Major U.S. indices were down over 1% last week on renewed fears about how much the spread of the coronavirus would affect the global economy. Investors dumped stocks and flocked to traditionally safer assets like government bonds.The benchmark 10-year U.S. Treasury Note closed at a yield of 1.47%.

Unlike concerns over concrete economical data like corporate earnings, the social and commercial implications of the effects of the virus can be tough to pinpoint, leaving investors with a great deal of uncertainty. Small businesses are in a particularly tough spot. The ripple effects of the coronavirus has disrupted global supply chains and left Chinese factories closed or short-staffed. Small businesses typically don’t have the resources larger multi-national firms have access to. Between trade tariffs and the coronavirus, some small businesses are beginning to shift to suppliers in other Asian countries.

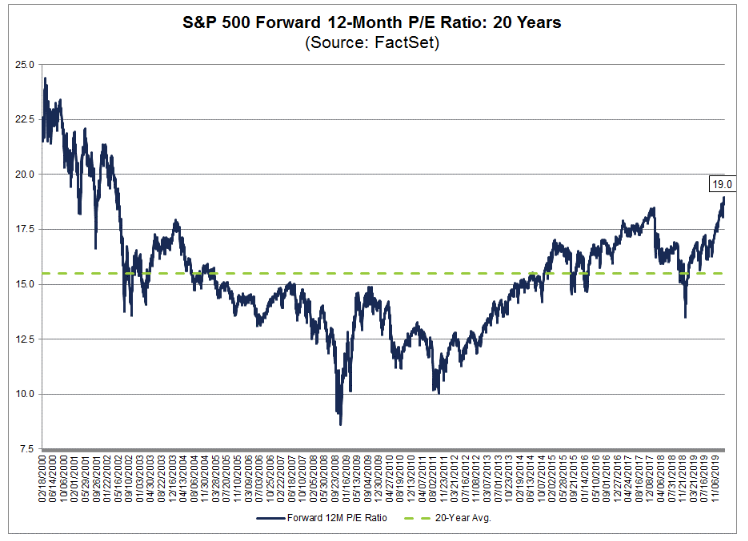

Despite all the concern over the effects of the coronavirus on the global economy, something interesting happened last week. On February 19, the S&P 500 closed at a record high of 3386.15. Based on that closing price, the forward 12-month P/E ratio (price to earnings) for the S& P 500 on that date was 19.0.

The forward P/E ratio of 19.0 was above the five-year, 10-year, 15-year and 20-year average. In fact, this marked the first time the forward 12-month P/E ratio had been equal to or above 19.0 since May 23, 2002 when it hit 19.1. It is still important, however, to note that even at 19.0, the forward 12-month P/E ratio is still well below the peak P/E ratio of the past 20 years at 24.4. The chart below from FactSet shows the growth of the P/E ratio over the last 20 years.

We are still cautiously optimistic about the growth of the U.S. economy and our domestic equity markets. However, we are watching closely for any signs of potential negative effects of the coronavirus on global economies and/or markets.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Consult your financial professional before making any investment decision. You cannot invest directly in an index. Past performance does not guarantee future results.

This blog was prepared by David M. Kover, CFP® C(k)P®

Sources: Bloomberg, Dorsey Wright & Associates, Inc. and The Wall Street Journal, FactSet. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly.

Securities offered through Triad Advisors, member FINRA/SIPC. Investment advice offered through Resources Investment Advisors, LLC, an SEC-registered investment adviser. Resources Investment Advisors. LLC and Vertical Financial Group are not affiliated with Triad Advisors.