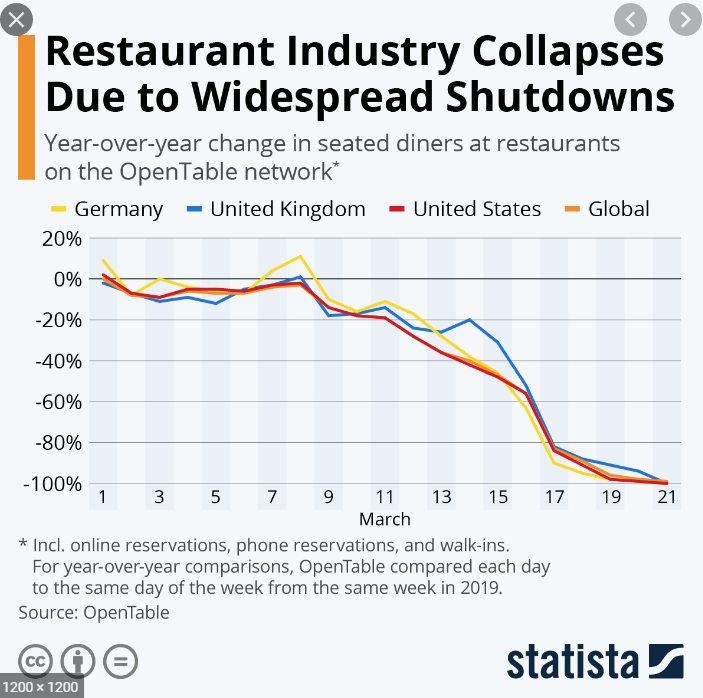

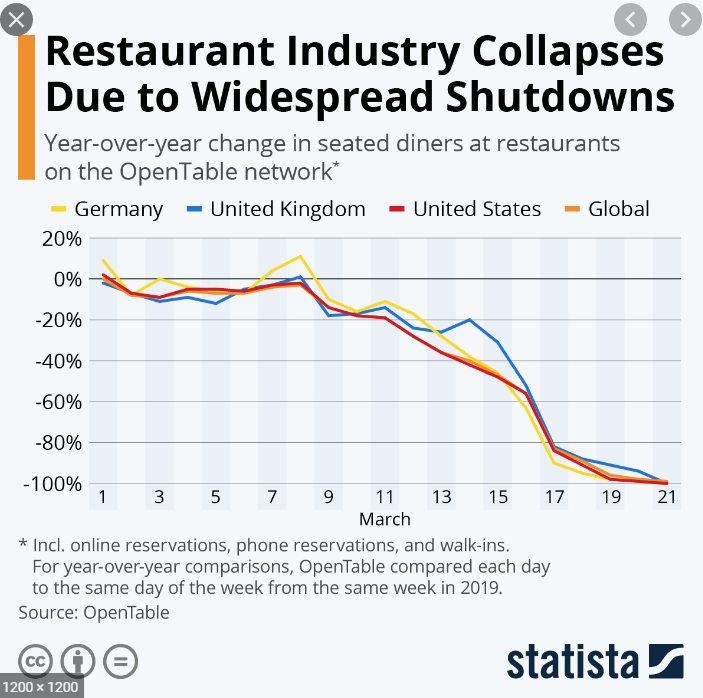

The Restaurant industry has been one of the hardest hit sectors of the economy. The following is from a very interesting article I read last week that covers the challenges restaurants face.

Before the pandemic, restaurants had employed 11 million workers nationwide – more than the number who work in construction or in factories that produce high-priced manufactured goods. They generated more revenue than grocery stores. From 1990 through February this year, restaurant jobs grew more than twice as fast (91%) as overall jobs (40%).

“The restaurant industry’s role in the economy is outsized compared to its share of overall GDP,” said Mark Zandi, chief economist at Moody’s Analytics. “As it is often among the first jobs for many workers, it is critical to the training of the American workforce. It is also a vital source of jobs and incomes for lesser-skilled and educated workers.’’

The struggles in the industry also disproportionately hurt Black and Hispanic workers. Together, they account for more than 40% of restaurant jobs, versus 30% of overall U.S. jobs.

