The market posted slight gains last week as the U.S. saw its worst day yet last Thursday, with more Covid-19 infections and deaths than at any stage of the pandemic. Hospitalizations from the coronavirus surpassed 100,000 for the first time, leaving hospitals in some regions of the country without enough beds in intensive-care units to meet their patients needs. Still, the market is focusing on the economic rebound that is expected to come over the next few quarters.

U.S. job growth was another concern last week. The labor-market recovery stalled in November as employers added just 245,000 jobs, down from the 600,000 jobs created in October according to the Labor Department. The official unemployment rate edged down slightly to 6.7% from the previous months reading of 6.9%

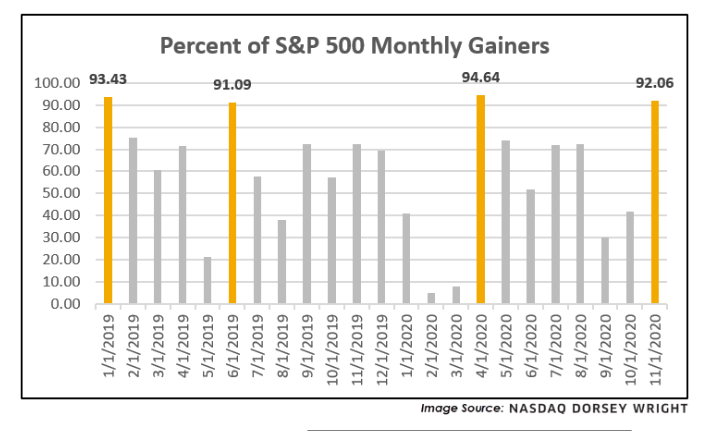

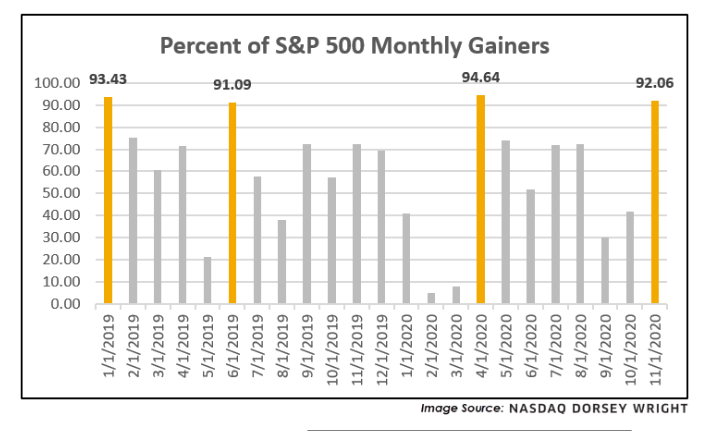

Whether talking internationally or domestically, market breadth is widening, meaning more and more stocks are participating in the stock market rally. With the continued news of vaccine developments and subsiding political uncertainty, broad equity market benchmarks have rallied, to the point where the Dow Jones Industrial Average just posted its best month since January of 1987 and the S&P 500 since April of this year. However, differing from April, the latest rally has been widespread. As of Friday (11/27), 464 stocks in the S&P 500, or about 92% posted gains in the month of November. In the past 20+ years, the percentage of S&P 500 stocks with positive monthly returns has only eclipsed the 90% mark on seven occasions, two of which belong to 2020 (April and November). Historically, these instances have occurred during strong market environments and signaled favorable returns ahead for the index, as shown below.

We view this optimistically combined with knowing the stock market is in its historically strong period of November thru April.

|

If you have any questions, please contact me.

|

The Markets and Economy

- On January 1, 2021, the free movement of goods across the English Channel is scheduled to end for the first time in half a century. Fears of severe bottlenecks are likely as approximately 10,000 trucks cross the channel daily on ferries. The outcome is unknown as custom officials will inspect vehicles under new regulations and amid an acute lack of staff that could result in strangling the supply chain.

- About half as many people visited stores on Black Friday as they did last year. Online spending, however, jumped 22% from a year ago according to research firms that track foot traffic.

- Companies and governments in the U.S. have issued $9.7 trillion in new debt so far this year. Globally, debt has risen from $15 trillion to $272 trillion in the first nine months of 2020. The borrowing binge is being fueled by accommodating central bankers who have kept short-term interest rates at historic lows (or in negative territory) to help fuel growth in struggling economies. Making it cheaper to borrow for families and corporations is a key tactic to spur economic growth.

- The average price of gasoline was $2.12 a gallon recently. The average price of gasoline hasn’t closed a calendar year that low since finishing 2015 at $2.00 a gallon according to AAA.

- According to the Census Bureau, 62% of the average net worth of an American household comes from just 2 assets–the equity they have built up in their home and the value of their retirement accounts.

- While the U.S. waits for FDA approval of the first Covid-19 vaccine, makers of frozen carbon dioxide (dry ice) are ramping up production. The biggest vaccination campaign in history will begin shortly and hinges precariously on the timing and coordination of transporting vaccine doses under the ultra-cold conditions the medicine requires.

- Activity in the service sector expanded for the sixth consecutive month and weekly jobless claims dropped to 712,000 for the week ending Nov. 28. That was lower than analysts had expected and welcomed good news for U.S. stock markets. Conversely, only 245,000 new jobs were added in November according to the Bureau of Labor Statistics. The U.S. economy is still down 9.8 million jobs since last February.

Offices in Chicago, Kansas City, St. Louis, Naples & Valparaiso.

The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is an unmanaged, market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Consult your financial professional before making any investment decision. You cannot invest directly in an index. Past performance does not guarantee future results.

Note: All figures exclude reinvested dividends (if any). Sources: Bloomberg, Dorsey Wright & Associates, Inc. and The Wall Street Journal. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly.

Securities offered through Triad Advisors, member FINRA/SIPC. Imvestment advice offered through Resources Investment Advisors, LLC, an SEC-registered investment adviser. Resources Investment Advisors. LLC and Vertical Financial Group are not affiliated with Triad Advisors.

|