As restaurants and bars closed their dining rooms, their sales sank from $66 billion in February to $30 billion by April – the lowest such total, adjusted since inflation, since 1983. In June, boosted by delivery and takeout customers, sales rebounded to $47 billion. But many restaurants desperately need to reopen their dining rooms.

“You cannot profitably run a takeover- delivery model if you also have 60 dark tables in the front of the house,” said Sean Kennedy of the National Restaurant Association. Restaurants had cut nearly 5.4 million jobs in March and April before restoring 1.4 million of them as states began to reopen in May. But the bounce back is in jeopardy. Confirmed cases have surged across the South and West, forcing states to slow or reverse plans to reopen. Zandi said he worries that restaurant jobs won’t return to pre-pandemic levels until the mid-2020s.

The chart below from Statista shows how severe the restaurant job loss situation is.

Being an economist or analyst is similar to being a weatherman, you’re seldom right and nobody really expects you to be. There are, however, a few analysts I do follow and have a high degree of respect for; Bob Doll, Senior Portfolio Manager & Chief Equity Strategist with Nuveen is one of them. He recently updated his projections from the start of 2020.

Citing data from the IMF, Mr. Doll notes that U.S. GDP is expected to fall 8% and global GDP 5% in 2020, but adds that the recession may be less severe than what was expected in late March and early April, and, in fact, may have already ended. “So far, the recovery has looked like a ‘V-bottom,’ but we think that will trail off and we expect a slow and uneven recovery worldwide,” Mr. Doll says, further noting that the country may not get back to expansion mode until late 2021 or early 2022.

There are a few things that do concern him though. After having accelerated monetary policy at an unprecedented rate, there isn’t much left in the Fed’s toolbox to continue the economic and market stimulus. With interest rates near 0 and the government stimulus programs running out of steam, there aren’t many tools left in the toolbox.

Speaking of government stimulus programs, Mr. Doll also questions how the country will pay for this massive bill. In addition to the monetary policy support, he notes that the U.S. has already increased federal spending by $2.9 trillion since the pandemic began, with more spending possible. “For now, the world remains in a deflationary environment, but at some point (probably late next year and into 2022), we’ll all need to figure out how to pay for this stimulus,” he writes. Possible options, according to Mr. Doll, include settling for a long-term slower rate of growth, raising taxes or expanding the money supply to generate inflation and depress the value of the dollar. “We’ll probably see some sort of a combination of all three approaches, with specifics depending on the results of the November elections,” he observes.

The Markets and Economy

- From the first quarter, to the second, the four largest American banks nearly doubled the amount of money they set aside to cover soured corporate loans. Big banks expect the coronavirus recession to cut a wide swath through U.S. corporations in the coming months.

- Some 25 million in the U.S. are set to lose $600 a week each in federal unemployment benefits at the end of the month. As Congress returns for a few weeks worth of work before another break in early August, they will deal with tough issues facing the millions of unemployed Americans.

- After a strong rebound in early June, hotel demand has plummeted again. Rising cases of Covid-19 are causing concerns for those considering travel.

- European Union officials took a bold step last week as a 750 euros economic rescue package was approved. The agreement puts all 27 members on the hook for debt to help prop up the finances of poorer EU nations.

- Researchers now believe the mortality rate of Covid-19 to be approximately 0.5% – 1.0%. This suggests the coronavirus is deadlier than the seasonal flu though not as lethal as Ebola and other infectious diseases according to an article in the Wall Street Journal.

- While still lower than pre-pandemic levels, home sales are experiencing a jump. According to the National Association of Realtors, sales of existing homes rose 20.7% in June over the prior month. Record low mortgage rates and a shrinking supply of available homes for sale are fueling the rise.

- The acrimony between the U.S. and China escalated last week when, in retaliation for forcing the closure of its consulate in Houston, TX, officials in Beijing ordered the U.S. consulate in Chengdu to close.

The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is an unmanaged, market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Consult your financial professional before making any investment decision. You cannot invest directly in an index. Past performance does not guarantee future results.

Note: All figures exclude reinvested dividends (if any). Sources: Bloomberg, Dorsey Wright & Associates, Inc. and The Wall Street Journal. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly.

Securities offered through Triad Advisors, member FINRA/SIPC. Imvestment advice offered through Resources Investment Advisors, LLC, an SEC-registered investment adviser. Resources Investment Advisors. LLC and Vertical Financial Group are not affiliated with Triad Advisors.